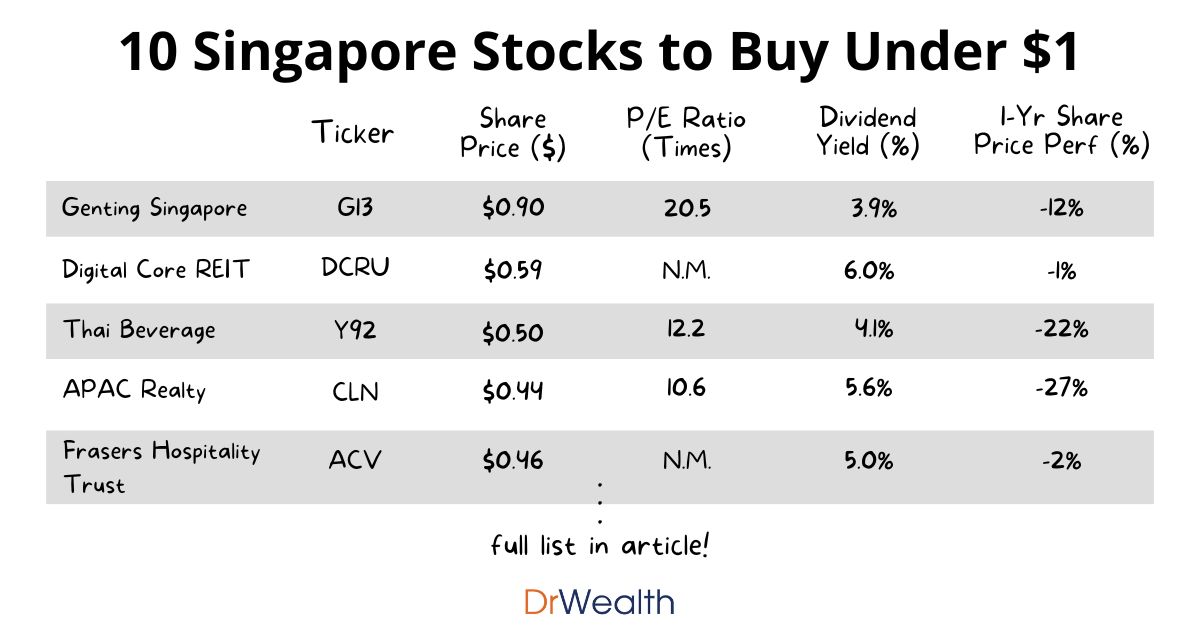

Here we have 10 Singapore stocks that have underperformed in recent times and fallen below $1. We explain why these 10 Singapore stocks are potentially a buy.

| Stock | Ticker (SGX) |

Share price | P/E ratio (times) |

Dividend Yield | 1yr Share Price Performance |

|---|---|---|---|---|---|

| Genting Singapore | G13 | $0.9 | 20.5 | 3.9% | -12% |

| Digital Core REIT | DCRU | $0.59 | N.M. | 6.0% | -1% |

| Thai Beverage | Y92 | $0.5 | 12.2 | 4.1% | -22% |

| APAC Realty | CLN | $0.44 | 10.6 | 5.6% | -27% |

| Frasers Hospitality Trust | ACV | $0.46 | N.M. | 5.0% | -2% |

| CapitaLand China Trust | AU8U | $0.74 | N.M. | 9.1% | -37% |

| CSE Global | 544 | $0.42 | 23.2 | 6.5% | +21% |

| Kimly | 1D0 | $0.31 | 10.6 | 5.4% | -9% |

| Frasers Property | TQ5 | $0.82 | 26.3 | 5.5% | -8% |

| Olam Group | VC2 | $0.98 | 15 | 7.5% | -36% |

1) Genting Singapore (SGX: G13)

Genting Singapore is finally seeing an economic rebound from the pandemic.

Earnings hit $611 million for FY23, up 80% from the $340 million recorded a year earlier, and just 10% lower than the $689 profit in FY19 pre-pandemic.

The strong numbers were driven by a 34% jump in gaming revenue to $1.6 billion, while non-gaming turnover rose 57% to $769 million.

Resorts World Sentosa, which also operates the Universal Studios theme park and the SEA Aquarium, delivered adjusted earnings before interest, tax, depreciation and amortisation of $1.1 billion, representing around 86% of pre-Covid-19 levels.

Genting, which ended the year with almost $4 billion in cash on a market cap of $11 billion, warned that its near-term prospects may be unpredictable due to macroeconomic and geopolitical factors beyond its control amid the ongoing post-pandemic recovery.

It also said that developments at the Forum Lifestyle zone, Universal Studios Singapore’s Minion Land and the Singapore Oceanarium are on track for a soft opening in early 2025.

Genting is a cash cow business and its planned expansions, with the blessings of the Singapore government, puts it in a stable policy state and would be an interesting play for investors who want to ride on Singapore’s tourism growth.

2) Digital Core REIT (SGX: DCRU)

Digital Core REIT IPO-ed at US$0.88 in November 2021 and hit a bottom of US$0.37 as its second largest tenant Cyxtera, which accounted for 22.4% of its annualised rental revenue, went through a chapter 11 proceeding.

In November 2023, the REIT resolved its overhang by selling the data centres tenanted by Cyxtera to Brookfield, a major property owner, and also diversified its portfolio through acquisitions.

In February 2024, the REIT further capitalised on its positive tailwinds and proposed a private placement for further acquisitions.

The REIT recovered nearly 60% from the bottom but is still substantially below the IPO price. With the management making the right moves to mitigate against its situation, Digital Core REIT could be one worth looking out for.

3) Thai Beverage (SGX: Y92)

Thai Beverage has been hit by shrinking margins in recent years due to global competition by major beer companies. For its 1Q24, it posted a 5.9% drop in revenue as the beer-making division underperformed amidst macroeconomic challenges.

The company said its beer-making division operated under the cusps of a slower-than-expected economic recovery in Thailand and Vietnam, leading to a 15% decline in volumes in the unit.

Despite the challenges, Thai Bev was able to eke out a 1.9% YoY growth in its EBITDA in 1Q24 to reach ฿13.8b as the beer business in Thailand saw EBITDA margin expansion.

Thai Bev achieved EBITDA growth in all its business segments, led by non-alcoholic beverages, which recorded a 9.8% YoY growth.

In a significant policy shift aimed at revitalizing the tourism and hospitality sectors, the Thai government has approved substantial reductions in taxes on alcoholic beverages, particularly focusing on wine. This strategic move aims to enhance Thailand’s allure as a destination for both international and domestic tourists.

Although the tax reduction is focused on wine, there are also tax reduction on liquors which Thai Beverage has under its stable of products. Additionally, a tourism boost would spur consumption and revitalise Thai Beverage’s sales.

4) APAC Realty (SGX: CLN)

2023 was a slower year for the Singapore residential property market and 2024 is expected to be lacklustre as well. APAC Realty, one of the bigger players in Singapore, posted a 31% drop in net profit for 2H23 off the back of a 18% decline in revenue. Its largest competitor Propnex (SGX: OYY) fared slightly better as profits fell 27% while revenues declined 15%.

Despite the current challenges, the Singapore residential market has always been a strong sector of the property market. Should interest rates fall and cooling measures taper, fuelling renewed interest in the residential property market, APAC Realty would be in prime position to benefit.

Additionally, APAC Realty is somewhat undervalued at $0.44 as it’s previous major shareholder Northstar sold its shares at $0.57 to Morgan Stanley and it is likely that Morgan Stanley would be looking to sell at a higher price.

5) Frasers Hospitality Trust (SGX: ACV)

With a slew of concerts from stars such as Ed Sheeren, Coldplay, Taylor Swift, Bruno Mars and K-pop artistes such as SHINee and IU as well as the usual array of events in Singapore like the F1 race and the hosting of the World Aquatics Swimming World Cup, there is no doubt that the Singapore tourism scene will thrive in 2024.

Global Tourism is also expected to improve in 2024 as China begins to implement mutual visa-free policies with various countries.

Frasers Hospitality Trust (FHT) is a likely beneficiary of these trends, with 14 properties across 9 cities. Additionally, FHT was subject to a failed delisting attempt at $0.70 by its major shareholder and sponsor Frasers Property, which makes the current share price of $0.46 look comparatively cheap.

6) CapitaLand China Trust (SGX: AU8U)

CapitaLand China Trust saw its FY23’s DPU fell 10.1% YoY due to the weaker RMB and higher finance cost, as a 5.3% increase to net property income in RMB terms could not mitigate against the RMB weakening by about 5% in 2023. The better NPI performance in RMB terms was due to CLCT’s retail portfolio which constituted 76% of the portfolio, and offset by lower contributions from its new economy portfolio which includes logistics and business parks.

CLCT’s share price is the worst performer on our list of stocks with a 37% decline, and with a DPU of 6.74 cents, puts the yield at 9.1%. This begs the question about whether CLCT has over-corrected due to its association with China and whether there could be a potential recovery if China’s economy improves further. We think CLCT would be a good China play, as it is backed by a Singapore sponsor in CapitaLand.

7) CSE Global (SGX: 544)

CSE Global is a company with acquisition in its genes, having executed 30-40 bolt-on acquisitions since its inception. The acquisitions serve as a form of diversification and resilience.

This is reflected in its recent FY23 financials where revenue grew 30% YoY led by the electrification and communications business segments while net profit almost quadrupled. Its order wins for FY23 amounted to $1 billion, a new all-time high for the company.

For FY23, CSE’s earnings per share stood at 3.66 cents as compared to 0.89 cents in FY22. Dividends for the past 6 years was 2.75 cents.

CSE is diversified into three business segments which have all seen growth and also diversified globally. All its geographic segments were also EBIT profitable in FY23.

What makes CSE attractive is its high successful integration rate, most of its large integrations are successful because it offer autonomy and flexibility as a parent company. The company has delivered 36 years of profitable growth in a steady and consistent manner, and said that it intends to do the same in FY24.

8) Kimly (SGX: 1D0)

We view Kimly as a defensive stock as it is one of the largest coffeeshop operator in Singapore, providing for affordable food to the masses. The only cheaper option is to cook meals on your own (or travel to Malaysia).

In FY23, revenue decreased marginally by 1.2% to S$313.9 million due to lower revenue contribution from Food Retail Division. Kimly provided for a total dividend for FY23 of 1.68 cents per share, representing about 57.2% dividend payout.

The Food and Beverage (F&B) industry in Singapore is currently facing multiple challenges, including high inflationary pressure on raw materials and utilities, which are driving up operational costs. Additionally, the ongoing manpower shortage and the implementation of the Progressive Wage Model (PWM), which mandates annual increases in the minimum wages of workers over three years, continue to pose significant challenges within the F&B industry in Singapore.

Despite the challenges, Kimly is taking proactive measures to achieve organic growth. This involves actively exploring new food outlet opportunities to expand its footprints. Kimly opened its fifth Halal Coffeeshop, Kedai Kopi in September 2023.

Riding on the growing demand in the Halal market, Kimly also opened a Tenderfresh restaurant in December 2023 and its third Makcik Tuckshop restaurant in 1H FY2024. In total, Kimly opened 3 coffeeshops, 14 food stalls, 1 kiosk, 1 restaurant in FY23.

Kimly is a defensive stock that continues to scale its presence gradually across various offerings and is a stock we view as having growth at a reasonable pace. At its current share price, the dividend yield of 5.4% is also attractive.

9) Frasers Property (SGX: TQ5)

Frasers Property (FPL) is a large property conglomerate with $34.2 billion asset under its ownership and management. In FY23, its revenue increased by 1.8% and profit before taxes which excluded valuation changes increased by 5.1%. Consequently, FPL provided for a dividend of 4.5 cents, up from 3.0 cents the previous year. The current share price of $0.82 places the yield at 5.5% and a P/B ratio of 0.33 times, significantly undervalued when compared to its large peers and even the mid-sized developers.

FPL would be a good play on a property recovery with its size, asset management platform and sector and geographic diversification. It also has a substantial land bank in various sectors and plans to carry out capital recycling to drive further value for shareholders.

10) Olam Group (SGX: VC2)

Rounding out the list is Olam Group, which faced a fraud accusation In September 2023. The Daily Nigerian and Prime Business Africa reported that Nigeria’s secret police were investigating the company’s units, Olam Nigeria and Olam International, and their associate companies, for a foreign exchange fraud exceeding US$50 billion (S$67 billion).

Singapore-listed Olam Group said on Feb 19 that a review has turned up no evidence that its Nigerian unit was involved in the alleged multibillion-dollar fraud as reported by media outlets.

Olam’s share price fell from $1.26 before the allegations to a 52 week low of $0.80 before recovering to $0.88. After announcing the lack of evidence against the allegations, the share price recovered to $0.98, still a distance away from the share price before the allegations were made. This makes Olam a play for investors who believe this is just a blip which will be proven unfounded.