In Asia, the perception of banks as reliable stocks is deeply rooted in the integral role they play in the economies and their history of paying out consistent dividends to shareholders. This is particularly evident in places like Singapore and Hong Kong, which are celebrated for their strong-performing banking stocks.

The prominence of these regions as global financial centers significantly contributes to this reputation. In these bustling hubs, a vast array of financial transactions occur, encompassing everything from stocks and bonds to more complex dealings in derivatives and foreign exchange (FX). This breadth of financial activities not only underscores the significance of these cities in the global financial landscape but also solidifies the status of their banks as key players in the economic fabric.

Hong Kong, in particular, has a long-standing tradition of banking excellence and the local banks have been central to its financial system.

The History Of Hang Seng Bank

A notable example is Hang Seng Bank (HKEX: 11), one of the oldest listed banks in Hong Kong. Since its establishment in 1933, Hang Seng Bank has ascended to become one of the leading local banks in the region. Today, it boasts a vast customer base, serving over 3.9 million clients. This impressive growth and the bank’s enduring prominence raise the question of how Hang Seng Bank emerged as a dominant force in Hong Kong’s banking scene.

The bank underwent significant development in the mid-20th century, notably in the 1950s and 1960s, when it solidified its status as a leading commercial bank in Hong Kong.

However, the trajectory of Hang Seng Bank took a dramatic turn in 1965 following a bank run. This critical event led to The Hongkong and Shanghai Banking Corporation (HSBC), now known as HSBC, acquiring a controlling interest in the bank. Initially, HSBC took a 51% stake in Hang Seng Bank, a figure that was later increased to just over 62%.

To this day, HSBC retains this majority share, positioning itself as Hang Seng Bank’s effective parent company.

Commercial And Retail Banking Stalwart In Hong Kong

Hang Seng Bank has carved out a niche for itself as a core lender for small and medium businesses (SMBs) as well as a diversified financial services provider to the Hong Kong public at large. This dual approach has allowed the bank to create a unique position in the market, catering to the diverse needs of both the business sector and individual consumers.

In addition to its domestic services, Hang Seng Bank has extended its reach into Mainland China with a fully owned subsidiary, Hang Seng Bank (China), located in the economically vibrant Guangdong province. This expansion signifies the bank’s strategic efforts to tap into the Chinese market.

Like many of its global counterparts, Hang Seng Bank has benefited from the rising interest rate environment. This period has been particularly profitable for banks, as higher interest rates generally lead to increased net interest margins, a key source of income for banks.

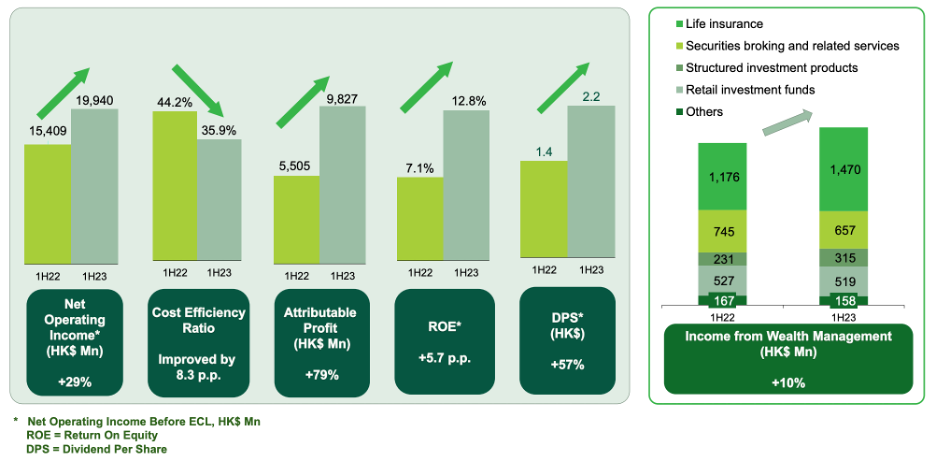

Hang Seng Bank’s financial performance in 1H2023 exemplifies this trend. The bank reported a significant increase in its net operating income, which rose by 29% year-on-year, reaching HK$19.9 billion (approximately US$2.4 billion). This substantial growth in income highlights the bank’s effective management and adaptability in a changing economic environment.

Additionally, in 1H2023 it also raised its dividend per share (DPS) by 57% year-on-year compared to the same period in 2022.

Source: Hang Seng Bank 1H2023 earnings presentation

Non-interest income for Hang Seng Bank in H1 2023 was robust, expanding by 55% year-on-year and was driven by its strong option trading business and equities-related wealth sales.

Hang Seng Bank’s wealth business is growing solidly in China too, with its total operating income from its Wealth & Private Banking (WPB) in the Greater Bay Area (GBA) growing by 20% year-on-year in 1H2023.

Hang Seng Bank – A Dividend Play For Investor

Hang Seng Bank, with its consistent and regular dividend payments, has carved out a reputation as a reliable dividend payer in the Hong Kong market.

This aspect of the bank’s financial practice particularly stands out when compared to other dividend-paying companies listed in Hong Kong, which typically distribute dividends bi-annually. In contrast, Hang Seng Bank aligns more closely with the US market trend by paying out dividends quarterly, meaning shareholders receive dividends four times a year.

The bank’s dividend yield is especially appealing to investors who prioritise income. On a trailing 12-month basis, Hang Seng Bank offers a substantial dividend yield of 6.2%. This rate is indicative of the bank’s commitment to providing consistent returns to its shareholders, a practice that has been a cornerstone of its financial policies.

Moreover, Hang Seng Bank’s resilience and reliability as a dividend payer were particularly evident during the Covid-19 pandemic. Despite the economic turmoil caused by the pandemic, which led even larger banks like HSBC to suspend dividend payments, Hang Seng Bank continued its dividend distributions. This decision not only reflected the bank’s strong financial position but also its dedication to maintaining shareholder trust and stability during challenging times.

However, despite these strengths, Hang Seng Bank’s share price experienced a downturn in 2023, with a decline of over 30%. This decrease in value has been influenced largely by concerns surrounding China’s property and banking sectors. Do note that these macroeconomic factors, while impacting investor sentiment, may not necessarily reflect the intrinsic value and performance potential of Hang Seng Bank.

Read Also: Understanding HSBC Holdings plc: Asia’s Local Bank

Listen to our podcast, where we have in-depth discussions on finance topics that matter to you.