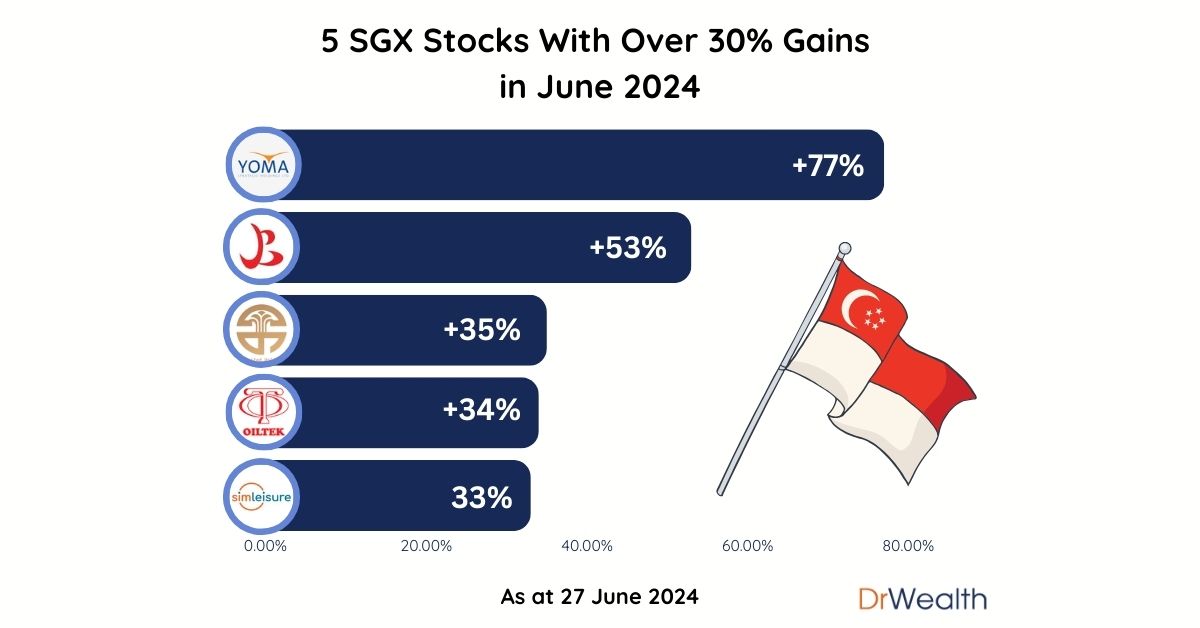

In June 2024, several SGX stocks have shown impressive gains, exceeding 30% in a single month. Let’s explore the top performers and the factors contributing to their remarkable gains.

| Company | Ticker (SGX) | 1M Gain (%) | YTD Gain (%) |

| Yoma Strategic | Z59 | 77% | 77% |

| Beng Kuang Marine | BEZ | 53% | 271% |

| Ever Glory United | ZKX | 35% | 75% |

| Oiltek International | HQU | 34% | 98% |

| Sim Leisure | URR | 33% | 82% |

Yoma Strategic Holdings Ltd (SGX:Z59) (+77%)

Key Driver: Strong recovery in the Myanmar market and successful strategic partnerships have boosted investor confidence.

Revenue grew nearly 79% YoY while core EBITDA increased 161%. Net profit reached US$21.2 million, marking a turnaround from a net loss of US$63.3 million the previous year.

We recently covered Yoma here noting that Yoma has bottomed out, will start to thrive and is a buy at current prices.

Yoma capitalised on its tremendous share performance by acquiring the remaining 20% stake in Yoma Fleet at US$13.7 million by issuing shares at $0.135 per share which is a premium to the last traded price. The 20% stake in Yoma Fleet was sold by Tokyo Century Asia who previously acquired the stake at US$26.6 million.

Yoma is also targeting the Burmese population working in Thailand. Yoma plans to expand the YKKO franchise which is known for its signature noodle soup dish known as kyah-oh to Bangkok.

Naturally, with a Burmese population in Thailand, Wave Money now provides international remittance services in Thailand to facilitate money transfers back to Myanmar.

Yoma Land recently held a Myanmar Property Roadshow in Bangkok. This event was specifically designed to cater to Myanmar nationals living in Thailand who may be interested in property investments in Myanmar.

Beng Kuang Marine Ltd (SGX:BEZ) (+53%)

Key Driver: New contract wins & robust earnings due to increased demand for its marine engineering services.

Beng Kuang provides a wide range of Infrastructure & Engineering (IE) services and Corrosion Prevention (CP) services. The IE segment saw a 47% revenue growth YoY from business expansion within the O&G sector, particularly in repairs and maintenance services for FPSOs and FSOs. There was also increased project management services for both existing and new builds.

The Corrosion prevention segment saw a 9% increase YoY from its recurring customers and will continue to act as a source of recurring income to the business.

In 1Q24, the business continued its improved performance as revenue grew 10.5% while gross profit increased 10.3% QoQ. The improved contribution was mainly from its IE segment.

Beng Kuang has also improved its balance sheet by disposing of part its Shipyard in Batam and a tugboat. As at the end of 1Q24, the company was in a net cash position, its cash stood at $14.1 million while borrowings reduced to $9.1 million.

Ever Glory United Holdings Limited (SGX:ZKX) (+35%)

Key Driver: Significant growth in their manufacturing segment and expansion into new markets have fuelled investor optimism.

Ever Glory was listed in May 2023 as a mechanical and electrical engineering service provider with a market cap of about $19 million.

In January 2024, it acquired Fire-Guard Engineering, a specialist subcontractor for fire protection services for a fee of up to $5.6 million thus utilising a substantial portion of its $6.6 million cash on hand and all its IPO proceeds of $1.5 million.

This was part of Ever Glory’s strategy to expand its existing fire protection systems engineering services as Fire-Guard’s services are complementary to the existing offerings of M&E engineering services. It will also potentially improve cost efficiencies, expand the company’s network and client base, as well as allow for more resources to pitch for more projects.

The company also delivered strong revenue and earnings growth. FY23 Revenue was 70% higher than the previous year at $47.5 million while profit quadrupled from $1.8 million to $6.8 million.

The increase in revenue was mainly due to an increased number of on-going M&E engineering projects and higher-margin M&E engineering projects undertaken and the increase in gross profit derived from M&E engineering was mainly due to higher-margin projects undertaken.

Oiltek International Ltd (SGX:HQU) (+34%)

Key Driver: Rising oil prices and increased production capacity have led to higher profitability.

Oiltek recently won new contracts worth RM94.8 million (S$27.2 million) from Malaysia, Indonesia and Kenya through its subsidiary in Selangor. This will take Oiltek’s current order book, which is expected to be fulfilled over the next 18 to 24 months, to a record high of RM400.5 million from RMB322.1 million as of 2023.

Works covered under the new contracts include constructing, fabricating and installing equipment and infrastructure for new crude palm oil pre-treatment as well as biodiesel plants.

This was off the back of a strong FY23 where revenue and profit increase 23% and 51% respectively.

Sim Leisure Group Ltd (SGX:URR) (+33%)

Key Driver: Reopening of tourism and increased visitor numbers to their theme parks and leisure facilities, resulting in higher revenues and improved financial performance.

Sim Leisure achieved revenues of RM135.50 million for FY23 representing an increase of RM68 million versus FY22 and profit before taxation of RM35.13 million against a PBT of RM34.25 recorded in FY22.

The theme parks segment achieved revenues of RM60.08 million, and a record of approximately 500,000 visitors for all three parks for FY23, just slightly higher than FY’s 489,000 figure. Overall, the theme parks segment achieved a 3.3% increase in revenues and 1.8% increase in attendance when compared against the same period last year.

In May 2024, Sim Leisure relaunched Kidzania Singapore with over 40 branded establishments spanning 7600 sqm. With ticket prices at $68 per child and $37 per adult, it would likely contribute significantly to Sim Leisure’s growth.

One point to be aware of is the cessation of its CEO after less than 2 years. It is noted that the Executive Director of the company will assume the CEO duties and the company will not replace the position.

Closing statements

The Straits Times Index traded in a 2% range in the last 1 month. The 52 week range is about 10%. This makes many investors think that the Singapore stock market is a quiet market. This may be true for the larger caps, however there are actually many undervalued stocks that have the potential to make substantial gains. These 5 stocks here are good examples of such gems.

Join our free webinar session to learn how we uncover such gems. Register now!