The MSCI Singapore Index is one of the largest Singapore indices with 16 constituents (formerly 21). The Index tracks most of the biggest Singapore companies, with their total market capitalisation amounting to more than S$200 million.

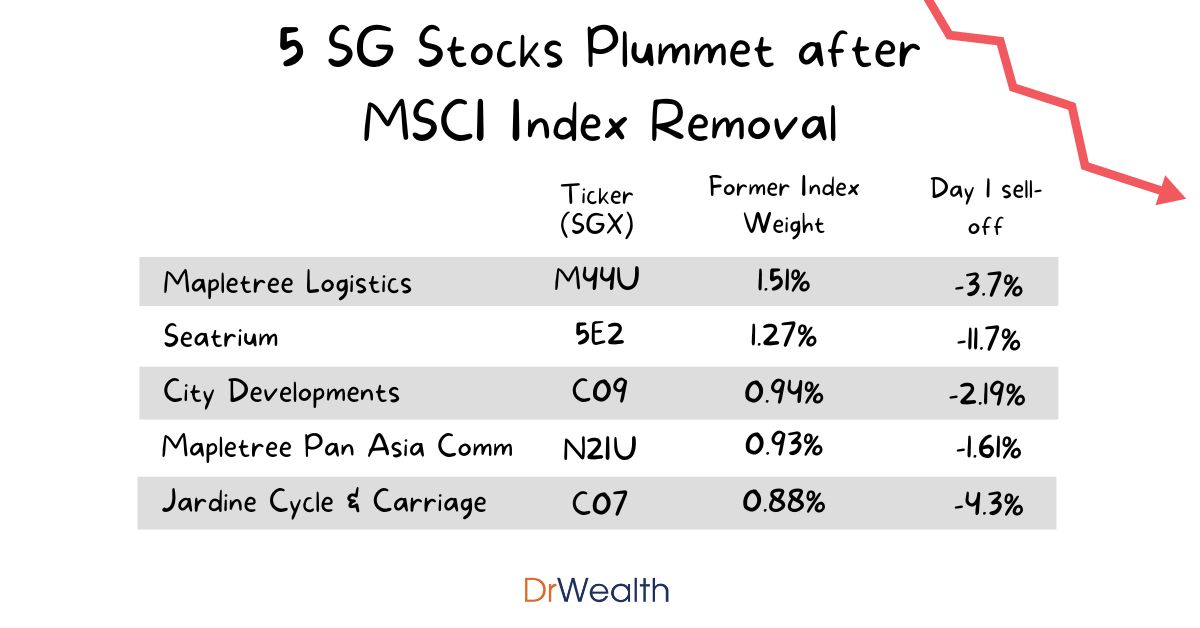

As part of MSCI’s quarterly review, it was announced on 14 May 2024 that 5 Singapore-listed stocks would be removed from the MSCI Singapore index. These 5 stocks are in a variety of sectors such as REIT, Industrials and Real estate.

The removals will be implemented at the close of 31 May 2024. However, this announcement led to an immediate sell-off for these 5 stocks as investors begin to rebalance their portfolios. This reaction is also because being removed from the index means less optics and, more importantly, less institutional investor fund flows.

MSCI Singapore Constituents

The 21 current and soon-to-be former MSCI Singapore Index constituents and their weights are as follows. Most of these stocks are also in the Straits times Index, with the exception of Sea (NYSE: SE) and Grab (NASDAQ: GRAB) as they are listed in the US.

| Security Name | Index weight (%) | Remarks |

| DBS GROUP HOLDINGS | 22.44 | Remain |

| OCBC BANK | 15.49 | Remain |

| UNITED OVERSEAS BANK | 12 | Remain |

| SEA A ADR | 10.49 | Remain |

| SINGAPORE TELECOM | 6.37 | Remain |

| CAPITALAND INTEGRATED | 3.3 | Remain |

| SINGAPORE AIRLINES | 3.23 | Remain |

| KEPPEL | 3.14 | Remain |

| CAPITALAND ASCENDAS REIT | 3.11 | Remain |

| GRAB HOLDINGS A | 2.9 | Remain |

| SINGAPORE EXCHANGE | 2.52 | Remain |

| CAPITALAND INVESTMENT | 2.16 | Remain |

| SINGAPORE TECH ENGR | 2.08 | Remain |

| WILMAR INTERNATIONAL | 1.95 | Remain |

| GENTING SINGAPORE | 1.79 | Remain |

| SEMBCORP INDUSTRIES | 1.51 | Remain |

| MAPLETREE LOGISTICS | 1.51 | Removed |

| SEATRIUM | 1.27 | Removed |

| CITY DEVELOPMENTS | 0.94 | Removed |

| MAPLETREE PAN ASIA COMM | 0.93 | Removed |

| JARDINE CYCLE & CARRIAGE | 0.88 | Removed |

These 5 stocks already had the smallest weights in the index, adding up to 5.5% in total. Their weight would be distributed to the other stocks in the index.

However, we should not assume that there will be clear beneficiaries as the weight to be distributed is too small and there could be an overall capital outflow from the MSCI Singapore constituents as there are less stocks in the index now.

We can also see the shift in global focus by noting that the three largest additions to the MSCI World Index, measured by full company market capitalization, will be Microstrategy (USA), Pure Storage (USA) and Emcor Group (USA). The three largest additions to the MSCI Emerging Markets Index, measured by full company market capitalization, will be Chandra Asri Pacific (Indonesia), JSW Energy (India) and Canara Bank (India).

Performance of the MSCI Singapore Index

The MSCI Singapore Index outperformed the global index from the period of Apr 2009 up to early 2015 and has underperformed the indices since with the exception of 2017. This is likely due to the outperformance in countries such as the US.

Looking at the fundamentals, MSCI Singapore has a 4.5% dividend yield, much higher than the global indices. The P/E and P/B ratios are also much more favourable. However, when we look at the forward P/E ratio, the forecast is for the global indices to have their earnings improve at a much higher rate as compared to the MSCI Singapore.

As the market is forward looking, this may further weigh on the performance of MSCI Singapore.

What will happen to these 5 stocks?

While the initial reaction is negative, all is not lost for these companies. All 5 stocks are still part of the Straits Times Index. The 2 REITs, Mapletree Logistics Trust and Mapletree Pan Asia Commercial Trust, are also part of REIT indices such as the iEdge S-REIT Index.

City Development is also a member of indices such as the World and Asia Dow Jones Sustainability Index. It is also part of the FTSE4Good Index and included in other indices such as the Bloomberg Gender Equality Index and the S&P Global Sustainability Yearbook.

Seatrium has just joined the Straits Times Index less than a year ago and investors could take comfort of Seatrium’s entry then.

Jardine C&C, much like the other Jardine stocks have found themselves being removed from indices due to factors like their low trading volume as a result of their low liquidity, or for other reasons related to its share structure and secondary market listing status. However, Jardine C&C remains part of the Straits Times Index for now, as its primary and sole listing status is in Singapore.

As long as these stocks work on improving their fundamentals, the share price should naturally reflect their performance.

A case in point is by ComfortDelgro (CDG) (SGX:C52). CDG was removed from the Straits Times Index in September 2022. The share price fell from $1.38 when the removal was announced to about $1.28 within a month. It subsequently fell to as low as $1.01. It is now trading at $1.41, as the bottom line and dividends improved, slightly higher than when the removal was announced, providing for a return on capital as well as an overall positive total return that beat the MSCI Singapore in both 2022 and 2023.

Could these stocks have done more?

Yes and No.

Yes, because fundamentally, if these stocks were superstars and were able to grow their bottom line, a higher share price and market capitalisation would naturally follow. This would keep them away from the bottom of the pack and keep them in the various indices.

No, because the overall performance of the Straits Times Index has been lacklustre and does not have global or even regional significance. There have been recent media articles highlighting the disparity between the success of Singapore as a financial centre and its stock market performance, prompting discussions and efforts to revitalise the stock market. If the stock market can be revitalized and grab a bigger share of the regional and global pie, then the stocks in the Singapore indices would all be natural beneficiaries.

Closing statements

The removal of these 5 large stocks leaves MSCI Singapore with a mere 16 stocks as opposed to 21 previously and 30 stocks in the Straits Times Index.

As the MSCI Singapore Index attracts foreign investors and institutional funds, there is a possibility that the overall allocation to the Singapore market by these players may drop too. Hence, there may not be any clear beneficiaries from reallocating the weightage of these 5 stocks to the other 16 stocks.

All is not lost for these stocks as they are still part of other indices and can become attractive should they be able to perform well fundamentally.

A larger macro issue remains: whether the Singapore stock market can be revitalised and act as a rising tide that lifts all boats.

p.s. If you’re looking for more stock ideas, Alvin shares how he finds the best stocks to invest in to grow our Dr Wealth portfolio. Learn more here.