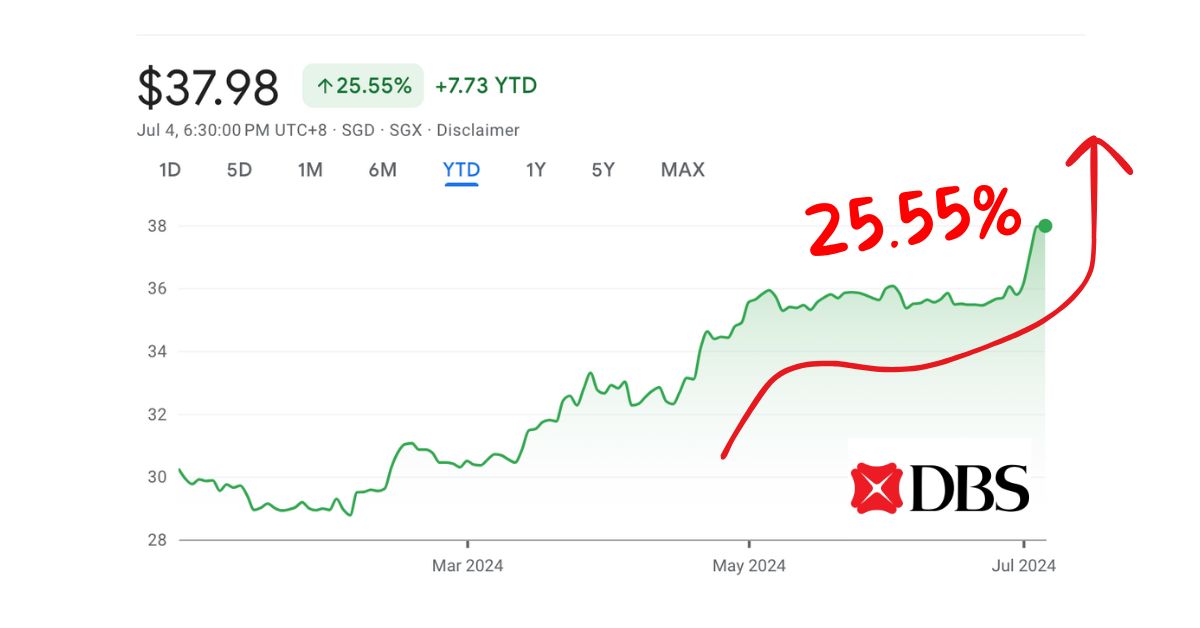

Avid Dr Wealth readers might remember me saying that DBS Group Holdings Ltd (SGX: D05) is one of the stocks that will huat in 2024.

I even listed Oversea-Chinese Banking Corporation Ltd (SGX: O39) and United Overseas Bank Ltd (SGX: U11).

So again, people might be wondering if there is more upside to DBS.

This time, rather than preach the numbers, let me offer another perspective on the Singapore banks.

Aka the qualitative part of the business.

Singapore’s port is the world’s 2nd busiest port

It can be hard to fathom that a country of just 6 million population has the world’s 2nd busiest port.

It also boasts the world’s largest seaport. It is only behind Shanghai Port in terms of container volumes in TEUs.

So what has that got to do with DBS’s meteoric rise over the years?

Singapore is a trade-dependent country. With limited available resources, its strategic position across the millennia, from the civilizations during the days of the Majapahit to the British and Japanese colonization sees it as an important outpost and trade hub.

And when there is trade, there is money to be made. The flow of goods equals the flow of money.

And money does not flow through freely. DBS will continue to ride on Singapore’s prospect as an international trade hub and financial centre.

Singapore is one of the world’s richest countries

Singapore, as most of you know, is one of the world’s richest countries measured by Gross Domestic Product (GDP) per capita.

In plain simple words, the value added created by every individual in Singapore, when measured globally, comes in at 6th. And that means businesses around the world are paying that amount of value to Singapore businesses.

And with great GDP comes great debt. Debt, often perceived negatively, is one of the greatest tools to expedite progress and development if well utilized. Debt and financing play a vital part in financing from the business world, to mortgage and automobile loans.

Good debt is a powerful tool, but bad debt can kill you

Robert Kiyosaki

And you don’t need me to remind you who is the largest debt issuer in Singapore, right?

The Singapore Dollar is one of the most stable currencies

The money we use today has come a long way. From seashells to rocks and pebbles and eventually gold, coins and notes, standardizing and accepting payment currencies has always been evolving.

Although our Singapore Dollar might not be the most valuable, it definitely is one of the most stable. Stability plays more emphasis than strength in the world of currency exchange – no point in having the exchange rate as volatile as crypto where favourable and unfavourable differs by each second.

The strength and stability of a currency also tie back to the faith and credibility of a country’s government. Over the years, we have gone through times where we have seen a significant devaluation of the Argentinian Peso, Lebanese Pound and many more.

Having stability on top of other factors helps affirm the position of the Singapore Dollar as an important currency, regardless of trade or other reasons. So long as the monetary policy of Singapore is monitored and governed well by the Monetary Authority of Singapore, there is that intangible rationale that helps DBS and its peers flourish.

DBS and its peers are the heartbeat of Singapore

If there is to be a word of the day, it would be D-SIBs.

D-SIBs stands for Domestic Systemically Important Banks. In layman’s terms, it is also known as too-big-to-fail.

DBS, together with OCBC, UOB, Citigroup Inc (NYSE: C), Standard Chartered PLC (LON: STAN), Malayan Banking Berhad (KLSE: MBB) and HSBC Holdings plc (HKG: 0005), these seven formed the list of Singapore’s important banks. Any hiccups and failures could spell disastrous repercussions and even trigger contagion that will rock the country’s economic stability and even other regions.

To ensure these banks’ stability and stress ability, the Monetary Authority of Singapore has enforced supervisory measures, especially on the banks’ capital requirements. This is also in line and aligns with the global approach and similar framework of Basel III, rolled out by the Basel Committee on Banking Supervision, a consortium of central banks.

This is why on top of the annual reports and earnings presentation, there is always another set of documents published and shared by the banks, purely on Pillar 3 and Liquidity Disclosures.

It is one of the best banks in the world, margin-wise and efficiency ratio

I may be the first to make this claim – SG banks are superior to their peers in other regions.

Let’s take a look at the net margins attributable to stockholders, excluding extraordinary items.

Our Terrific Trio of banks have a strong record of outperforming the big banks in the US. That translates to a lot of reasons. Better expense ratio, lesser loan loss provisions, and better interest income and non-interest income.

And how that translates to return to shareholders, the return on equity is evident. For the past 5-6 years, DBS’s ROE has been among the best versus its cohort.

In the latest FY 2023, it achieved an ROE of 16%, pipping JPM to the top spot.

So in a nutshell, you are looking at a bank that excels in running its business well and maximizing shareholders’ return on equity.

Dividend yield > Fixed Deposit rates

This has been fairly consistent over the years – most of the Singapore banks have been dishing out growing dividends, trading at a dividend yield that is way more than the fixed deposit rates it offers.

Share prices of equities can be volatile, even for the rock-solid banks. But by track record, we can observe that the Terrific Trio trumps its US counterparts in terms of dividend yield.

And that is before accounting for the dividend withholding tax on US dividends!

We might have been discounting DBS all this while using conventional quantitative metrics.

Yes, the rule of thumb is never to pay excessive prices to a bank. Because a bank’s biggest asset is denominated in cash.

If we strictly follow the rule of not paying more than 1x price-to-book ratio for buying a bank share, against the historical p/b ratio trend over the last 10 years, we limit ourselves to just 2 periods to buy DBS shares. The whole year of 2016, and during the pandemic period of 2020.

But when you invest in DBS or other Singapore banks, you are not just investing in a bank.

You are buying into the prospect of Singapore becoming a global force to be reckoned with.

Singapore has and will continue to do well.

And when Singapore does well, South East Asia will do well. And by doing well, I mean financially. So that all naturally floats Singapore’s banking and financing activities.

My forefathers, for whatever reasons have decided to expel Singapore from Malaysia almost 60 years ago.

Here as a descendant, I urge whoever now reading this article, to never bet against Singapore.

The qualitative aspect of DBS is evident, hopefully aptly presented.

As for valuation, I leave you to decide the right price you are willing to pay, should you think DBS fits into your investment portfolio!

My take? This is a bank that comes with a Singapore catalyst that no other banks around the world can replicate. A price-to-book ratio of 1.2x to even 1.4x is considered a bargain analytically.

Sure, be very, very patient if you want to get it below book value. Just make sure you set aside that silver bullet with DBS’ name on it.

p.s. if you want to learn how to analyse and find the best stocks to buy, Alvin shares our strategy at this live webinar.