“First we shape the cities – then they shape us.”

Jan Gehl, founding partner of Gehl Architects

Although Singapore is a small city, it boasts a well-defined structure and transportation system. The MRT lines are undoubtedly a key aspect of the city’s infrastructure. While urban planners determine the locations of these stations, the stations themselves significantly influence how people live, work, and play. Movements and activities in the city tend to centre around these MRT stations.

Therefore, it’s unsurprising that many malls have sprung up at MRT stations, with a significant number directly connected to MRT exits. Malls situated in areas of high footfall, especially those near stations, are economically viable due to the guaranteed human traffic. This proximity not only boosts accessibility but also increases spending within the malls.

With Singapore’s strategic push towards decentralization, malls and facilities have also become prevalent in the heartlands. As a result, there is reduced incentive for residents to travel far, given the availability of similar shops in nearby malls. This ‘cookie-cutter’ approach has been successfully replicated in the majority of Singapore’s malls. While this results in less variety, in Singapore, practicality often takes precedence. Shoppers generally know what to expect from these malls, leading to a predictable shopping experience.

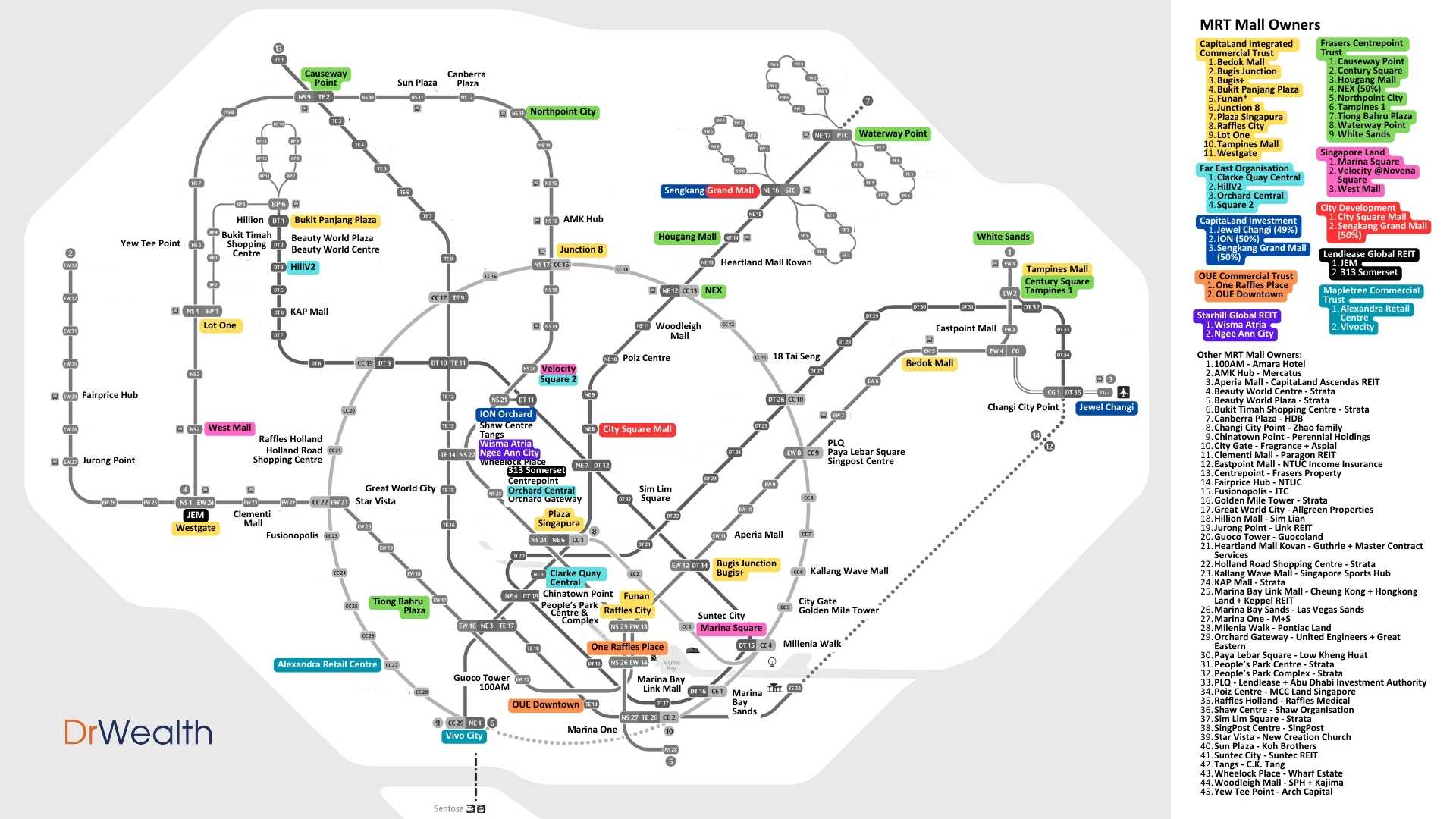

Malls and MRT stations in Singapore are inextricably linked. Based on my analysis, there are 85 MRT-connected malls, and this number is likely to increase. For a mall to be classified as an ‘MRT mall’ in this context, it must meet specific criteria, including a certain size threshold and a function beyond serving as a town centre. Consequently, malls like Pioneer Mall were not included in this count. Furthermore, while there are numerous malls near stations, especially in areas like Orchard, I have chosen to count only those with direct exits to the stations.

As such, the MRT map provided below has been edited to exclude the names of the stations, featuring only the names of the malls.

The overview provided by the map should convey a clear sense of the malls’ density. It’s noticeable that most malls are concentrated in the central area, which is expected. Interestingly, a greater number of malls are located near the extremities of the MRT lines, rather than between these ends and the city centre. This pattern likely arises from a deliberate effort to cater to residents living on the outskirts of Singapore, reducing their need to travel extensively into the city centre for shopping.

The subsequent information I’ve compiled is displayed on the right side of the map, where the various owners of MRT malls are listed. This information is particularly valuable for investors, as it’s believed that these malls hold greater value and are better investments due to their proximity to MRT stations. Given the unlikely scenario of MRT stations relocating, these malls possess a lasting advantage over others situated further from the stations.

Let’s now delve into a discussion about some of the key owners of these MRT malls.

1) CapitaLand Integrated Commercial Trust (CICT)

CapitaLand Integrated Commercial Trust (CICT) boasts the largest number of MRT malls, totaling 11. Approximately half of these malls are located in the central area, while the others serve the heartlands.

As the largest Real Estate Investment Trust (REIT) listed on the Singapore Exchange (SGX), with a market capitalization of S$13 billion, CICT has a prestigious lineage. Its predecessor, CapitaLand Mall Trust, holds the distinction of being the first REIT ever listed on the SGX. Beyond malls, CICT’s portfolio also includes office properties.

CICT may have opportunities to expand its portfolio, as its sponsor, CapitaLand Investment, co-owns three additional malls: Jewel Changi Airport, ION Orchard, and Sengkang Grand Mall. However, it is uncertain whether CICT holds the Right of First Refusal (ROFR) to acquire these properties if they were to be sold. These malls are popular and would significantly enhance CICT’s already impressive portfolio.

Yet, the potential acquisition of these properties faces a challenge. CapitaLand Investment does not hold full ownership, meaning any sale would require approval from the other shareholders.

- Jewel Changi Airport is 51% owned by Changi Airport Group

- ION Orchard is 50% owned by Sun Hung Kai and

- Sengkang Grand Mall is 50% owned by City Development

Despite these complexities, partial sales of malls are not unprecedented, as seen with NEX, where Fraser Centrepoint Trust acquired a 50% stake.

2) Frasers Centrepoint Trust (FCT)

Frasers Centrepoint Trust (FCT) ranks second with ownership of 9 MRT malls. Although they previously owned additional MRT malls, such as Changi City Point, these have been divested. Nevertheless, FCT stands as the third-largest retail Real Estate Investment Trust (REIT) by market capitalization on the Singapore Exchange (SGX), following CICT and Mapletree Commercial Trust.

FCT is renowned as a Singapore heartland mall specialist, given its exclusive focus on malls outside the central area. Unlike some of its counterparts, FCT does not have a Right of First Refusal (ROFR) arrangement with its sponsor, Frasers Property. This isn’t an issue since the only MRT mall in Frasers Property’s portfolio is The Centrepoint. Acquiring this property would shift FCT’s focus away from being a heartland mall pure play, which might explain why such an acquisition has not occurred. Over the years, FCT has sought properties from other owners, expanding its portfolio beyond those of its sponsor.

A significant move by FCT was the acquisition of a 50% stake in NEX, a popular heartland mall. There’s potential for FCT to acquire the remaining 50% from NTUC’s subsidiary, Mercatus. Other Mercatus-owned heartland malls, like AMK Hub, align well with FCT’s portfolio, particularly as Mercatus has recently divested other assets, including Jurong Point and Thomson Plaza, to Link REIT.

Furthermore, FCT could consider acquiring malls from smaller MRT mall owners who possess a singular property. These entities might be more inclined to sell compared to those owned by other competing REITs. Potential acquisition targets for FCT could include Eastpoint Mall, Heartland Mall Kovan, and Sun Plaza.

3) Singapore Land (SGX:U06)

Singapore Land (SGX:U06) is noteworthy in this context due to its attractive assets for Real Estate Investment Trusts (REITs). It owns several prominent and popular malls, including Marina Square, Velocity@Novena Square, and West Mall. Additionally, its parent company, UOL Group Limited, holds other mall properties such as KINEX and United Square Shopping Mall. Collectively, these five malls present a viable opportunity for integration into a retail REIT, potentially appealing to investors.

However, despite the apparent advantages, Singapore Land and UOL have not yet undertaken this strategy. This decision suggests the presence of other considerations, which are not publicly known.

Upcoming Opportunities: East part of Thomson-East Coast Line (TEL)

The eastern segment of the Thomson-East Coast Line (TEL) is currently under construction, and it will introduce a series of new MRT stations.

Among these upcoming stations, only Marine Parade station is linked to a mall, namely Parkway Parade.

In a strategic move, Lendlease Global REIT (LREIT) has acquired a 10% stake in the Parkway Parade Partnership, which owns 77.09% of the Parkway property. This acquisition can be interpreted as an indicator of LREIT’s potential long-term strategy to eventually acquire a larger share or full ownership of this property.

CICT and FCT Remain the Most Strategic Singapore Mall Owners

CICT and FCT stand as the most strategic owners of MRT malls in Singapore. These malls continually benefit from the steady flow of commuters and nearby residents. Together, they own 20 out of the 85 MRT malls in Singapore, nearly a quarter of the total. Moreover, these 20 malls are among the more prominent and popular in the city. According to the Pareto Principle, while they own only a quarter of the malls, their properties might generate to more than half of the total MRT mall revenue.

However, it’s important to note that CICT is not exclusively focused on malls, as it also includes office properties in its portfolio. In contrast, FCT specializes solely in mall properties, positioning it as a potentially ideal choice for investors seeking a pure-play retail REIT in Singapore.