In the Singapore Budget 2024, Deputy Prime Minister and Finance Minister Lawrence Wong announced a significant change for CPF members aged 55 and above: the discontinuation of the CPF Special Account. This change is particularly relevant to Singaporeans, as most have a CPF account.

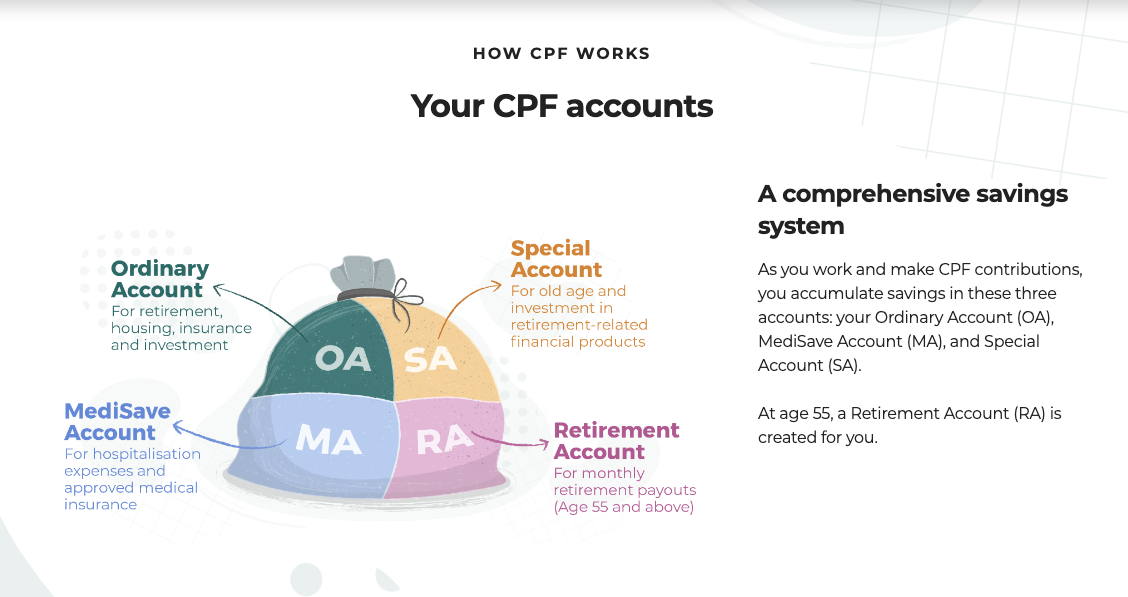

Under the current system, when CPF members reach the age of 55, a Retirement Account (RA) is established for them. This RA is then filled to meet a predetermined retirement sum, which can be the Basic Retirement Sum, Full Retirement Sum, or Enhanced Retirement Sum, depending on the member’s choice.

To reach the chosen retirement sum in the RA, funds are initially drawn from the CPF Special Account. If the Special Account’s funds are insufficient, the Ordinary Account is then tapped to make up the difference and achieve the retirement sum specified by the CPF member.

Clearly, the government intent is that savings in our CPF Special Account should be first used to contribute to our RA, which in turn would fund our CPF LIFE payouts, before utilising savings from the Ordinary Account. This approach makes perfect sense since the Special Account’s savings are intended primarily for retirement purposes, while the Ordinary Account’s savings can be used for a broader array of needs, including housing and education.

However, because the CPF Special Account pays a higher base interest rate of at least 4.0%, compared to the 2.5% offered by the CPF Ordinary Account, some individuals might prefer to preserve their savings in the Special Account. They do this by using their CPF Ordinary Account to top up their RA. This is also popularly known as the CPF Shielding Hack

Editor’s note: We won’t explain the CPF Shielding Hack in this article, but you can read it in the article link above if you wish.

RA & CPF Special Account Serves A Similar Function

Given that the Special Account and the RA both aim to support retirement income through CPF LIFE payouts, it could be argued that their functions overlap once the RA is established at age 55.

This raises a question: if CPF members have the RA specifically set up to finance their CPF LIFE payouts, what purpose does the Special Account serve beyond acting as an additional CPF account that offers a higher interest rate than the 2.5% provided by the Ordinary Account?

From this viewpoint, the CPF Special Account appears redundant for those aged 55 and above. If CPF members wish to have their savings contribute towards their RA to fund their CPF LIFE payouts, then logically, these funds should reside in their RA.

Conversely, if members choose not to maximise their RA up to the Enhanced Retirement Sum for the sake of maintaining access to CPF lump sum cash withdrawals, their savings would be more appropriately held in the Ordinary Account. Thus, permitting CPF members aged 55 and over to retain surplus savings in their Special Account—rather than allocating these funds to either their Ordinary Account or RA—seems unnecessary. This arrangement merely provides an opportunity to accrue higher interest rates than the Ordinary Account offers, while still offering withdrawal flexibility akin to that of the Ordinary Account.

Hence, from 2025 onwards, for those aged 55 and above, Special Account savings will be transferred to their RA up to the Full Retirement Sum ($213,000 as of 2025) where members will continue to earn a base interest of 4.0% (similar to that of their Special Account). The remaining Special Account savings will be transferred to their Ordinary Account. Of course, members can voluntarily transfer their Ordinary Account savings to their RA at any time, up to the Enhanced Retirement Sum, to earn higher interest and to receive higher retirement payouts when they turn 65.

Read Also: Here’s What Your CPF Full Retirement Sum Might Look Like When You’re 55

Top Image from CPF

Listen to our podcast, where we have in-depth discussions on finance topics that matter to you.