The CPF is probably one of the most important pillars of retirement for many Singaporeans and Permanent residents, being a mandatory social security savings scheme which serves to meet retirement, housing, and healthcare need.

As usual, there was a plethora of changes, all intended to better shape the policies for Singapore’s future. One of the most eventful changes announced in the 2024 Budget was for the CPF, here we summarise the changes and the key impacts.

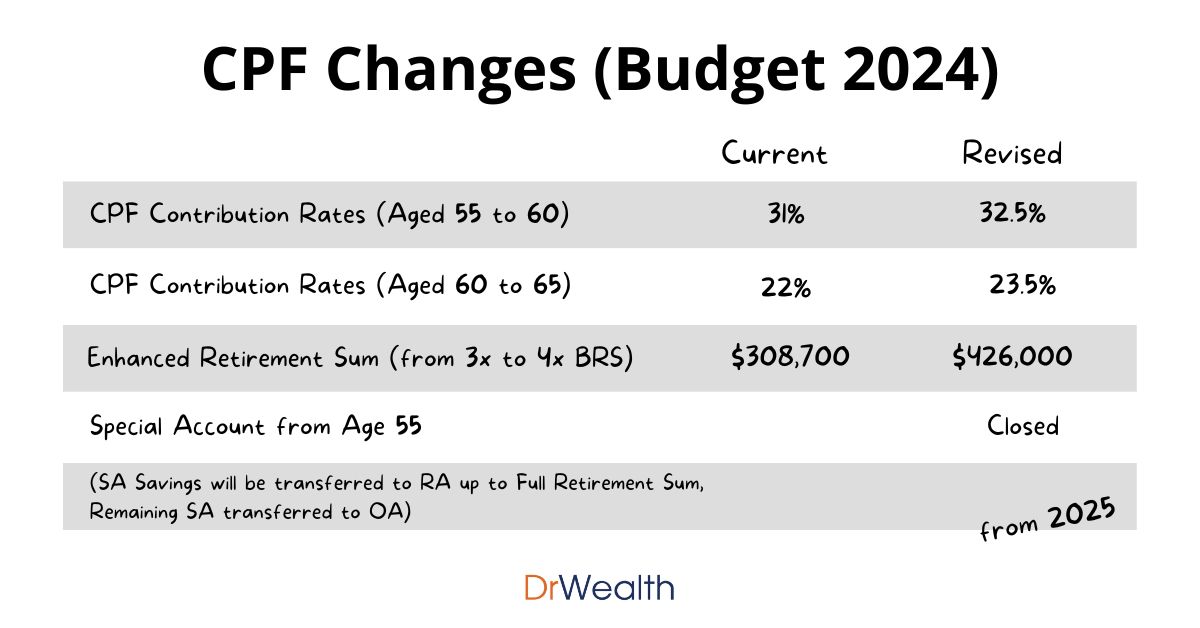

Budget 2024 CPF Changes

1) Increase in contribution rate for ages 55 to 65

In line with Singapore’s long term goal of ensuring adequacy in retirement, effective 1 January 2025, the CPF contribution rates for ages 55 to 65 have been increased by a further 1.5%. Of this increase, 0.5% will be contributed by the employer and 1% will be contributed by the employee.

This means that for ages 55 to 60, the total CPF contribution rate will now be 32.5% and for ages 60 to 65, the total contribution rate will now be 23.5%.

This is 6.5% and 7% higher respectively as compared to 2021 where the total contribution rates for the ages 55 to 60 and age 60 to 65 were 26% and 16.5% respectively,

This increase for 2025 is similar to the 2024 increase and similarly, the government will be providing for a one year CPF transition offset to employees equivalent to half of the 2025 increase in employer CPF contributions to help businesses cushion the impact.

This increase is off the back of multiple previously announced increases. The previous change effected on 1 January 2024 was of 1.5% for the ages 55 to 65 and 1% for the ages 65 to 70.

There were earlier changes effected on 1 January 2022 and 1 January 2023 which increased the total contribution rate by 2% and 1.5% respectively.

2) Enhanced Retirement Sum raised

From 2025, the Enhanced Retirement Sum (ERS) will be raised from three times the Basic Retirement Sum (BRS) to four times. This amount is increased proportionately to $426,000, from $308,700.

This change will allow more members turning 55 to fully commit their CPF savings to receive higher CPF payouts, should they wish to do so.

The Full Retirement Sum (FRS) will remain at two times of the Basic Retirement Sum. For members turning 55 years old in 2025, this would be $213,000 and $106,500.

A member turning 55 years old in 2025 can receive about $3,300 per month of CPF LIFE payouts at age 65, if he chooses to top up to the raised ERS, up from about $2,500 today.

This will allow for CPF members to commit a larger sum of money to CPF payouts and reduce the need to source for their own private annuity plans should they wish to build a larger fixed payment stream.

3) Special account closed from age 55!

The CPF Special Accounts (SA) of those aged 55 and above will be closed from 2025. The amounts in the SA would be transferred to their Retirement Accounts (RAs), up to the FRS.

Any SA savings that remain will go to the Ordinary Account (OA). OA savings can be withdrawn, but interest is accrued at the lower, short-term interest rate.

CPF members can, at any time, transfer their OA savings to the RA – where savings can only be disbursed to members in retirement payouts – to boost their ERS.

Savings in the Ordinary Account earn the 3-month average of major local banks’ interest rates, currently subject to the legislated minimum interest of 2.5% per annum.

Savings in the SA, Medisave (MA), and RA currently earn the 12-month average yield of 10-year Singapore Government Securities (10YSGS) plus 1%, subject to the current floor interest rate of 4% per annum. This is reviewed quarterly and the current interest rate from 1 January 2024 to 31 March 2024 is at 4.08% per annum.

This is effectively making CPF members choose between liquidity and higher interest rates. By keeping the funds in the OA, CPF members accrue interest rates at a lower rate with the flexibility of lump sum withdrawals.

Transferring the OA savings to the RA is a one-off irreversible process which would increase the monthly retirement payouts.

Good bye SA Shielding

The CPF SA Shielding was a strategy to maximise the interest income in the CPF accounts when the CPF member turns 55 years old.

At the age of 55, CPF will create a RA, on top of the existing OA and SA.

Once the RA is created, current funds from both the OA and SA will automatically flow into it, up to the prevailing FRS for that year. In terms of priority, SA funds would be transferred into the RA first before OA funds.

Astute CPF members would transfer out the amounts in the SA just before they turn 55, until after the RA is formed. To transfer out the amounts, CPF members would have to invest their SA funds in permitted investment products included under the CPFIS, usually via unit trusts, investment linked insurance products, annuities, endowment policies, exchange traded funds or Singapore treasury bills.

After the RA is formed, the funds that was transferred out, would be returned to the SA. In essence, the whole purpose of SA shielding is to use the funds in the OA to fund the RA, thereby allowing CPF members to keep as much funds as possible in the SA rather than OA to earn the higher SA interest rate.

Now with the SA closed, this strategy is no longer available. All CPF members currently above the age of 55 will also see the benefit cease as their SA would be closed from 2025 and the monies will be transferred to the OA.

For CPF members who currently have their funds in other investments, once the investments are sold, the monies will be returned to the OA as the SA would no longer exist.

So how now? What can you do?

Effectively, now only the ERS and medisave would be eligible for an interest rate of at least 4.08% once a CPF member reaches the age of 55.

For those who have gone past the age of 55 and carried out CPF contributions that were planned based on the existing policies, unfortunately because the policy takes effect to all members, they would either see their interest income reduce by 1.5% for the amounts that are currently in the SA and would be transferred to the OA or have their funds put through the CPF Life payout plan in the RA.

Many CPF members currently top up substantial amounts, some even above the tax relief threshold because of the higher interest rates provided for as they know that they would be either able to earn at least a 4.08% interest rate in the SA or be able to withdraw these amounts at any time. They would have to weigh the benefits now with the new structure.

Investment strategy options?

At the end of the day, a 2.5% interest rate in the OA could be higher on a long term basis as compared to bank interest rates which has limits and hurdles such as salary crediting.

Additionally, there is a wide range of investments available to the CPFIS-OA that can potentially beat the 2.5% or even 4.08% rate.

For investors who want their capital protected, the current government t-bills and bonds exceed the OA interest rate but do not exceed the SA interest rate.

To beat the OA and even SA on a longer run, the options available are equities or ETFs which naturally comes with price volatility.

As such, the options to consider are as follows:

Option 1: no top up to CPF

This group of members would have wanted 4.08% interest at the minimum with the flexibility of withdrawal and not be satisfied with new state of play of either 2.5% interest rate or a lock up into the ERS.

Option 2: top up CPF for tax relief and prefer liquidity

This group of members would keep the monies in the SA till the age of 55, have the monies moved to the OA and earn 2.5% interest a year thereafter.

This group believe that the long term combined returns of SA till the age of 55 and OA thereafter plus any tax relief would provide a return exceeding option 1. Liquidity is a priority for these members

Option 3: same as Option 2, but prefer higher interest rate over liquidity

This group of members would move the monies to the RA up to the ERS and have the remaining amounts (if any) earning 2.5% interest in the OA.

Here we also look at what people in different situations can do:

1) Group who have not commenced substantial CPF top ups

This group may either take the view of Option 1 or carry out a blend of Option 1 & 2.

They would have to preserve enough funds in the OA for any lump sum withdrawals and should be comfortable having a larger sum of money in the RA.

2) Group who have made CPF top ups but are below age 55

This group would have enjoyed the tax relief accorded to top ups, may have even top up above the tax relief limit and been looking forward to the CPF Shielding strategy.

It is crucial for this group to relook the entire strategy, taking into consideration their required rate of return for their entire portfolio of assets and the amount of payout they want to obtain from the RA.

They may then taper their top ups accordingly and would have to find alternative avenues for their funds in alternative investments which are likely not capital protected, such as equities.

3) Group above age 55 with substantial CPF

This group would have enjoyed some years of the CPF Shielding strategy and are now faced with an immediate dilemma.

Similar to the first group, they should preserve enough funds in the OA for any lump sum withdrawals and should be comfortable having a larger sum of money in the RA.

They would now have to adjust expectations of their interest income or commit more funds to the RA.

For the 1M65 crowd who have committed substantial funds to their CPF and have excess funds in the OA even after meeting the ERS, unfortunately the option is to adjust expectations or invest into investment products included under CPFIS.

4) Other minor enhancements

There are also other minor enhancements to schemes such as the Matched Retirement Savings Scheme, Silver Support scheme and Workfare Income supplement Scheme. The first two schemes will provide additional support for the older members while the third will support the lower income workers.

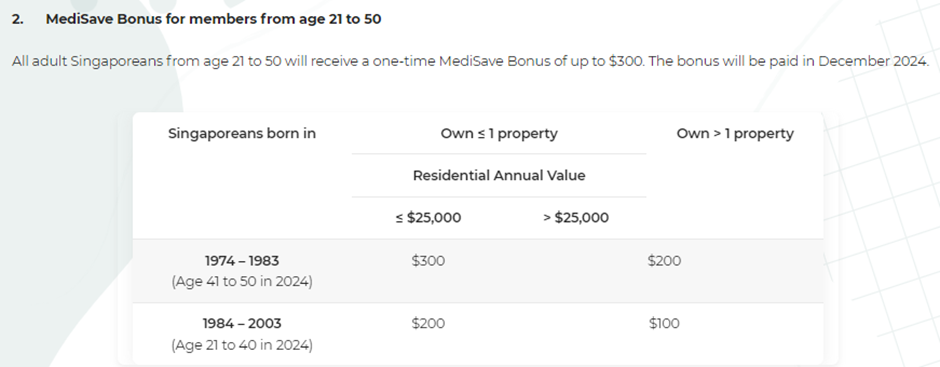

There is also a one off Medisave bonus of between $100 to $300 for members aged 21 to 50, depending on their age and property value.

Closing statements

The main changes to the CPF were to incentivise older workers and to increase the structured payouts. Minor enhancements were also made to support the ageing population who may have seen their spending power reduce due to inflation and worry about their future.

The government is making a move to close the SA when the RA is formed and explained that this would better align CPF interest rates to the nature of CPF savings in each CPF account. Unfortunately, the consequence is the elimination of the CPF SA shielding strategy. Now CPF members will have to return to the drawing board in strategizing their CPF contributions over the years and especially for the years leading up to age 55.

It is clear that the more funds one has in the CPF, the more they would likely see their interest income diminish, especially if their funds exceed the ERS and they would have to find alternatives should they want to reach for higher returns.