High quality REITs are better for long-term investments.

Lower quality REITs tend to entice investors with higher dividend yields but issues often arise eventually. In contrast, high quality REITs allow an investor to have less headaches and heartaches while holding them long-term.

With REITs underperforming over the past year due to macroeconomic issues, it might be a good time to explore for opportunities.

What are High Quality REITs?

We define high quality REITs as those that are able to consistently raise their distribution per unit (DPU) over a long period of time.

The premise is that it isn’t easy to raise rent each year so as to pay out higher dividends to unit holders. It usually means that they have great properties that can command higher rents and that the management is doing a good job in extracting value from these properties.

Given the current interest rate environment, it is also prudent to look at the debt profile of the REITs. They should have as much fixed rates as possible and debt maturity far into the future.

Lastly, these REITs should provide not just dividend gains, but capital gains too, delivering an attractive total return to the investors.

Take the 7 high quality REITs Report [2024 update!] with you: Download Now

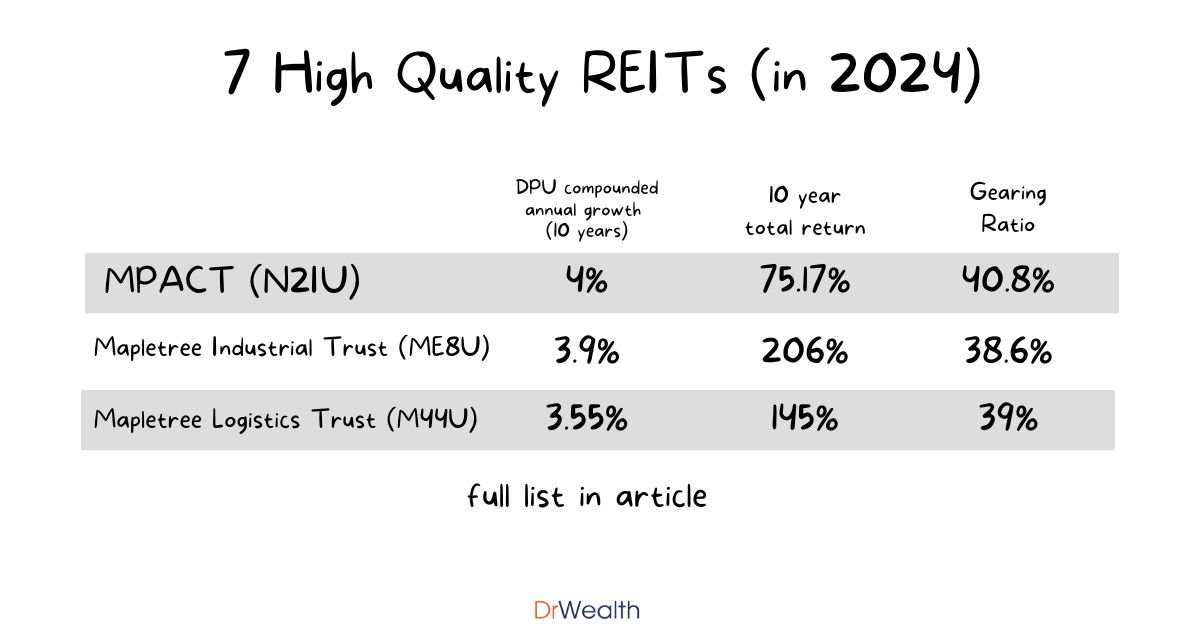

Using these criteria, I’ve found:

7 high quality REITs with rising dividends

| S-REIT | Stock Code | DPU compounded annual growth (10 years) | Gearing Ratio | Interest Rate | % of Fixed Rate Debt | Weighted Average Debt Maturity | 10 year total return | Forward Yield |

|---|---|---|---|---|---|---|---|---|

| Mapletree Pan Asia Commercial Trust | N2IU | 4% | 40.8% | 3.33% | 85% | 2.8 years | 75.17% | 6.3% |

| Mapletree Industrial Trust | ME8U | 3.9% | 38.6% | 3.10% | 79.5% | 3.6 years | 206% | 5.8% |

| Mapletree Logistics Trust | M44U | 3.55% | 39% | 2.50% | 83% | 3.7 years | 145% | 5.8% |

| ParkwayLife REIT | C2PU | 3.38% | 36% | 1.32% | undisclosed | 2.8 years | 127% | 4.1% |

| Frasers Centrepoint Trust | J69U | 1.96% | 37% | 4.3% | 63% | 2.8 years | 115% | 5.4% |

| CapitaLand Integrated Commercial Trust | C38U | 1.29% | 39.9% | 3.4% | 78% | 3.9 Years | 120% | 5.7% |

| CapitaLand Ascendas REIT | A17U | 0.99% | 37.9% | 3.5% | 79% | 3.4 years | 70% | 5.7% |

#1 Mapletree Pan Asia Commercial Trust (N2IU)

Mapletree Pan Asia Commercial Trust (MPACT) was formed through a merger between Mapletree Commercial Trust (MCT) and Mapletree North Asia Commercial Trust (MNACT) in 2022.

Its property portfolio became more geographically diversified after the merger that included Festival Walk in Hong Kong as well as properties in Mainland China, South Korea and Japan. The prized assets continued to be Vivocity, Mapletree Business City I & II in the southern part of Singapore.

MPACT has managed to grow its DPU by a compounded annual rate of 4% in the last 10 years, the highest rate among the REITs in this list.

MPACT’s gearing ratio is the highest among the REITs in this list, and it is the only one where its gearing ratio surpass 40%. With lower debt headroom, the chances of a rights issue are higher if MPACT plans to acquire more properties.

The interest rate of 3.33% is below market rate, considering the current rates are going at 5+%. Moreover, 85% of the debts are at fixed rates and current fixed rates are ~3.9%.

| 31/12/2023 | |

|---|---|

| Gearing Ratio | 40.8% |

| Interest Rate | 3.33% |

| % of debt with fixed rates | 85% |

| Weighted Average Debt Maturity | 2.8 years |

The debt maturity is evenly spread out with no significant debt due in any single year. Rate hikes should not have a big impact to MPACT given that it enjoys fixed rate debts and does not require significant refinancing in the immediate future.

Take the 7 high quality REITs Report [2024 update!] with you: Download Now

MPACT has returned 75% in total returns (capital + dividend gains) in the past 10 years, or a 5.77% annual return.

#2 Mapletree Industrial Trust (ME8U)

Mapletree Industrial Trust (MIT) have been aggressively expanded their portfolio to include data centres in recent years – currently 56% of its assets comprises of data centre properties. (You can also check out the comparison of data centre REITs in Singapore here.)

Most of these data centres are located in North America while the other industrial properties are in Singapore.

MIT has grown its DPU by 4% per year in the past 10 years, even during the Covid year (2020)!

MIT’s debt profile is healthy too. Its gearing ratio is at 38.6% which is way below the 50% limit while its interest rate has been kept low at about 3% despite the rate hikes. 79.5% of its debt are on fixed rates and the larger refinancing are only due from 2025 onwards.

| 31/12/2023 | |

|---|---|

| Gearing Ratio | 38.6% |

| Interest Rate | 3.1% |

| % of debt with fixed rates | 79.5% |

| Weighted Average Debt Maturity | 3.6 years |

This means that MIT will unlikely need to pay higher interest rates in the near term. And by the time MIT needs to refinance in 2025, interest rates may have already fallen.

Take the 7 high quality REITs Report [2024 update!] with you: Download Now

#3 Mapletree Logistics Trust (M44U)

Mapletree Logistics Trust (MLT), as the name suggests, holds a portfolio of logistics properties. It is well diversified across Asia with the exposure to China (including HK) being the largest at 42% of the total asset value. Singapore is second with 19%.

Logistics properties are playing an increasingly important role with the growth of e-commerce, and MLT may benefit from this trend.

MLT grew its DPU by 3.6% per year.

MLT’s debt profile is healthy. Its gearing ratio is at 39% and is paying an interest rate of just 2.5%. Majority of the debts are based on fixed rates so rate hikes should have minimal impact. Most of the debts are maturing in 2025 and beyond.

| 31/12/2023 | |

|---|---|

| Gearing Ratio | 38.8% |

| Interest Rate | 2.5% |

| % of debt with fixed rates | 83% |

| Weighted Average Debt Maturity | 3.7 years |

MLT’s total return was 145% in the past 10 years, or an annual return of 9.4%.

#4 ParkwayLife REIT (C2PU)

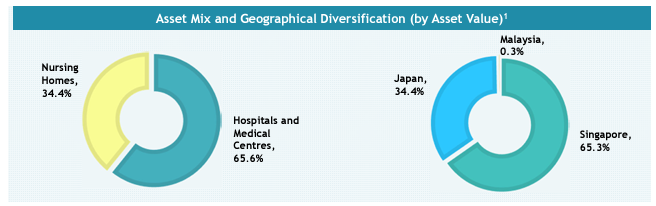

ParkwayLife REIT (PREIT) has the most unique assets – hospitals and nursing homes.

The hospital properties are mainly in Singapore and include well regarded names such as Mount Elizabeth and Gleneagles. These private hospitals attract patients around the region who want to seek quality medical services in Singapore.

PREIT has a variable component where it takes a cut of the revenue when the operator does well. These specialized buildings mean that the operator is unable to move anywhere else and have to keep using the premises. In fact, the operator had renewed a 20-year lease with PREIT in 2022.

The nursing homes are located in Japan and we all know that Japan is known for its aging population. The demand for nursing homes would only increase as the forecast says 1 in 3 Japanese will be over 65 years old in 2050.

We did a write-up on PREIT previously if you want to learn more about their business model and portfolio.

PREIT managed to grow its DPU by an average of 3.4% per year in the last 10 years.

PREIT’s debt profile is excellent. It has a normal gearing ratio of 36% but at an impressive low interest rate of 1.32%! This might be due to the cheap loans in Japan.

| 31/12/2023 | |

|---|---|

| Gearing Ratio | 36% |

| Interest Rate | 1.32% |

| Weighted Average Debt Maturity | 2.8 years |

Some of the debts are maturing in 2024, with a good proportion distributed to 2026 – 2027 which again, interest rate is likely to fall by then.

PREIT gained 127% in the last 10 years, including both capital and dividend gains. Its annual return is 8.58%.

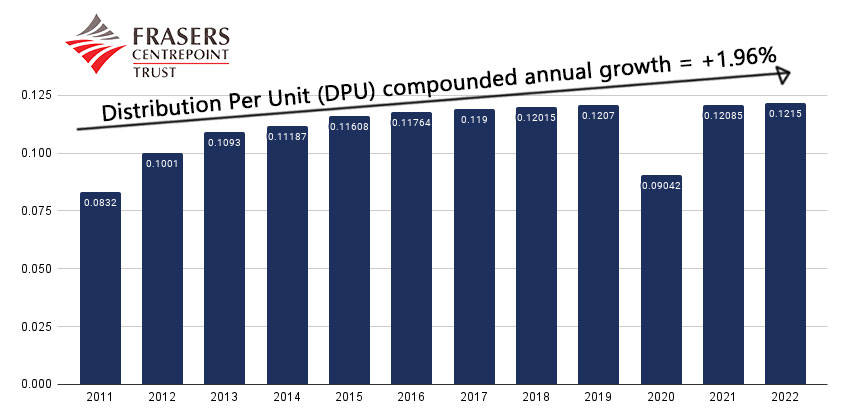

#5 Frasers Centrepoint Trust (J69U)

Frasers Centrepoint Trust (FCT) has a portfolio of suburban malls in Singapore. Some of these suburban malls can be more crowded than the malls in the city as they are usually located in high-density residential areas. They are frequented by residents and not reliant on tourists. Moreover the shops are largely similar among the malls so one does not need to travel far to get the products or services.

FCT’s DPU has compounded annual at a rather unimpressive rate of 1.96% in the past 10 years. It might seems a bit low but it is still acceptable to us because it is still growing. Most REITs don’t even have such a track record.

Its debt profile is not as good as the rest of REITs. Most of its FY24 debt had already been refinanced, hence you’ll notice that FCT has the highest interest rate of the REITs on this list. There’s also a significant proportion of debt maturing in 2025.

| 31/12/2023 | |

|---|---|

| Gearing Ratio | 37.2% |

| Interest Rate | 4.3% |

| % of debt with fixed rates | 63% |

| Weighted Average Debt Maturity | 2.8 years |

FCT has returned 114.8% in the past 10 years, or a 7.95% annual return.

#6 CapitaLand Integrated Commercial Trust (C38U)

CapitaLand Integrated Commercial Trust (CICT) is the very first REIT to be listed on SGX and it is also became the biggest REIT in Singapore after the merger between CapitaLand Mall Trust and CapitaLand Commercial Trust.

Hence, it now has both retail and office properties in its portfolio and is very Singapore centric with 93.7% of the portfolio value in the island-nation.

CICT’s DPU growth was just 1.29%, but their massive asset sizes are a valid reason for slower growth.

CICT’s gearing ratio is the highest among the REITs in this list, and it is the only one where its gearing ratio surpass 40%. With lower debt headroom, the chances of a rights issue are higher when CICT plans to acquire more properties.

Take the 7 high quality REITs Report [2024 update!] with you: Download Now

Debt maturity is spread over the next few years and interest rate of 3.4% is still considered low in the current markets.

| 31/12/2023 | |

|---|---|

| Gearing Ratio | 39.9% |

| Interest Rate | 3.4% |

| % of debt with fixed rates | 78% |

| Weighted Average Debt Maturity | 3.9 Years |

CICT’s total returns were the lowest among the 7 REITs at just 70% or 5.5% gain per year. This means that most of the returns came from dividends and capital gain was negligible, if any.

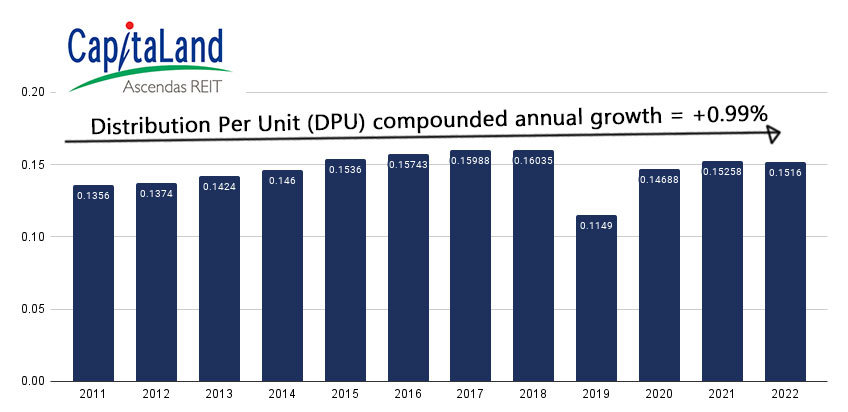

#7 CapitaLand Ascendas REIT (A17U)

Finally we have come to the last in the list! It is none other than CapitaLand Ascendas REIT (CLAR), the largest industrial REIT listed on SGX.

It has a mixture of industrial, logistics, data centres, business spaces and life science labs. It is quite diversified globally and not focused on Asia alone. Besides 64% of the assets in Singapore, it has exposure in Europe, North America and Australia.

We covered CLAR with more depth here.

CLAR grew its DPU at 0.99% per year in the past 10 years.

The debt maturity is evenly spread between 2024 and 2029. There isn’t a single year where significant debt is due. The interest rate that it is paying is relatively low at 3.5% with 79.1% of its debt on fixed rates.

| 31/12/2023 | |

|---|---|

| Gearing Ratio | 37.9% |

| Interest Rate | 3.5% |

| % of debt with fixed rates | 79.1% |

| Weighted Average Debt Maturity | 3.4 years |

CLAR’s 10y total returns were 120% while its annual return was 8.2%.

Is it time to buy these REITs?

The recent rate hikes have had a negative impact on REITs. The iEdge S-REIT Index was down 12% in the past year:

Although it seems like REITs have fallen less than the other stocks, it is considerable to REIT investors who often go for yields – a 5% dividend yield would not be able to cover the 16% capital loss.

Rising bond yields could have also prompted some investors to dump REITs and buy bonds instead, causing REIT prices to fall.

The general thinking is that there will be more rate hikes and that a recession is looming. But it pays to be a contrarian in the markets at times. While investors are pessimistic about REITs, there might be opportunities to buy.

Take the 7 high quality REITs Report [2024 update!] with you: Download Now

When to buy a high quality REIT?

To answer this we look at the yield spread between the Singapore Government 10-year bond yield and the REIT Index’s forward dividend yield.

According to SGX, the 10-year average spread is at 3.83%.

REITs are worth buying if their yields are above the sum of SG 10y bond yield and yield spread.

The current 10y bond yield is 3.4%.

That means REITs should yield at least 7.23% to be worthwhile.

But we should note that the yield spread of 3.83% consists of all the REITs, including the high yield REITs which have widened the spread. And High quality REITs usually offer lower yields.

Hence, if we take a 30% discount to the spread, we will get a minimum yield requirement of 5.06%.

Below is the table of high quality REITs’ forward dividend yields. 6 of them are above the yield requirement of 5.06%.

| S-REIT | Stock Code | Forward Yield |

| Mapletree Pan Asia Commercial Trust | N2IU | 6.30% |

| Mapletree Industrial Trust | ME8U | 5.80% |

| Mapletree Logistics Trust | M44U | 5.80% |

| CapitaLand Integrated Commercial Trust | C38U | 5.70% |

| CapitaLand Ascendas REIT | A17U | 5.70% |

| Frasers Centrepoint Trust | J69U | 5.40% |

| ParkwayLife REIT | C2PU | 4.10% |

Summary

We believe that high quality REITs are more suitable for long-term investments as compared to high-yielding REITs as the latter tends to have issues once in a while. High quality REITs enable investors to sleep better at night.

It is important to look at the DPU track record of a REIT. We prefer those that are able to raise DPU over a long period of time – we used 10 years here and found 7 REITs to have pass this test.

But they may not be at the right prices to buy. Given the rising interest rate environment, it is important to consider the bond yield and add on a bond-REIT yield spread to determine the minimum acceptable dividend yield one should demand from a REIT.

Want more ways to pick high quality REITs and dividend stocks? Chris Ng reveals his strategy live, you can join him here. (p.s. he used the same strategy to retire successfully at 39, might be something you want to learn)