It seems that the verdict is already out. Electric Vehicles (EV) will replace Internal Combustion Engine (ICE) vehicles in time to come. EVs are viewed as more energy efficient, more environmentally friendly and cost less to maintain.

Although EVs get a lot of attention, they are still a relatively small portion of the overall vehicle market. In 2023, EVs accounted for approximately 18% of all cars sold worldwide, up from 14% in 2022 and just 2% in 2018.

This growth is particularly notable in regions like China and Europe. In China, nearly 40% of new cars sold in 2023 were electric, while in Europe, the share was around 24%. In contrast, the United States has seen slower adoption, with electric cars comprising about 8% of new car sales in 2023.

While most cars on the road today are still ICE vehicles, this balance is expected to shift dramatically over the next 30-40 years. As ICE vehicles are phased out and EV sales continue to grow, EVs are projected to make up the vast majority of vehicles on the road.

As technology improves, the cost of electric vehicles (EVs) is expected to drop significantly. Batteries, which make up 30-40% of an EV’s cost, could become nearly 50% cheaper by 2026 compared to 2023, thanks to innovations in battery production.

Battery prices have already fallen from $153 per kilowatt-hour (kWh) in 2022 to $149/kWh in 2023 and are expected to reach $111/kWh by the end of 2024. Goldman Sachs predicts prices could drop to $80/kWh by 2026. At that level, EVs would cost the same to own as gasoline cars in the US, even without subsidies.

To obtain exposure to EVs, one approach is via an EV themed ETF which will include not only EVs but also companies who are in batteries, other EV components, mining of critical minerals, hydrogen and even in charging stations and autonomous vehicles.

A couple of years ago, we would have said that if one wants to get exposure to this theme, buy an EV ETF as we wouldn’t know who would survive. Now, buying into an EV ETF allows investors to get the broad based exposure required to an important macro trend.

There are also ETFs focusing on other parts of the supply chain such as Battery, Self driving, EV minerals. Here we look at 4 EV focused ETFs.

Best EV ETFs

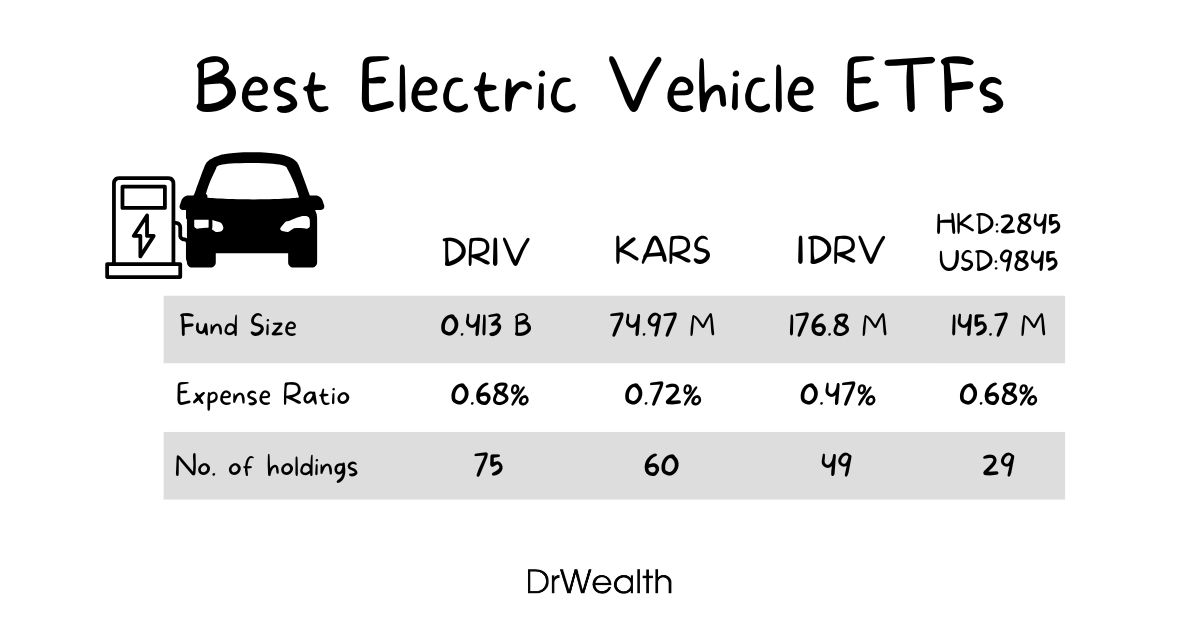

Some of the most popular and largest EV thematic ETFs are listed in the table below

| ETFs | Global X Autonomous & Electric Vehicles | KraneShares Electric Vehicles and Future Mobility Index | iShares Self-Driving EV and Tech | Global X China Electric Vehicle and Battery |

|---|---|---|---|---|

| Exchange | Nasdaq | NYSE | NYSE | HKSE |

| Ticker | DRIV | KARS | IDRV | HKD:2845; USD:9845 |

| Inception date | 13/4/18 | 18/1/18 | 16/4/19 | 16/1/20 |

| Denomination | USD | USD | USD | USD |

| Expense ratio | 0.68% | 0.72% | 0.47% | 0.68% |

| Fund size | 0.413b | 74.97 Million | 176.8 Million | US$ 145.7 Million |

| No. of holdings | 75 | 60 | 49 | 29 |

| Top 10 holdings weighting | 27.43% | 40.27% | 47.55% | 75.12% |

| Top 10 holdings | Nvidia, Tesla, Alphabet, Microsoft, Toyota, Honeywell, Qualcomm, Hitachi, Geely, General Motors | Contemporary A-A (CATL), Tesla, Albemarle, Panasonic, BYD, Geely, Arcadium Lithium, Xpeng, Li Auto, Rivian | Xpeng, Nio, Tesla, Li Auto, BYD, LG Energy Solution, Schneider Electric, Lucid Group, ABB, Zhejiang Leapmotor Technology | CATL, BYD, Li Auto, Shenzhen Inovance Technology, Fuyao Glass Industry, Zhejiang Sanhua Intelligent Controls, EVE Energy, Ningbo Tuopu Group, Ganfeng Lithium, Huizhou Desay SV |

Here we have 2 US centric ETFs, namely DRIV & IDRV, 1 Global ETF (KARS) and 1 Chinese centric ETF.

Comparing the Top 10 holdings across the first 3 ETFs, obviously the one mainstay would be Tesla. Toyota also features on 2 ETFs. FAANG stocks such as Apple and Alphabet also feature on 2 ETFs. Semiconductor themed companies such as Qualcomm and Samsung also feature on 2 ETFs.

Global X Autonomous & Electric Vehicles (DRIV)

The Global X Autonomous & Electric Vehicles ETF (DRIV) seeks to invest in companies involved in the development of autonomous vehicle technology, electric vehicles (“EVs”), and EV components and materials.

It includes companies involved in the development of autonomous vehicle software and hardware, as well as companies that produce EVs, EV components such as lithium batteries, and critical EV materials such as lithium and cobalt.

This ETF tracks the Solactive Autonomous & Electric Vehicles Index which tracks the price movements in shares of companies which are active in the electric vehicles and autonomous driving segments. This particularly includes electric vehicle manufacturers, electric vehicle component producers, companies that mine or produce raw materials that are relevant to the electric vehicle and autonomous vehicle technology segment, companies that build autonomous vehicles, and suppliers of autonomous vehicle technologies.

The top 10 holdings in DRIV as of 31 Oct 2024 are as follows:

The industry and country breakdown are as follows:

As the Global X Autonomous & Electric Vehicle ETF is actively managed and aims to track the Solactive Autonomous & Electric Vehicles Index, do also check out the latest developments of the Global X Autonomous & Electric Vehicle ETF at their website here before an investment is made.

KraneShares Elecric Vehicles and Future Mobility Index (KARS)

KARS has positions in global companies that operate in all areas of new transportation methods, passenger, and freight, including electric vehicles, autonomous vehicles and shared mobility.

KARS provides exposure to companies that lead the development of vehicle connectivity like Internet of Vehicles (IoV) and Intelligent mobility and to the potential growth brought on by increased demand for lithium-ion battery and non-ferrous metals like lithium due to electric vehicle adoption. It also has access to equities listed in Mainland China, which is currently the world’s largest electric vehicle market.

KARS seeks to measure the performance of the Bloomberg Electric Vehicles Index. The Index is designed to track the performance of companies engaged in the production of electric vehicles and/or their components or engaged in other initiatives that may change the future of mobility. The Index includes issuers engaged in the electric vehicle production, autonomous driving, shared mobility, lithium and/or copper production, lithium-ion/lead acid batteries, hydrogen fuel cell manufacturing and/or electric infrastructure businesses.

Here are the Top 10 holdings in KARS as of 29 Nov 24:

The industry and country breakdown are as follows:

Do also check out the latest developments of the KraneShares Electric Vehicles and Future Mobility ETF at their website here before an investment is made.

iShares Self-Driving EV and Tech (IDRV)

The iShares Self-Driving EV and Tech ETF tracks the NYSE FactSet Global Autonomous Driving and Electric Vehicle Index. The index comprises of developed and emerging market companies that benefit from growth and innovation in EV, battery technologies and autonomous driving technologies.

Hence, investing in IDRV provides access to companies at the forefront of self-driving and EV innovation These companies are globalised and capture the full value chain for self-driving and EV industries across sectors and geographies and will provide long-term growth

The top 10 holdings in IDRV as of 30 Sep 2024 are as follows:

The sector and country breakdown are as follows:

Do also check out the latest developments of the iShares Self-Driving EV and Tech ETF at their website here before an investment is made.

Global X China Electric Vehicle and Battery (HKG 2845 / 9845)

The Global X China Electric Vehicle and Battery ETF enables investors to access high growth potential through companies critical to the development of electric vehicles in China.

It seeks to invest in companies at the forefront of cybersecurity innovation, gaining exposure to stocks across the full value chain of cybersecurity and tech industries globally. These companies should have long term growth that can shape the global economic future.

Here are the Top 10 holdings as of 17 December 24:

The ETF’s geographic exposure is 100% in China and all underlying holdings are listed in China.

The sector breakdown is as follows:

As this ETF is listed in Hong Kong, it provides for easy access to investors globally. There is also an option of either investing in HKD or USD. However, as a 100% China-centric ETF, the prevalent risks associated with China are worth noting.

Do also check out the latest developments of the Global X China Electric Vehicle and Battery ETF at their website here before an investment is made.

Closing statement

Electric Vehicles are likely to replace ICE vehicles in the long term, supported by longer term government policies across the world. We have shared with you 4 ETFs you can consider if you wish to bet on EVs.

The 2 US centric and 1 Global ETFs are quite varied, with Tesla as the only company present across all 3 ETFs The ETFs also have a certain degree of industry diversification as some chips companies and FAANG companies have also been included.

For investors who are keen on getting exposure to China, a country with a 1.5 billion population and strong government support for EVs, there is also an ETF available that is listed in Hong Kong and traded in both HKD & USD.