Gold – the flashy metal that gets teased when the economy is booming, but suddenly becomes everyone’s bestie when things get shaky. If you’re looking to hop on the gold train, you’re not alone! Gold prices have jumped up 20% recently because so many people are doing the same.

But hold up, before you start stashing gold bars under your bed, let’s talk about the reality of owning physical gold. Spoiler alert: it can be pretty darn expensive, even if you’re investing through a tax-deferred option like a Gold IRA.

So what’s an investor to do? Enter: Gold ETFs.

Gold ETFs can be a convenient option for investors to consider – you can buy and sell it just like any stock. Plus, the good ones offer good liquidity and low costs too.

In this article, we’re diving into the best Gold ETFs out there and giving you some tips to help you choose the perfect one for your portfolio.

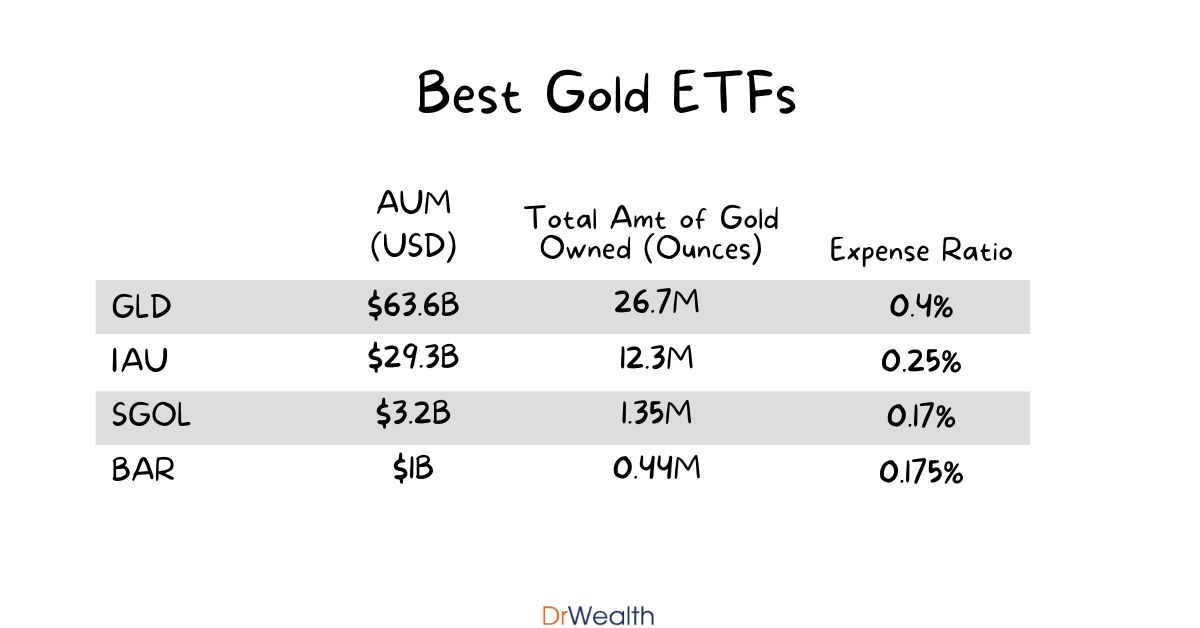

Best Gold ETFs

| SPDR Gold Trust | iShares Gold Trust | abrdn Physical Gold Shares ETF | GraniteShares Gold Trust | |

|---|---|---|---|---|

| ETF code | GLD | IAU | SGOL | BAR |

| AUM (USD) | $63.6B | $29.3B | $3.2B | $1B |

| Expense Ratio | 0.4% | 0.25% | 0.17% | 0.175% |

| Inception Date | 18 Nov 2004 | 21 Jan 2005 | 9 Sep 2009 | 31 Aug 2017 |

| Exchange | New York Stock Exchange Arca | New York Stock Exchange Arca | New York Stock Exchange Arca | New York Stock Exchange Arca |

| How much Gold do they own? (ounces) | 26.7M | 12.3M | 1.35M | 0.44M |

| Gold Custodians | HSBC Bank plcJPMorgan Chase Bank, N.A. | JPMorgan Chase Bank N.A | JPMorgan Chase Bank N.A | ICBC Standard Bank |

| Vault Location(s) | London, Zurich, New York | London, New York | London, New York | London |

| Why Invest? | largest physically backed gold exchange traded fund (ETF) in the world | 2nd largest Gold ETF | Lowest fees | If you’re looking for a Gold ETF that isn’t using JPMorgan Chase as a custodian… |

1. SPDR Gold Trust (GLD)

GLD prides itself as the “largest physically backed gold exchange traded fund (ETF) in the world”. At the point of writing, it owns about 29.9M ounces of physical gold being stored with its custodians, making it the Gold ETF holding the largest amount of physical gold.

Key information

- Name (Code): SPDR Gold Trust (GLD)

- Assets Under Management: US$58.7B

- Expense Ratio: 0.4%

- Exchange: NYSE Arca

GLD is one of the biggest Gold ETF, offers good liquidity and its price moves in tandem with Gold’s spot prices:

If you’re curious about GLD’s historical performance, here’s a quick overview:

| 1 Year | 3 Year | 5 Year | 10 Year | |

| GLD performance | 11.41% | 8.96% | 10.86% | 5.11% |

As the oldest Gold ETF, SPRD GLD ETF will likely be in the market for a long time. The main downside to this ETF is its expense ratio, which is the highest out of all the Gold ETFs I’ve listed here.

SPDR had released the newer SPDR Gold MiniShares (GLDM) ETF in 2018. This newer gold ETF offers a lower expense ratio of 0.1% (cheapest in the market currently). However, the AUM is also relatively smaller and the gold reserves are still being built. If you’re in it for the long term, GLDM might be an option to consider.

2. iShares Gold Trust (IAU)

Like GLD, IAU ETF offers a simple, cost-effective way to gain exposure and diversify your portfolio with physical gold.

Key information

Similar to GLD, IAU also offers good liquidity and its price moves in-tandem with Gold’s spot price:

Here’s IAU’s historical performance, accurate at the point of writing:

| 1 Year | 3 Year | 5 Year | 10 Year | |

| IAU performance | 11.58% | 9.13% | 11.05% | 5.28% |

3. abrdn Physical Gold Shares (SGOL)

SGOL aims to track the price of gold bullion. It is managed by abrdn and offers one of the lowest expense ratio (aka fee). However, you should note that it is newer, has lesser liquidity as compared to the older GLD and IAU gold ETFs.

Key information

SGOL’s price moves inline with the Spot Price of Gold as well:

If you’re curious about SGOL’s historical performance, here’s a quick overview:

| 1 Year | 3 Year | 5 Year | 10 Year | |

| SGOL performance | 11.66% | 9.22% | 11.13% | 5.25% |

4. GraniteShares Gold Trust (BAR)

BAR is another Gold ETF that allows you to gain exposure to the price of physical gold. Unlike the rest, BAR uses ICBC as their custodian, holding their physical gold in a vault located in London.

Key information

BAR’s price moves inline with the Spot Price of Gold as well:

If you’re curious about BAR’s historical performance, here’s a quick overview:

| 1 Year | 5 Year | |

| BAR performance | 12.96% | 9.79% |

Why invest in Gold?

There are several reasons why you may want to consider investing in gold:

Gold has historically been a store of value and a hedge against inflation. When the value of fiat currencies like the U.S. dollar drops, gold tends to hold its value or even increase in price, making it a valuable asset for investors to hold in their portfolio.

During times of economic uncertainty, political turmoil, or market volatility, investors tend to seek out safe-haven assets like gold. In these situations, gold tends to hold its value or even increase in price, providing a safe haven for investors looking to protect their wealth.

- Potential for capital appreciation

In addition to providing a hedge against inflation and a safe-haven asset, gold also has the potential for capital appreciation over the long-term. While the price of gold can be volatile in the short-term, it has historically increased in value over the long-term, making it a potentially attractive investment for investors seeking long-term capital appreciation.

Gold is not strongly correlated with the price movements of other asset classes like stocks and bonds. Adding gold to your portfolio could allow you to diversify and reduce the overall risk of your portfolio.

Gold is a finite resource and the supply of gold is limited. As a result, the price of gold can be influenced by supply and demand dynamics which can lead to increases in price over time.

What to look for in the best gold ETFs?

When investing in ETFs, here’re some pointers to look out for. Refer to our guide on Investing in ETFs for more!

As with any investment, the expense ratio of a gold ETF can have a big impact on your returns. Look for funds with low expense ratios to help keep your costs down.

You want to be able to buy and sell your gold ETFs easily, so look for funds with high trading volumes and tight bid-ask spreads.

Larger funds tend to have better liquidity. Look for funds with a significant amount of assets under management (AUM).

Finally, take a look at the historical performance of the ETF you’re considering. While past performance doesn’t guarantee future results, it can give you a sense of how the fund has performed in different market conditions.

When it comes to Gold ETFs, you should also consider the following:

The custodian is the company that physically holds the gold backing the ETF. Make sure the custodian is reputable and trustworthy.

Gold ETFs can track the price of gold in a few different ways, such as physical bullion or futures contracts. Consider which tracking method you’re most comfortable with.

I’ve only included Gold ETFs that track gold prices by owning physical bullion in this article.

Frequently Asked Questions

GLD vs IAU: Which is better?

If you’re looking to invest in gold via an ETF, the two common options are usually GLD or IAU. In a nutshell, the key differences between GLD and IAU are:

- Expense Ratio: IAU is cheaper at 0.25% while GLD charges 0.4%

- AUM: GLD has 2x more assets under management than IAU

- Diversity of vaults: GLD stores their gold in various vaults in London, Zurich and New York, customized under two different companies, while IAU relies on 1 custodian. The diversity of vaults and custodian that GLD has offers a greater peace of mind regarding the security of the Gold assets.

GLD vs IAU

| SPDR Gold Trust (GLD) | iShares Gold Trust (IAU) | |

|---|---|---|

| ETF code | GLD | IAU |

| AUM (USD) | $63.6B | $29.3B |

| Expense Ratio | 0.4% | 0.25% |

| Inception Date | 18 Nov 2004 | 21 Jan 2005 |

| Exchange | New York Stock Exchange Arca | New York Stock Exchange Arca |

| How much Gold do they own? (ounces) | 26.7M | 12.3M |

| Gold Custodians | HSBC Bank plcJPMorgan Chase Bank, N.A. | JPMorgan Chase Bank N.A |

| Vault Location(s) | London, Zurich, New York | London, New York |

| Why Invest? | largest physically backed gold exchange traded fund (ETF) in the world | 2nd largest Gold ETF |

Which Gold ETF is best in Singapore?

Other than the Gold ETFs mentioned above, you can also consider the SPDR Gold ETF (SGX:O87). We shared how you can buy gold in Singapore here.

Are gold ETFs a good idea?

Gold ETFs are an easy way for anyone to gain exposure to the alternative investment asset. However, you will need to decide if it is a good fit for your investment needs.

To help you decide, here’re the pros and cons in a table:

| Pros of investing in Gold ETFs | Cons of investing in Gold ETFs |

|---|---|

| Diversification Investing in gold ETFs can provide diversification in your portfolio, as gold tends to have a low correlation with other asset classes like stocks and bonds. |

Volatility Gold ETFs can be subject to volatility, and their value can fluctuate based on a variety of factors such as interest rates, economic conditions, and geopolitical events. |

| Convenience Gold ETFs can be bought and sold like stocks, making them a convenient way to invest in gold without having to purchase and store physical gold. |

Counterparty risk Gold ETFs rely on custodians to manage and store their physical gold. Should anything happen to the custodian, the fund may lose its gold, this results in counterparty risk. |

| Lower costs Gold ETFs generally have lower costs compared to physical gold. You don’t have to pay for storage or insurance. |

No direct access to physical gold If you’re looking to own gold for its portability during a crisis (like a war), then Gold ETFs are definitely not for you. |

| Liquidity Gold ETFs are highly liquid, meaning you can easily buy and sell them on the stock exchange. |

Overall, gold ETFs can be a good idea if you’re looking to diversify your portfolio and potentially hedge against inflation or market downturns. However, it’s important to carefully consider the potential risks and drawbacks before making an investment decision.