Did you know that Japan’s NIKKEI 225 index outperformed the S&P500 in the past year?

After stagnating for decades, Japan has finally started to move. With a rich history and vibrant culture, Japan has emerged as a powerhouse in various industries such as technology, automotive, robotics, and healthcare.

Japan is changing…

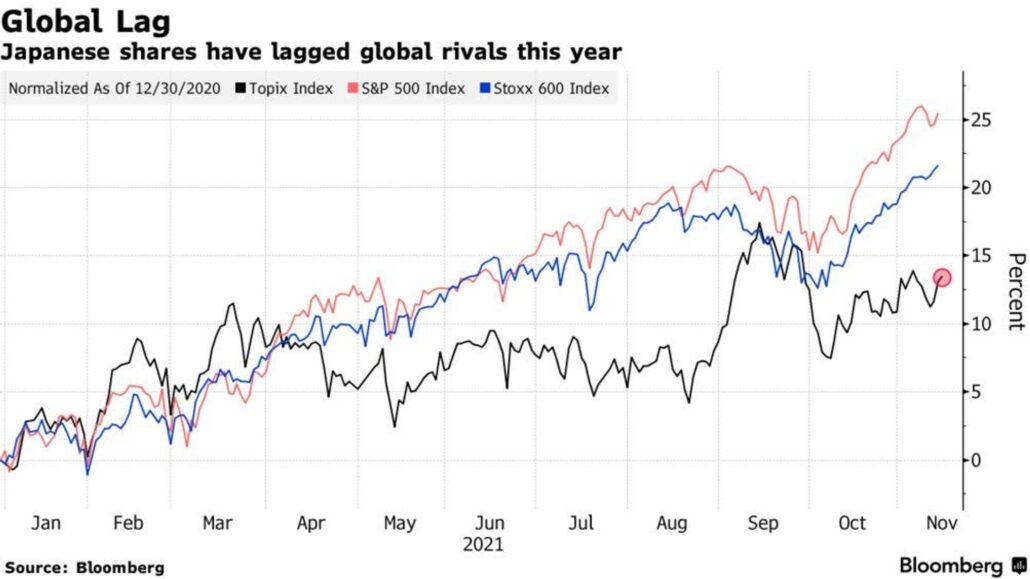

Before 2022, Japan stocks were still lagging behind:

You see, investing in Japan stocks used to be unpopular due to unaligned motivations between foreign shareholders and the management.

Today, we see a shift in the way Japanese (listed) companies are being run – dividends and share buybacks are picking up in the market, reaching an all-time high in 2022. The Tokyo Stock Exchange is also looking to make it compulsory for top listed companies to issue all disclosures in English alongside Japanese.

Even the currency risk is abating as Japan sought to stimulate economic growth by keeping its interest rates low. Alvin shares more reasons to invest in Japan here.

With these changes in the works, its no wonder that after 33 years, the Nikkei Stock Average finally broke its 1990 all-time high in 2023 and doesn’t seem to be stopping anytime yet:

With smart money moving into Japan, you may be thinking of riding its growth.

You could study the Japan markets, get key financial data from Nikkei and spend days to find suitable Japanese stocks for your portfolio.

Or, you could get exposure to the Japanese markets through these ETFs.

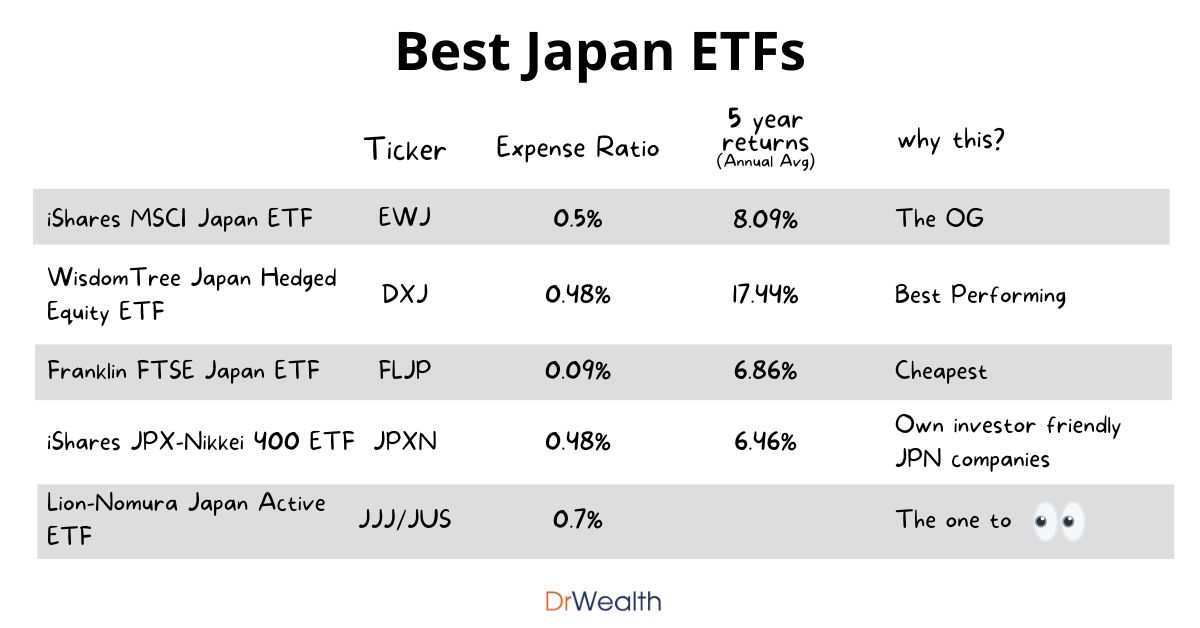

Best Japan ETFs

| Japan ETF | Ticker | Exchange | Why Choose this ETF? | Expense Ratio | 1 year performance | 5 year performance (annual average) | AUM | Average Daily Volume (liquidity) |

|---|---|---|---|---|---|---|---|---|

| iShares MSCI Japan ETF | EWJ | NYSE Acra | Exposure to the largest companies listed in Japan. Also the largest and most liquid Japan ETF. | 0.5% | 19.78% | 6.44% | US$14.5B | 11M |

| iShares Core Nikkei 225 ETF | 1329 | Tokyo Stock Exchange (TSE) | Tracks the Nikkei 225 index that gives you exposure to large Japan companies. | 0.0495% | 30.86% | 12.92% | ¥1.3T | 38.5K |

| WisdomTree Japan Hedged Equity ETF | DXJ | NYSE Acra | Exposure to dividend paying Japanese companies while hedging against currency fluctuations. Also has the highest performance currently. | 0.48% | 41.75% | 17.44% | US$3.43M | 0.99M |

| Franklin FTSE Japan ETF | FLJP | NYSE Acra | Cheapest Japan ETF for exposure to large and mid sized Japanese companies. | 0.09% | 20.03% | 6.86% | US$1.66B | 0.5M |

| iShares JPX-Nikkei 400 ETF | JPXN | NYSE Acra | Exposure to large and mid sized Japanese companies that are deemed to be shareholder-friendly. | 0.48% | 19.47% | 6.46% | US$83.2M | 4.6K |

| Lion-Nomura Japan Active ETF | JJJ (SGD) JUS (USD) |

Singapore Exchange (SGX) | Active ETF listed in Singapore, for exposure to Japanese stocks. | 0.7% | to be listed on 31st Jan 2024 | tbu | tbu | tbu |

iShares MSCI Japan ETF (EWJ): The OG Japan ETF

One of the oldest, biggest and most liquid Japan ETF, EWJ gives you exposure to the largest companies listed in Japan. The EWJ tracks the MSCI Japan Index.

If you’re looking to diversify your portfolio and don’t want to spend too much time picking the best Japan ETF, EWJ is probably your go-to.

The iShares MSCI Japan ETF was launched on 12 March 1996 and is listed on the NYSE Acra. It tracks the MSCI Japan Index and currently has 231 holdings.

The top 10 holdings include:

- Toyota Motor 5.71%

- Sony 3.3%

- Mitsubishi UFJ Financial Group 2.73%

- Keyence 2.35%

- Tokyo Electron Ltd 2.31%

- Shin-Etsu Chemical Co Ltd 1.9%

- Hitachi 1.89%

- Sumitomo Mitsui Financial Group 1.69%

- Mitsubishi Corp 1.61%

- Recruit Holdings 1.6%

iShares Core Nikkei 225 ETF (1329): tracks Nikkei directly

The iShares Core Nikkei 225 ETF tracks the Nikkei 225 index which is the stock market index for the Tokyo Stock Exchange (TSE), much like the STI is for the Singapore market or the S&P 500 for the US market.

This ETF trades on the TSE which may not be as accessible to all investors.

Its top 10 holdings at the point of writing are:

- Fast Retailing 10.86%

- Tokyo Electron 7.45%

- Advantest 3.99%

- Softbank 3.63%

- KDDI 2.78%

- Shin Etsu Chemical 2.65%

- Daikin Industries 2.2%

- TDK 2.02%

- Fanuc 1.97%

- Terumo 1.97%

WisdomTree Japan Hedged Equity ETF (DXJ): best performing Japan ETF

DXJ gives you exposure to dividend paying companies in Japan, especially those with revenue stream from export sales. As a Hedged ETF, it also protects you from currency fluctuations between the Yen and the US dollar.

The WisdomTree Japan Hedge Equity ETF has been trading since Jun 2006 and has 446 holdings currently.

And its top 10 holdings include:

- Toyota Motor 5.15%

- Mitsubishi UFJ Financial Group 4.69%

- Japan Tobacco Inc 4.14%

- Mitsubishi Corp 3.26%

- Shin-Etsu Chemical Co Ltd 2.7%

- Mizuho Financial Group 2.33%

- Sumitomo Mitsui Financial Group 2.96%

- Takeda Pharmaceutical Co Ltd 2.11%

- Itochu Corp 2.03%

- Nintendo 1.96%

The DXJ ETF is also the top performing Japan ETF currently.

Franklin FTSE Japan ETF (FLJP): cheapest Japan ETF

The cheapest Japan ETF on this list, the Franklin FTSE Japan ETF allows you to get exposure to large and mid sized Japanese companies at a low expense ratio of 0.09%. The FLJP tracks the FTSE Japan Capped Index

At the point of writing, the FLJP has 512 holdings which include the top 10:

- Toyota Motor 5.54%

- Sony 2.78%

- Mitsubishi UFJ Financial Group 2.38%

- Keyence 2.03%

- Tokyo Electron Ltd 1.85%

- Shin-Etsu Chemical Co Ltd 1.71%

- Hitachi 1.55%

- Sumitomo Mitsui Financial Group 1.44%

- Recruit Holdings 1.4%

- Itochu Corp 1.38%

iShares JPX-Nikkei 400 ETF (JPXN): own investor friendly Japanese companies

The iShares JPX-Nikkei 400 ETF tracks the Nikkei 400 index which consists of companies deemed to be highly appealing to investors. Constituents are scored based on their 3-year average ROE, 3-uear cumulative operating profit and Market Capitalization, as well as specific qualitative factors.

The JPXN ETF has 392 holdings at the point of writing with these as its top 10:

- Tokyo Electron 1.84%

- Recruit Holdings 1.83%

- Shin Etsu Chemical 1.79%

- Itochu Corp 1.76%

- Toyota 1.75%

- Mitsubishi UFJ Financial Group 1.7%

- Nintendo 1.7%

- Hitachi 1.68%

- Mitsubishi 1.66%

- Mitsui 1.62%

Lion-Nomura Japan Active ETF: the Japan ETF to watch

The Lion-Nomura Japan Active ETF is an exciting addition to this list. It is an active ETF and it will be listed on the SGX. You can choose to invest in SGD or USD. This makes investing in the Japan markets even more accessible. Plus…it is powered by AI!

Alvin shares more about the appeal of the Lion-Nomura Japan Active ETF and how it works here.

What is the best performing Japanese ETF?

The WisdomTree Japan Hedged Equity ETF (DXJ) has done relatively well with a +89% return in the past 5 years, outperforming the market as represented by the Nikkei 225 ETF (shown in black).

Should I consider Hedged Japan ETFs?

Because…forex risk is real.

⚠️Currency Risk

The Japanese Yen has a notorious reputation of declining. It has done so since 2011.

As Japan looks to move out of deflation, it has kept its interest rates low while the rest of the world had started to raise theirs. This led to a reversal in trend where the Yen has started to strengthen against the USD.

Although the Yen looks to be strengthening now, we cannot be sure of the long term trend just yet. Hedged Japan ETFs allow you to reduce the risk of currency volatility, which could deliver higher returns. The downside is that their expense ratio tend to be slightly higher.

Japan’s rising popularity; Whales are swimming in!

Big names like JPMorgan and Morgan Stanley have been buying up Japanese stocks.

Foreign investors bought $15.6 billion worth of Japanese stocks last month, the highest monthly amount since October 2017

Japan Exchange Group

And of course, there’s Warren Buffett.

Buffett had been investing in Japan since 2020. Notably, he has been buying 5 Japanese Trading Houses through Berkshire Hathaway. As the OG investor, it’s no surprise that Buffett’s picks are doing well.

How is Buffett’s Japan Portfolio doing now?

That’s what we’re all curious about right?

While I can’t determine Buffett’s entry price, here’s how his 5 Japanese trading houses stocks did since 2020 (Nikkei225 in black):

| Stock | Mitsubishi | Mitsui | Itochu | Marubeni | Sumitomo |

|---|---|---|---|---|---|

| Ticker | TSE: 8058 | TSE: 8031 | TSE: 8001 | TSE: 8002 | TSE: 8053 |

| Market Cap | 11.12T | 9.03T | 10.44T | 4.21T | 4.09T |

| Revenue 5y CAGR | 23.3% | 23.9% | 20.4% | 4.0% | 7.1% |

| ROIC | 3.3% | 4.0% | 5.3% | 4.5% | 3.9% |

| PE | 12X | 8.7X | 13X | 8.9X | 8.3% |

| (estimated) returns since 2020 | 214% | 265% | 181% | 323% | 150% |

Tap into the Potential of Japan’s Economy with the Best Japan ETFs

The Japan market has been hot and the Best Japan ETFs offer an easy way for investors to gain exposure to this booming market. You can immediately own a portfolio of the best Japan stocks with a single investment.

That said, you should pick the best Japan ETF for your portfolio depending on your investment objective. Investing narratives change all the time and everyone’s investment objectives are different. So, remember to do your own research before making any investments!