Despite widespread expectations for interest rate cuts at the start of the year, market watchers have shifted their expectations due to the recent hawkish tone by the Fed and the higher-than-expected inflation rate announced yesterday.

In line with expectations, most banks are keeping their short-term interest rates for USD fixed deposits high, while reducing their longer-term USD fixed deposit interest rates.

New to foreign currency fixed deposits? Quick Intro:

A Foreign Currency Fixed Deposit is a time deposit placed in foreign currency. After a fixed tenure (period of time), interest will be paid upon maturity of the time deposit.

You will need to set up a Foreign Currency Fixed Deposit account with the bank to take advantage of their Foreign Currency Fixed Deposit Interest rates. An early withdrawal fee is usually imposed and you may earn less or no interest if you withdraw your fixed deposit before the fixed period is up.

All interest rates are calculated on a per annum basis, in %!

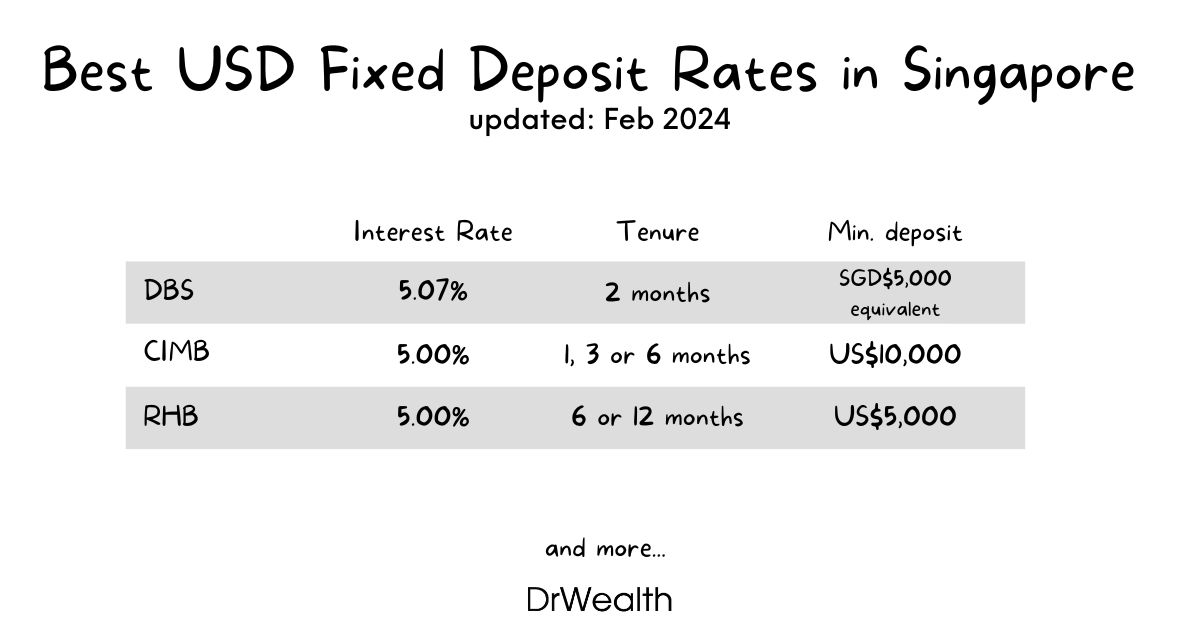

Best USD Fixed Deposit Rates in Singapore

- Best 12-month USD fixed deposit rates in February 2024 is 5.00% by RHB.

- Best 6-month USD fixed deposit rates in February 2024 is 5.00% by RHB or CIMB.

- Best 3-month USD fixed deposit rates in February 2024 is 5.00% by CIMB.

| Bank | Min deposit (USD) | Highest interest rate available (p.a.) | Tenure | Notes |

| DBS | $5,000 | 5.07% | 2 months | |

| CIMB | $10,000 | 5.00% | 1, 3 or 6 months | |

| RHB | $5,000 | 5.00% | 6 or 12 months | |

| Citibank | $50,000 | 5.00% | 3 months | Only for Citigold/ Citigold Private |

| Maybank | $10,000 | 4.90% | 3 months | iSAVvy Foreign Currency Time Deposit |

| UOB | $5,000 | 4.85% | 1 month | |

| ICBC | $500 | 4.85% | 3 or 6 months | |

| Bank of East Asia | $10,000 | 4.84% | 3 months | |

| Bank Of China | $2,000 | 4.80% | 3 months | |

| OCBC | $5,000 | 4.79% | 1 month | |

| State Bank of India | $5,000 | 4.75% | 3 or 6 months | |

| Standard Chartered | $25,000 | 4.68% | 8 months | SC Mobile |

| HL Bank | $50,000 | 4.6160% | 3 months | |

| HSBC | $25,000 | 3.75% | 3 or 6 months |

Rates accurate as at 14 February 2024.

All interest rates are calculated on a per annum basis, in %!

Where can I get the Highest Interest Rate for a 12-Months Fixed Deposit?

| Bank | Min deposit (USD) | Highest interest rate available (p.a.) | Notes |

| RHB | $5,000 | 5.00% | |

| ICBC | $500 | 4.65% | |

| CIMB | $10,000 | 4.60% | |

| Bank Of China | $2,000 | 4.55% | |

| HL Bank | $50,000 | 4.5337% | |

| Bank of East Asia | $10,000 | 4.51% | |

| State Bank of India | $5,000 | 4.50% | |

| UOB | $5,000 | 4.28% | |

| DBS | $5,000 | 4.25% | |

| OCBC | $5,000 | 4.12% | |

| Standard Chartered | $5,000 | 3.85% | |

| HSBC | $25,000 | 3.70% | |

| Citibank | Only 3 months | ||

| Maybank | Max 6 months |

All interest rates are calculated on a per annum basis, in %!

Higher rates are typically offered for larger deposit amounts and to customers with Preferred or Premium banking status. Do check with your bank for the rates if you have access to preferred or premium banking.

Do refer to individual fixed deposit rates (for USD) listed under each bank below. You can use the table of content to navigate quickly:

Bank of China

Bank of China offers fixed deposits across 10 different currencies including SGD and USD. Here’s the latest interest rates for USD Deposits as at 1 January 2024:

| Deposit Amount | 1Mth | 3Mth | 6Mth | 9Mth | 12Mth | 18Mth | 24Mth |

| Below 5,000 | 4.60 | 4.80 | 4.75 | 4.65 | 4.55 | 4.10 | 3.90 |

| 5,000 to below 50,000 | 4.60 | 4.80 | 4.75 | 4.65 | 4.55 | 4.10 | 3.90 |

| 50,000 to below 100,000 | 4.65 | 4.85 | 4.80 | 4.70 | 4.60 | 4.10 | 3.90 |

| 100,000 to 500,000 | 4.65 | 4.85 | 4.80 | 4.70 | 4.60 | 4.10 | 3.90 |

| 500,000 and Above | 4.70 | 4.90 | 4.85 | 4.70 | 4.60 | 4.15 | 3.95 |

- Currencies Available: SGD, RMB, USD, EUR, GBP, NZD, AUD, JPY, CAD and HKD

- Eligibility: You need to be at least 18 years old to set up a Foreign Currency Time Deposit with Bank of China.

- Minimum Initial Deposit: USD $2000

Bank of East Asia

Bank of East Asia offers fixed deposits across 10 different currencies. Here’s the latest interest rates for USD Deposits as at 14 February 2024:

| Deposit Amount | 1Wk | 1Mth | 2Mth | 3Mth | 6Mth | 12Mth |

| Min 10,000 | 4.37 | 4.46 | 4.53 | 4.84 | 4.71 | 4.51 |

| Min 100,000 | 4.50 | 4.59 | 4.66 | 4.97 | 4.84 | 4.64 |

- Currencies Available: AUD, CAD, CHF, CNY, EUR, GBP, HKD, JPY, NZD, USD

- Eligibility: 18 years old or above.

- Minimum Initial Deposit: US$10,000 (For term of one month and above); US$50,000 (For term shorter than one month)

CIMB

CIMB’s Exclusive Online Promotion for USD, AUD and GBP Fixed Deposit Placements is now ongoing till 29 February 2024.

| Deposit Amount | 1Mth | 3Mth | 6Mth | 12Mth |

| Min 10,000 | 5.00 | 5.00 | 5.00 | 4.60 |

- Currencies Available: USD, GBP, AUD, NZD, EUR, CAD & CNH

- Eligibility: Minimum 18 years of age

- Minimum Initial Deposit: USD $10,000

Citibank

Citibank offers a USD Time Deposit Promo Rate solely for Citigold Private Clients and Citigold Clients. This promo is eligible only for new funds deposited to the account.

| Deposit Amount | 3 Mth |

| US$50,000 to US$3 mil | 5.00 |

Citibank has an ongoing USD Time Deposit promotion for Citigold / Citigold Private Clients. This Promotion is valid till 29th February 2024 and the Promotional Time Deposit must be placed through a Relationship Manager.

DBS

DBS offers up to 9 different foreign currencies for their Foreign Currency Time Deposits (as at 14 February 2024).

| Deposit Amount | 1Mth | 2Mth | 3Mth | 6Mth | 12Mth |

| <10,000 | 5.06 | 5.07 | 4.86 | 4.5 | 4.25 |

| <25,000 | 5.06 | 5.07 | 4.86 | 4.5 | 4.25 |

| <50,000 | 5.06 | 5.07 | 4.86 | 4.5 | 4.25 |

| <100,000 | 5.06 | 5.07 | 4.86 | 4.5 | 4.25 |

| <250,000 | 5.16 | 5.17 | 5.01 | 4.8 | 4.55 |

| <=500,000 | 5.16 | 5.17 | 5.01 | 4.8 | 4.55 |

- Currencies Available: USD, GBP, AUD, NZD, EUR, CAD & CNH

- Eligibility: At least 18 years old

- Minimum Initial Deposit: USD $5,000

- Auto-renewal: Available upon maturity, you can choose to renew the principal and interest, renew just the principal or withdraw everything.

HL Bank

HL Bank offers fixed deposits across USD, GBP, AUD, NZD, HKD and CNH. This is their latest fixed deposit rates (as at 14 February 2024) on USD.

| Deposit Amount | 1Mth | 3Mth | 6Mth | 12Mth |

| Min 50,000 | 4.5344 | 4.6160 | 4.5659 | 4.5337 |

- Eligibility: 21 years and above

- Minimum Initial Deposit: A minimum deposit of 50,000 for at least one month in the respective currency

HSBC

HSBC offers various Foreign Currency Time Deposit rates for their customers of different tiers. The rates for HSBC Personal Banking Customers (as at 22nd January 2024):

| Deposit Amount | 1Mth | 3Mth | 6Mth | 12Mth |

| USD25,000 to USD49,999 | 3.65% | 3.75% | 3.75% | 3.70% |

| USD50,000 to USD99,999 | 3.65% | 3.75% | 3.75% | 3.70% |

| USD100,000 to USD249,999 | 3.75% | 3.85% | 3.85% | 3.80% |

| USD250,000 to USD499,999 | 3.85% | 3.95% | 3.95% | 3.90% |

| USD500,000 to USD999,999 | 3.85% | 3.95% | 3.95% | 3.90% |

| USD1,000,000 and above | 3.85% | 3.95% | 3.95% | 3.90% |

HSBC Premier Customers enjoy rates that are 0.15-0.20% higher.

- Currencies Available: USD, GBP, JPY, CAD, CHF, NZD, AUD, HKD, EUR, CNY

- Eligibility: Minimum 18 years of age

- Minimum Initial Deposit: US$25,000

ICBC

ICBC offers fixed deposits across only 3 foreign currencies, here’s their rates on USD Fixed Deposits as at 22nd December 2023:

| Deposit Amount | 1Mth | 3Mth | 6Mth | 1Yr |

| Deposit over counter with min amt USD20,000 | 4.30 | 4.85 | 4.85 | 4.60 |

| Deposit via E-banking with min amt USD500 | 4.30 | 4.85 | 4.85 | 4.65 |

- Currencies Available: SGD, USD, RMB

- Minimum age: 18 years old

- Initial deposit: USD 500 (E-banking) or USD 20,000 (over counter)

Maybank

Maybank offers fixed deposits across only 4 foreign currencies, here’s their rates on USD Fixed Deposits as at 14 February 2024.

| Deposit Amount | 1Mth | 2Mth | 3Mth | 6Mth |

| Min 10,000 | 4.60 | 4.65 | 4.70 | 4.60 |

| Min 50,000 | 4.65 | 4.70 | 4.75 | 4.65 |

| Min 100,000 | 4.80 | 4.85 | 4.90 | 4.80 |

| iSAVvy Foreign Currency Time Deposit (Min 10k) | 4.80 | 4.85 | 4.90 | 4.80 |

- Currencies Available: AUD, GBP, NZD and USD

- Minimum age: 18 years old

- Initial deposit: 10,000 units for all foreign currencies

OCBC

OCBC offers fixed deposits across 10 foreign currencies, here’s their rates on USD Fixed Deposits as at 14 February 2024.

| Deposit Amount | 1Mth | 2Mth | 3Mth | 6Mth | 8Mth | 9Mth | 12Mth |

| First $49,999 | 4.79 | 4.61 | 4.59 | 4.34 | 4.48 | 4.5 | 4.12 |

| $50,000-$99,999 | 4.89 | 4.71 | 4.67 | 4.34 | 4.51 | 4.53 | 4.12 |

| $100,000-$249,999 | 4.89 | 4.71 | 4.69 | 4.64 | 4.62 | 4.64 | 4.42 |

| $250,000-$499,999 | 4.99 | 4.81 | 4.79 | 4.64 | 4.65 | 4.67 | 4.42 |

| Above $500,000 | 4.99 | 4.81 | 4.79 | 4.64 | 4.65 | 4.67 | 4.63 |

- Currencies Available: USD, AUD, CAD, CNH, EUR, HKD, NZD, GBP, CHF, JPY

- Eligibility: Minimum 18 years of age

- Minimum Initial Deposit: $5,000 in USD currencies

RHB

RHB’s Foreign Currency Fixed Deposit Account offers 9 different currencies and flexible tenures with placement periods ranging from 1-week to 24-months.

Their USD Fixed Deposit Rates (in %) as at 14 February 2024:

| Deposit Amount | 1Wk | 1Mth | 2Mth | 3Mth | 6Mth | 9Mth | 12Mth | 24Mth |

| Up to 99,999 | 0.01 | 4.36 | 4.45 | 4.54 | 4.59 | 4.54 | 4.44 | 4.44 |

| 100,000 to 499,999 | 0.02 | 4.37 | 4.46 | 4.56 | 4.61 | 4.56 | 4.46 | 4.46 |

| 500,000 to 999,999 | 0.03 | 4.38 | 4.48 | 4.58 | 4.63 | 4.58 | 4.48 | 4.48 |

| 1 mil & above | 0.05 | 4.40 | 4.50 | 4.60 | 4.65 | 4.60 | 4.50 | 4.50 |

In addition to the standard Fixed Deposit rates above, RHB also offers Promotional rates for 6- and 12-month Fixed Deposit placements.

| Min Placement Amount | 6-Month | 12-Month |

| USD 5,000 | 5.00 | 5.00 |

- Currencies Available: USD, GBP, AUD, NZD, CAD, HKD, CHF, EUR, & Offshore Yuan

- Eligibility: Minimum 18 years of age

- Minimum Initial Deposit : Minimum placement of S$5,000 or equivalent for tenures of 1 week and above

Standard Chartered

Standard Chartered offers fixed deposits across 9 foreign currencies with flexible tenures of 1-12 months.

| Deposit Amount | 1Wk | 1Mth | 2Mth | 3Mth | 6Mth | 12Mth |

| 5,000 to 24,999 | 3.9111 | 3.8676 | 3.8923 | 3.9070 | 3.9962 | 3.8500 |

| 25,000 to 49,999 | 3.9111 | 3.8676 | 3.8923 | 3.9070 | 3.9962 | 3.8500 |

| 50,000 to 99,999 | 3.9111 | 3.8676 | 3.8923 | 3.9070 | 3.9962 | 3.8500 |

| 100,000 to 249,999 | 4.0111 | 3.9676 | 3.9923 | 4.0070 | 4.0962 | 3.9500 |

| 250,000 to 499,999 | 4.1111 | 4.0676 | 4.0923 | 4.1070 | 4.1962 | 4.0500 |

| 500,000 and above | 4.1611 | 4.1176 | 4.1423 | 4.1570 | 4.2462 | 4.1000 |

- Currencies Available: USD, GBP, AUD, NZD, EUR, CAD, HKD, CNH

- Eligibility: 18 years old

- Minimum Initial Deposit: USD $5,000

Standard Chartered has also extended their USD Time Deposit Fresh Funds Promotion to 29th February 2024 which is open to new and existing customers. A minimum placement of US$25,000 fresh funds must be deposited for a tenure of 6 or 8 months:

| Channel | Tenure | Promotional Rate | Priority Banking Preferential Rate | Priority Private Banking Preferential Rate |

| Branch | 6 months | 4.60 | 4.70 | 4.80 |

| SC Mobile | 8 months | 4.68 | 4.78 | 4.88 |

State Bank of India

SBI offers fixed deposits across only 3 foreign currencies, here’s their rates on USD Fixed Deposits as at 26 January 2024:

| Deposit Amount | 1Mth | 2Mth | 3Mth | 6Mth | 12Mth | 18Mth | 24Mth |

| 5,000 – <1,000,000 | 3.50 | 3.50 | 4.75 | 4.75 | 4.5 | 3.25 | 3.0 |

- Currencies Available: USD, GBP or AUD Fixed Deposits

- Eligibility: Individuals of the age of 21 years and above

- Minimum Initial Deposit: USD $5,000

UOB

UOB offers fixed deposits across 9 foreign currencies, here’s their rates on USD Fixed Deposits as at 14 February 2024.

| Deposit Amount | 1Wk | 1Mth | 2Mth | 3Mth | 6Mth | 12Mth |

| Below $50,000 | 3.84 | 4.85 | 4.76 | 4.76 | 4.47 | 4.28 |

| $50,000-$99,999 | 3.84 | 4.95 | 4.86 | 4.86 | 4.47 | 4.28 |

| $100,000-$249,999 | 4.34 | 4.95 | 4.86 | 4.86 | 4.75 | 4.58 |

| $250,000-$499,999 | 4.34 | 5.05 | 4.96 | 4.96 | 4.75 | 4.58 |

- Currencies Available: USD, AUD, GBP, CAD, EUR, NZD, CHF, JPY, HKD

- Eligibility: 18 years old and above

- Minimum Initial Deposit: USD $5,000

- Auto-renewal: Available upon maturity

Best bank to earn extra interest on your USD?

We’ve compiled the latest USD Fixed Deposit Rates offered by banks in Singapore here. At the point of writing, DBS offers the highest rate of 5.07% for a 2-month tenure with a minimum deposit amount of SGD$5,000 equivalent.

Next up would be RHB with a rate of 5.00% for a 6 or 12 months tenure or CIMB with a rate of 5.00% for 1, 3 or 6-month tenure.

If you’re looking to park very small sums of USD, you can also consider ICBC which offers 4.85% for a 3 or 6-month tenure for a min. deposit of US500.

Take note of your risks!

Also, before you put your money into foreign currency fixed deposits, do take note of the following!

Foreign currency deposits, dual currency investments, structured deposits and other investment products are not insured under SDIC, unlike SGD Fixed Deposits.

There will also be Forex risk if you are converting SGD to USD and back to SGD just to take advantage of the higher Fixed Deposit rates as you are taking on the risk of USD/SGD exchange rate moving in an unfavourable manner to your conversions.

If you do not wish to lock your money into another fixed deposit, consider other options to park your money.