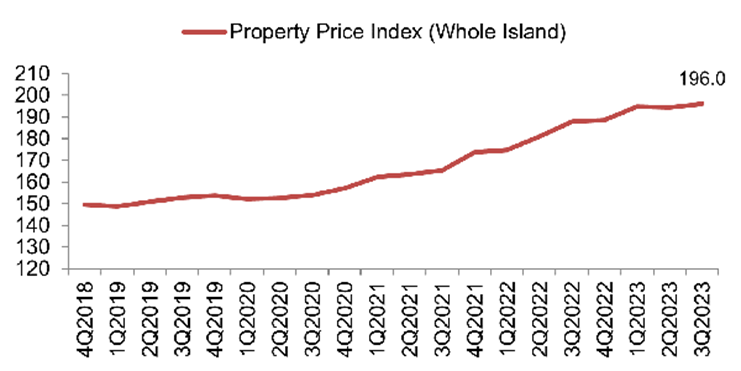

With private property prices nearly doubling since 2009 and increasing by 30% in five years, we wonder if private property is still affordable.

Prices for property in both public and private housing markets are currently at an all-time high. Having high prices is one thing, but it is not as much of an issue if salaries have kept up. But did they?

- Individual median income for full timers inclusive of CPF in 2009 and in 2022 was $2,600 and $5,070 respectively.

- Median household income including CPF in 2009 and in 2022 was $6,006 and $10,099 respectively.

This means that on a longer term basis, property prices income actually rose in line with median income but was lower than the median household income. This could be due to smaller households.

Are Private Properties in Singapore still affordable?

In September 2023, UBS found that Singapore’s residential property was fairly valued.

The bank said that a skilled service worker in Singapore needs an average 10 years of income to be able to buy a 650 sq ft flat near the city centre. Hong Kong fared the worst, requiring 22 times the average annual income.

In comparison, house prices were more sustainable in Miami, Madrid, and Toronto, where the price-to-income ratio is five times.

According to UBS’ data, a Singapore apartment takes about 23 years of rent to pay for itself, compared to 15 years in Miami and 42 years in Tel Aviv.

There is also a Rule of 15 – If the house is 15 times or less the annual rent of a similar property in the same area, it would make more sense to buy than to rent.

In this regard, houses could seem expensive or rental yields could be low as investors may not demand such high yields for Singapore property.

Average monthly income data in year 2022

| House type | Year 2022 average monthly income | % of households |

| 4-room HDB | 10,385 | 31.4 |

| 5-room/EA HDB | 13,814 | 22.6 |

| Condo | 21,497 | 17.0 |

| Landed | 26,659 | 4.9 |

Currently there are about 1.4 million resident households (where the reference person is a citizen or PR), of which only 306k or 21.9% are private residentials.

There is a total of 442k private residential units including executive condos of which 406k are occupied. Of the 406k occupied private residential units, about 25% or 100k of private residential units are foreign households.

| Monthly Household Income from Work (Including Employer CPF Contributions) | 2022 | Cumulative |

| $20,000 & Over | 16.9% | 16.9% |

| $17,500 – $19,999 | 4.4% | 21.3% |

| $15,000 – $17,499 | 6.1% | 27.4% |

| $14,000 – $14,999 | 2.7% | 30.1% |

| $13,000 – $13,999 | 3.1% | 33.2% |

| $12,000 – $12,999 | 3.3% | 36.5% |

| $11,000 – $11,999 | 3.7% | 40.2% |

| $10,000 – $10,999 | 4.1% | 44.3% |

The average income of condo and landed households of $21.5k and $26.7k respectively. The top 17% of households earn $20k and over while the top 21% of households earn $17.5k and over. Its safe to say that these people can comfortably afford the mortgage required to purchase a condo.

The next 25% of the population is the focus here because we know the top 20% can comfortably afford a private property but wonder if the next 25% who earn between $10k and $17.5k can afford to upgrade to a condo.

To assess this affordability, we look at a few case studies of HDB upgraders living in 4 room HDBs.

Case studies of HDB upgraders

Let’s see if potential HDB upgrader who had a successful BTO as a first timer will be able to garner enough equity from selling the property and make a downpayment of at least 25% or more.

Here are examples based on 2 age groups, across a variety of BTO locations. We estimated the equity they have based on the capital gain and see if they can afford at condo that will cost $1.7m and $2.2m.

Table 1: Can HDB upgraders afford a condominium at $1.7M?

| BTO year | 2014 | 2014 | 2009 | 2009 |

| Owner’s Age (years) | 35 | 35 | 40 | 40 |

| BTO location | Non-mature (Sengkang) | Mature (Tampines) | Non-mature (Sembawang) | Mature (Dawson) |

| 4 room HDB BTO purchase price ($) | 280,000 | 350,000 | 240,000 | 280,000 |

| Current value ($) | 620,000 | 690,000 | 540,000 | 930,000 |

| Gain ($) | 340,000 | 340,000 | 300,000 | 650,000 |

| Estimated Equity ($) | 430,000 | 450,000 | 410,000 | 780,000 |

| OCR condo (1,000 sqft) | 1,700,000 | |||

| Downpayment ($) | 430,000 | 450,000 | 425,000 | 780,000 |

| Downpayment (%) | 25% | 26% | 25% | 46% |

| Loan quantum ($) | 1,270,000 | 1,258,000 | 1,275,000 | 920,000 |

| Loan tenure (years) | 30 | 30 | 25 | 25 |

| Mortgage (per month at 4.5% interest) | 6,435 | 6,374 | 7,087 | 5,114 |

| Income required | $11,700 | $11,589 | $12,885 | $9,298 |

We can see here that the income required to purchase a condo that’s priced at $1.7m is between $9.3k and $12.9k depending on the equity available from the BTO flat and the age of the owner. This shows that older resale condos are within reach of HDB upgraders who belong to the next 15% to 25% of income brackets depending on their equity.

Table 1: Can HDB upgraders afford a condominium at $2.2M?

| BTO year | 2014 | 2014 | 2009 | 2009 |

| Owner’s Age (years) | 35 | 35 | 40 | 40 |

| BTO location | Non-mature (Sengkang) | Mature (Tampines) | Non-mature (Sembawang) | Mature (Dawson) |

| 4 room HDB BTO purchase price ($) | 280,000 | 350,000 | 240,000 | 280,000 |

| Current value ($) | 620,000 | 690,000 | 540,000 | 930,000 |

| Gain ($) | 340,000 | 340,000 | 300,000 | 650,000 |

| Estimated Equity ($) | 430,000 | 450,000 | 410,000 | 780,000 |

| OCR condo (1,300 sqft) | 2,200,000 | |||

| Downpayment ($) | 550,000 | 550,000 | 550,000 | 780,000 |

| Downpayment (%) | 25% | 26% | 25% | 46% |

| Loan quantum ($) | 1,650,000 | 1,650,000 | 1,650,000 | 920,000 |

| Loan tenure (years) | 30 | 30 | 25 | 25 |

| Mortgage (per month at 4.5% interest) | 8,360 | 8,360 | 9,171 | 7,893 |

| Income required | $15,200 | $15,200 | $16,674 | $14,350 |

We can see here that the income required to purchase a condo that’s priced at $2.2m is between $14.3k and $16.7k depending on the equity available from the BTO flat and the age.

As many newer 3 bedroom condos are being built at around 1000 to 1100 sqft and priced at around $2200 psf and up, we can see that newer condos tend to be out of reach of HDB upgraders unless they put in more of their savings to bring the loan quantum down.

What If You Had A Windfall or Inheritance?

Of course, for those who have other sources of wealth such as windfall gains or inheritance.

Looking at the statistics, the death rate in Singapore has risen from an average of 4.5 deaths per 1000 residents before year 2010 to 5.2 in 2020 and 6.3 in 2022.

In 2013, a study said that the average inheritance left behind in Singapore was $466,099. When there is only a single or few inheritors, this amount when added to the inheritor’s networth would significantly support the inheritor’s endeavours to afford a private property.

The sizeable inheritance could be attributed to the high percentage of home ownership in Singapore, CPF as well as the lack of inheritance tax.

So can you afford a private property without a BTO or an inheritance

The appeal of Singapore’s private residential homes and Singapore as a thriving economy has certainly been reflected in prices. This is why we often find gateway cities more expensive from a global perspective.

Currently, Singapore’s median property price to median annual income is 13.7 for private property and 4.5 to 4.7 for public housing. This is based on the median household income of about $10,099 and properties around $1.58 million will be considered unaffordable to the median household.

The housing affordability ratio for new launch condos has risen substantially from 10.84 in 2016 to 16.06 in 2021 and possibly much higher now.

This firmly places private homes, especially new launch condos in the “unaffordable” range. This is based on the 3-3-5 rule of thumb which advises among other factors that the price tag of the property should not be more than 5 times of annual income.

However, this does not consider the fact that many Singapore citizens who were fortunate enough to secure a BTO or an inheritance would have enough equity to afford a private property.