So you’ve found the love of your life, and you’re ready to settle down in your own HDB flat in Singapore.

There’s a catch, though – your partner isn’t a Singaporean Citizen (SC) or Singapore Permanent Resident (SPR).

But don’t worry—it is possible to get an HDB flat even with a foreign spouse. There are just some extra steps and requirements before applying.

Here’s how to speed up the application process!

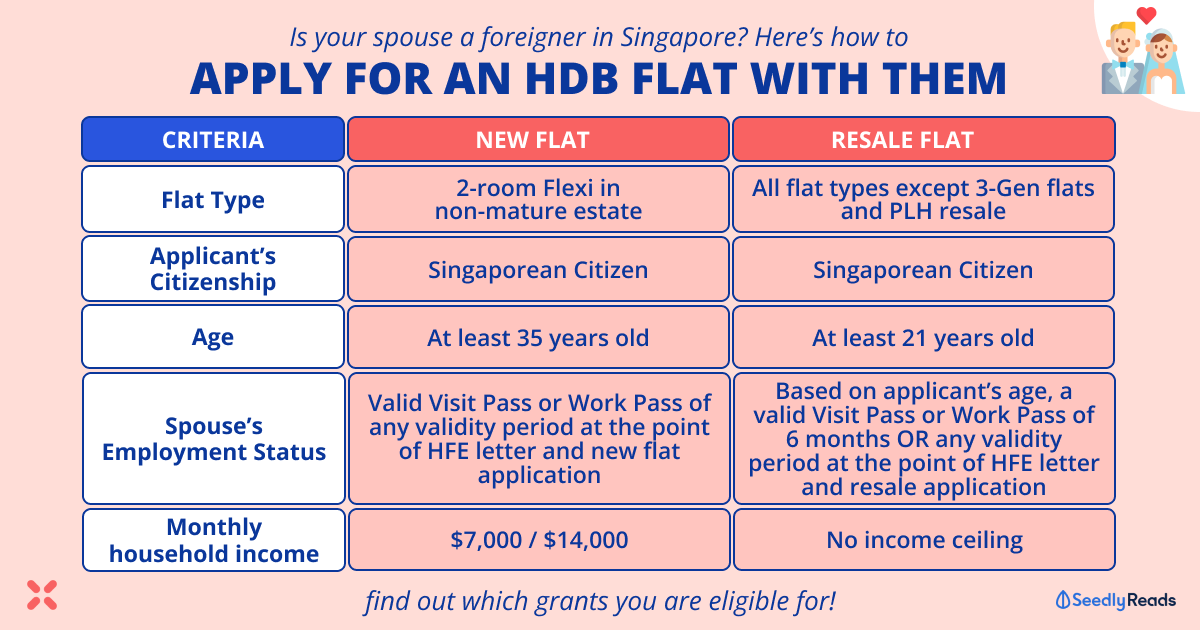

TL;DR: How Do You Apply for an HDB Flat With a Foreign Spouse?

These are the criteria you and your spouse will need to meet:

| Requirements | New Flats | Resale Flats |

| Flat type | 2-room Flexi in non-mature (note: will likely change when the Standard, Plus and Prime scheme comes into effect) | All flat types (excluding 3Gen flats and Prime Location Public Housing resale flats) |

| Citizenship | Applicant must be a Singaporean Citizen

Your non-resident spouse (i.e., neither an SC nor an SPR) must hold a valid Visit Pass or Work Pass of any validity period at the point of your Housing Flat Eligibility (HFE) letter and new flat application. |

Applicant must be a Singaporean Citizen

If you are 21 years old or above: Your spouse must have a valid Long Term Visit Pass or Work Pass of at least six (6) months from the date of issue at the point of your HFE letter and resale flat application If you are 35 years old or above: Your spouse must have a valid Visit Pass or Work Pass of any validity period at the point of your HFE letter and resale flat application |

| Age | At least 35 years old | At least 21 years old |

| Monthly household income ceiling |

2-room Flexi flat (99-year lease): $7,000

Short-lease 2-room Flexi flat (for Seniors 55 years old and above): $14,000 |

No income ceiling |

Click here to jump:

Can You Buy an HDB Flat With a Foreigner Spouse?

Yes, you can do so under the Non-Citizen Spouse Scheme (previously known as the Non-Resident Spouse Scheme), which is specifically designed for Singapore Citizens who are married to non-citizens.

Which HDB Flat Scheme Can You Apply For?

Under the Non-Citizen Spouse Scheme, you have two main options:

- Build-to-Order (BTO) flats: You’re limited to 2-room flexi flats in non-mature estates (note: will likely change when the Standard, Plus and Prime scheme comes into effect)

- Resale flats: You can apply for any HDB flat type or size available on the open market

Non-Citizen Spouse Scheme Eligibility Criteria

Before you start your application, make sure you meet these basic requirements.

Age

The main applicant must be a Singapore Citizen:

- Aged 35 or older to apply for a new HDB BTO flat with a foreign spouse

- Aged 21 or older to apply for a resale flat with a foreign spouse.

Yup, HDB BTO applications with a foreign spouse require you to be at least 35 years old.

But as most Singaporeans will know, resale flat prices are at an all-time high now, with a 1.8 per cent increment in Q1 2024, a 1.1 per cent increase compared to Q4 2023.

As such, do consider your household finances carefully before diving straight into purchasing a four-room resale flat.

Work Passes Requirements for BTO Flats

Suppose you are applying for a new HDB BTO. In that case, your non-resident spouse must hold a Long Term Visit Pass (LTVP) or Work Pass (WP) of any validity period at the point of the Housing Flat Eligibility (HFE) letter and new flat application.

If the pass expires during the transaction to buy a new flat, it must be renewed and valid when you collect the keys to your new flat.

Work Passes Requirements for Resale Flats

If you are 21 years old or above, your non-resident spouse needs a valid Long Term Visit Pass (LTVP) or Work Pass (WP) of at least 6 months from the date of issue at the point of your HFE letter and resale flat application.

Otherwise, if you are 35 or above, your non-resident spouse needs a valid LTVP or WP of any validity period at the point of your HFE letter and resale flat application.

Monthly Income Requirements

The income ceiling assessment will consider the incomes of all persons listed in the HFE letter application.

It’s slightly more complicated for new BTO applications:

- 2-room Flexi BTO flat (99-year lease): $7,000

This flat type will be available for those who are 35 and above.

- Short-lease 2-room Flexi BTO flat (Type 1 or 2): $14,000

This flat type will be available only for seniors who are 55 years old and above.

Likewise, all buyers and their spouses who are applying for the short-lease 2-room Flexi BTO flat with a foreign spouse must be at least 55 years old at the time of HFE letter application.

As for resale flats, there is no income ceiling for the application itself.

However, there is one when you plan to apply for Central Provident Fund (CPF) housing grants (excluding Proximity Housing Grant) and HDB housing loans.

Ownership Structure

If you or any person listed in the application owns or has an interest in an HDB flat, you must dispose of it within six (6) months of completing the purchase.

Likewise, if private residential property is concerned, you, your spouse or anyone who’s listed as occupiers in the HFE letter application:

- Must not own or have an interest in any local or overseas private property; and

- Must not have disposed of any private residential property in the following time period:

The conditions for seniors, however, do differ.

Senior citizens (and their spouses) aged 55 and above who own or have an interest in a private residential property are exempt from meeting the time period requirements in the table above if they intend to purchase one of the following:

- A short-lease 2-room Flexi flat or Community Care Apartment from HDB; or

- A 4-room or smaller non-subsidised resale flat (they may apply for the Proximity Housing Grant if eligible)

Plus, these seniors must dispose of their private residential property within 6 months of completing the flat purchase.

Back to top

Can You Still Apply for HDB Housing Grants?

Good news! You’re still eligible for some housing grants if it’s your first time applying for an HDB subsidy for an HDB BTO, i.e., you’re a first-timer who has not taken any housing subsidy before.

If you or any core applicant and/or core occupier have taken a housing subsidy previously, you are a second-timer and will not be eligible for grants.

On the other hand, for resale flats, any previous housing subsidy taken does not affect your eligibility to buy a resale flat. However, the number of housing subsidies you have taken will affect your eligibility to apply for CPF housing grants (excluding Proximity Housing Grant).

That said, check out these HDB housing grants if you were to apply for an HDB flat with a non-resident spouse:

| Type of Grant | CPF Housing Grants for Resale (Singles) | Enhanced CPF Housing Grant (Singles) | Proximity Housing Grant (Singles) | Top-up Grant (at a later stage if eligible) |

| Applies to | Resale flats only; Specifically for first-timer Singapore Citizens buying resale flats on their own | Both new (BTO) and resale flats; provide additional support for first-timer applicants, including those buying with non-resident spouses | Resale flats only | Both new (BTO) and resale flats; If you have previously taken the CPF Housing Grant (Singles) for a resale flat or bought a 2-room or 2-room Flexi flat from HDB as a single and are now married, you may apply for the Top-Up Grant

You must have met one of the following conditions:

|

| Grant Amount | Fixed amount of $40,000 for 2- to 4-room flats, or $25,000 for 5-room or larger flats | Up to $40,000, with the actual amount tiered based on income (see below) |

|

|

| Income ceiling | No specific income ceiling | Income ceiling of $4,500 per month | N.A. |

|

Enhanced CPF Housing Grant (Singles)

Here’s a breakdown of the amount of EHG you may be getting based on your income:

| Average Monthly Income | EHG (Singles) |

|---|---|

| Not more than $750 | $40,000 |

| $751 – $1,000 | $37,500 |

| $1,001 – $1,250 | $35,000 |

| $1,251 – $1,500 | $32,500 |

| $1,501 – $1,750 | $30,000 |

| $1,751 – $2,000 | $27,500 |

| $2,001 – $2,250 | $25,000 |

| $2,251 – $2,500 | $22,500 |

| $2,501 – $2,750 | $20,000 |

| $2,751 – $3,000 | $17,500 |

| $3,001 – $3,250 | $15,000 |

| $3,251 – $3,500 | $12,500 |

| $3,501 – $3,750 | $10,000 |

| $3,751 – $4,000 | $7,500 |

| $4,001 – $4,250 | $5,000 |

| $4,251 – $4,500 | $2,500 |

| More than $4,500 | N.A. |

Back to top

How Do You Apply for an HDB Flat With a Foreign Spouse?

For BTO flats:

- Wait for HDB sales launches

- Apply through HDB’s website during the application period

Check out our preview of the October 2024 BTO launches!

We’ve also written a step-by-step guide to how to apply for BTO.

For Resale Flats:

- Obtain the HDB Flat Eligibility (HFE) letter to check through your eligibility

- Proceed with your flat purchase on the open market

FAQs on Buying an HDB Flat With a Foreign Spouse

Can I apply for an HDB flat if my spouse is a foreigner?

Yes, you can apply for an HDB flat under the Non-Citizen Spouse Scheme.

The main applicant must be a Singapore Citizen, and the foreign spouse must have a valid Long Term Visit Pass or Work Pass. The validity period of the Visit Pass or Work Pass will depend on the age of the main applicant.

What types of flats can I apply for with a foreign spouse?

For BTO flats, you are limited to 2-room flexi flats in non-mature estates.

For resale flats, you can apply for any HDB flat type or size available on the open market.

Can my foreign spouse be a co-owner of the flat?

No, only the Singapore Citizen spouse can own the flat. The foreign spouse must be listed as an occupier, not a co-applicant or co-owner.

What if my foreign spouse became a Singapore Citizen or Singapore Permanent Resident after we have purchased the house?

Congrats! Your spouse can be added as a co-owner of the flat from then.

You can do so by submitting an application to HDB to update the ownership details.

Once HDB approves the application, the ownership transfer will be processed.

Are there any grants available when buying an HDB flat with a foreign spouse?

Yes, you may be eligible for the Enhanced CPF Housing Grant (EHG) for singles and the Singles Grant.

The EHG amount depends on your household income (divided by two), with a maximum income ceiling of $4,500. The Singles Grant provides $40,000 for 2- to 4-room resale flats or $25,000 for 5-room or larger resale flats.

What is the household income ceiling for applying for an HDB flat with a foreign spouse?

For BTO flats, your combined household income must not exceed $7,000 or $14,000 per month.

For resale flats, there is no income ceiling.

Is there a Minimum Occupation Period (MOP) for flats purchased under the Non-Citizen Spouse Scheme?

Yes, you must observe a 5-year Minimum Occupation Period (MOP) during which you cannot sell or lease out the entire flat.

Can we own other properties while applying for an HDB flat?

Neither spouse can own other properties locally or overseas during the application process and the MOP.

What is the process for buying a resale flat with a foreign spouse?

First, obtain the HDB Flat Eligibility (HFE) letter before purchasing a resale flat or submitting a BTO application.

Once you have the HFE letter, you will understand your eligibility and start applying.

Do I need to dispose of our private residential property if I buy an HDB flat?

If you’re buying an HDB flat, a resale flat with CPF housing grant(s) or applying for a housing grant, you must dispose of your private residential property at least 30 months before the HFE letter application.

Likewise, if you’re buying a non-subsidised resale flat (including Proximity Housing Grant), you must dispose of your private residential property at least 15 months before the HFE letter application.

If you are a senior citizen (55 years and above) who owns or has an interest in a private residential property, you must dispose of it within 6 months of completing the HDB flat purchase.

Pro Tip: If you have a child who is a Singapore Citizen or Permanent Resident, you might be eligible to form a family nucleus under the Public Scheme. This could give you more options and benefits, similar to regular Singaporean couples.

Back to top