2024 is poised to be a monumental election year, with major elections scheduled not only in the United States and the United Kingdom but also in India, among other nations globally. Elections often herald a period of change and uncertainty. They can inspire renewed optimism as people anticipate potential improvements; however, they also raise doubts and fears about the future, especially regarding whether these changes will yield positive outcomes.

Investors, in particular, face a period of heightened anxiety as they consider the potential impacts of these political shifts on their portfolios. A significant concern is how elections influence stock markets.

US Elections & Stock Market Performance

Research indicates that the period leading up to elections tends to be marked by volatility in the stock market, as investors exercise caution while assessing the potential impact of policy changes that new administrations might bring.

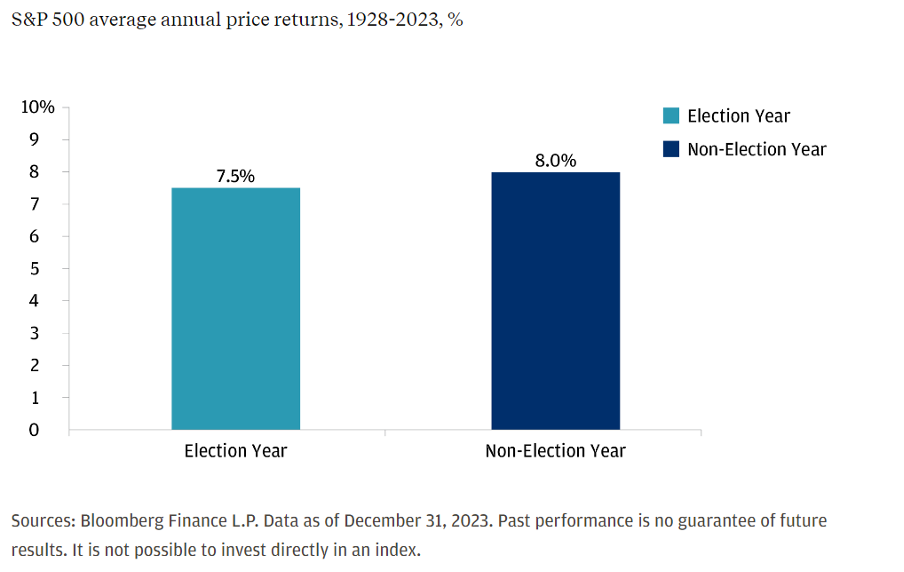

Historically speaking, the S&P 500 often records slightly lower returns in election years than in non-election years. This trend suggests that political transitions’ uncertainty can affect market dynamics, leading investors to adopt a more conservative approach as they navigate the unpredictability of election outcomes and their subsequent effects on economic policies.

Source: JP Morgan

Market fluctuations are regular occurrences, but election years can intensify volatility, particularly as voting day approaches. During tightly contested elections, investor caution can lead to more pronounced market dips as participants brace for possible shifts in policy that could affect their holdings.

However, once election results are confirmed, and the cloud of uncertainty dissipates, the stock market often experiences a rebound. Historical data from the past 40 years supports this pattern: on average, the market has typically shown an uptrend one year after Election Day.

This trend is evident when examining the purple line on the accompanying chart, which illustrates that while stocks tend to be volatile in the lead-up to the election, they generally rally once the outcome is clear. The market stabilizes with the resolution of political uncertainties. This cyclical recovery highlights how, despite initial hesitations, the market’s long-term trajectory post-election tends to skew positively.

Source: JP Morgan

Beyond 12 months, data suggests that the party affiliation of the elected president—whether Republican or Democrat—does not significantly influence long-term stock market returns.

According to analysis by Fisher Investments, stock market gains have been recorded regardless of which political party controls the presidency.

A historical review of stock performance from January 1925 to December 2023 illustrates this point. During times when a Democratic president was in office, U.S. stocks averaged an annual return of 15.4%. Conversely, under Republican administrations, the average annual return was 9.0%. Both figures indicate positive trends regardless of the governing party.

The variation in returns between the two is often attributed more to broader economic and market conditions that are largely outside the direct influence of any particular president.

This data underscores a crucial insight for investors: despite the political party in power, maintaining a long-term investment in stocks has historically yielded significant returns. This suggests that market fundamentals and broader economic factors tend to play a more pivotal role in influencing returns over extended periods than the political landscape.

Source: Fisher Investments

Beyond The US

Similar patterns of market behaviour observed during election periods in the United States might also apply to other major countries that undergo elections, such as the UK and India.

Although elections are significant events that capture extensive media attention and typically induce short-term market volatility, they are not usually the primary determinants of long-term market performance.

Instead, the fundamental economic drivers, such as interest rates, inflation, and corporate earnings, play a more significant role in shaping the long-term trajectory of the stock market. These factors are crucial because they directly affect the cost of borrowing, the purchasing power of consumers, and the profitability of companies, all of which are integral to sustained economic growth.

A robust underlying economy, characterised by stable or growing interest rates, controlled inflation, and strong corporate earnings, is more likely to lead to a healthy stock market. This holds true regardless of the political party or leader in office. Essentially, while political landscapes can influence market sentiments and cause fluctuations in the short term, it is the economic fundamentals that ultimately determine market stability and growth over the long haul.

Have A Long-Term Perspective

As investors, we should zoom out and always look far ahead into the future. Decades of data suggest that who gets elected has minimal impact on overall stock market returns over the long haul. As famed investor Warren Buffett once said:

“Over the long term, the stock market news will be good. In the 20th century, the United States endured two world wars and other traumatic and expensive military conflicts; the Depression; a dozen or so recessions and financial panics; oil shocks; a flu epidemic; and the resignation of a disgraced president. Yet the Dow rose from 66 to 11,497.”

Read Also: Building A Healthy Investment Portfolio: How You Also Need Discipline, Stamina and Resilience

Advertiser Message

Get The Latest Bite-sized Investment News, Ideas & Insights

It’s free! Don’t miss out on the latest financial market movements.

FSMOne aims to help investors around the world invest globally and profitably,

follow

FSMOne’s Telegram

for bite-sized finance analyses and exclusive happenings.