[This is a sponsored article with Syarikat Jaminan Pembiayaan Perniagaan (SJPP).]

In high-risk industries like oil and gas, ensuring worker safety isn’t just important—it’s essential to saving lives. That’s exactly what Berkat OSH Services (BOSH) has been committed to since its inception.

Under the leadership of Dr Sabariah Said, BOSH has grown from a single occupational health clinic in 2007 to becoming a leader in occupational health (OH). The company now boasts a team of 20 occupational health doctors and advisors, providing services to renowned companies including Petronas, Shell, and Mubadala Energy.

BOSH has also evolved beyond being just the leader of OH; it has transformed into a comprehensive in-house Remote Medical Services (RMS) provider. This includes delivering medical personnel and services to remote areas, managing disaster response through a 24/7 in-house call center for MEDEVAC, and supporting affected individuals in their recovery to return to work. Their approach addresses both physical and mental health needs.

However, behind their success lies a story of overcoming financial roadblocks, a challenge that many SMEs can relate to.

A rocky road to expansion

Dr Sabariah founded BOSH with a simple goal: to create safer workplaces for people in high-risk industries. Starting out with just one occupational health clinic, BOSH expanded over the years, becoming a key player in the field of emergency medical services, remote medical support, and employee wellness programmes.

However, like many SMEs, scaling up presented its own set of challenges.

As demand grew, so did the need for more equipment, staff, and operational clinics. Dr Sabariah knew she needed financing to support this expansion, but securing a bank loan turned out to be a bigger hurdle than expected.

Faced with high deposit requirements from the bank, Dr Sabariah shared that it really strained their cash flow. The banks also demanded stringent requirements the company wasn’t always able to meet.

The approval process was long and stressful, as Dr Sabariah detailed, “Some banks take more than three to six months for the loan application to be approved and another two months of disbursement upon approval.”

The longer approval process caused a delay in BOSH’s growth plans.

Finding the right support

Amid these challenges, BOSH found a solution through Syarikat Jaminan Pembiayaan Perniagaan (SJPP), a government initiative designed to help SMEs like theirs.

With the government acting as a guarantor through SJPP, BOSH was able to secure the loan they needed to continue expanding. This guarantee schemes provided banks more confidence in approving the loan, easing the financial strain on the company.

Dr Sabariah explained that although they didn’t work directly with SJPP, their guarantee schemes made all the difference in securing financing from the bank. The financial security allowed BOSH to invest in more clinics, hire additional staff, and purchase essential assets like ambulances and telehealth equipment.

Strengthening businesses’ credibility with banks

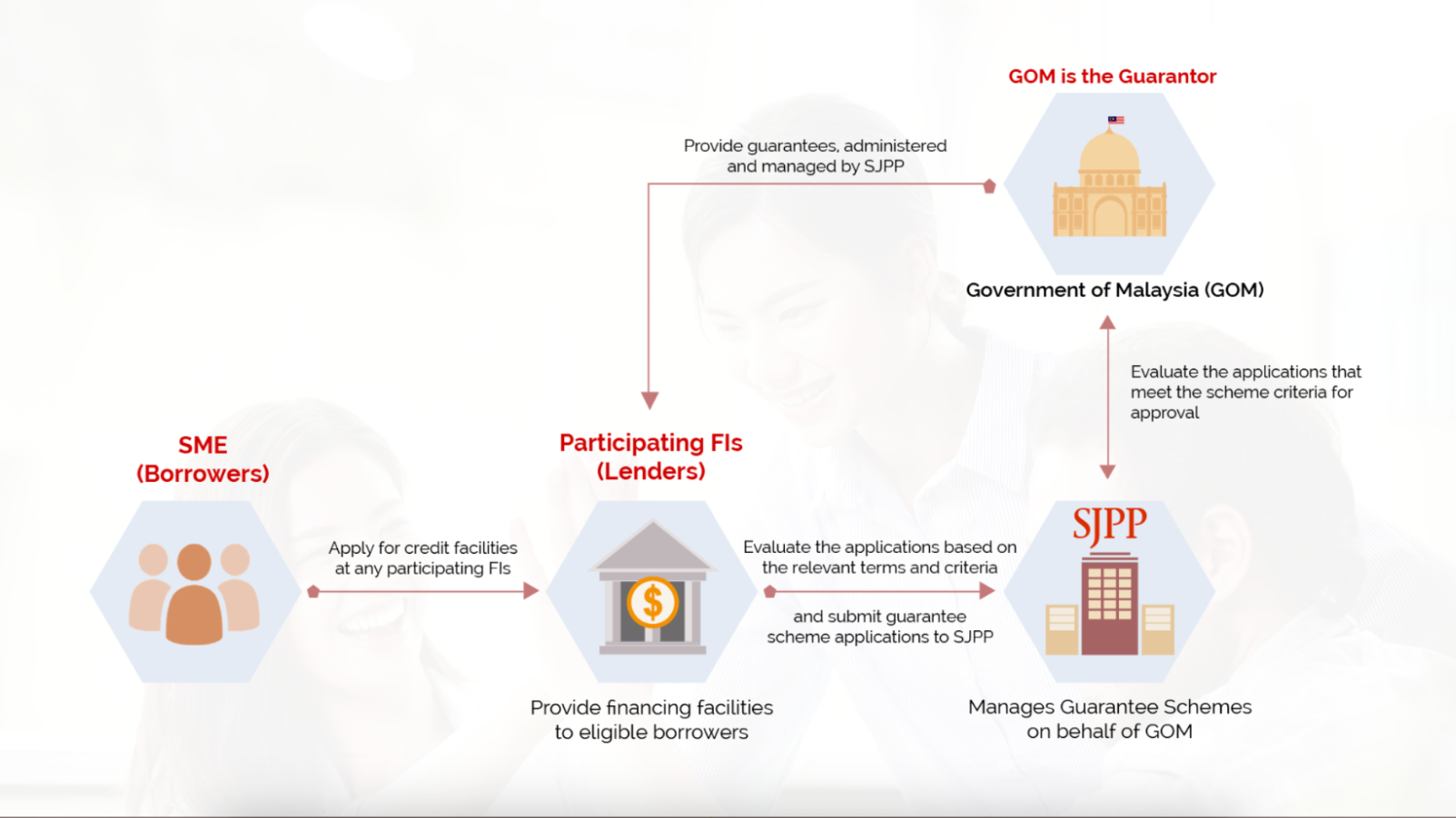

It’s important to note that the government’s role as a guarantor through SJPP doesn’t involve providing direct funds.

Instead, it works behind the scenes, reducing the risk for banks by guaranteeing a certain percentage of the loan. This reduced risk makes banks more willing to offer financing to SMEs, even those with limited collateral.

SJPP offers a range of schemes designed to support businesses in various sectors.

For instance, the Government Guarantee Scheme MADANI (GGSM) offers up to 90% loan coverage for businesses in high-priority sectors like high technology, agriculture, manufacturing and tourism.

Bumiputera-owned businesses can also benefit from the Working Capital Guarantee Scheme (WCGS-B), which provides financing with up to 80% loan coverage.

These schemes aim to lower financial barriers, offering companies like BOSH the support they need to grow.

You don’t need a unique struggle to get support

Reflecting on her experience, Dr Sabariah emphasised the importance of not relying solely on one financing channel.

“Diversifying your financing sources is crucial,” she said. “It’s [also] important to maintain open communication with your bank officers and have a strong business plan to improve your chances of securing a loan.”

BOSH’s journey with securing financing highlights a common struggle that many SMEs can relate to—the hurdles of high deposit requirements, stringent requirements, and lengthy approval processes, among other things.

The beauty of SJPP is that you don’t need to have extraordinary struggles to benefit from its support.

Whether your business is trying to expand its operations, invest in new equipment, or simply grow, SJPP’s government guarantee schemes can help remove financial obstacles and offer a reliable solution to obtain the necessary loans.

- Learn more about SJPP here.

- Read other articles on Malaysian startups here.

Featured Image Credit: Dr Sabariah Said, CEO of Berkat OSH Services