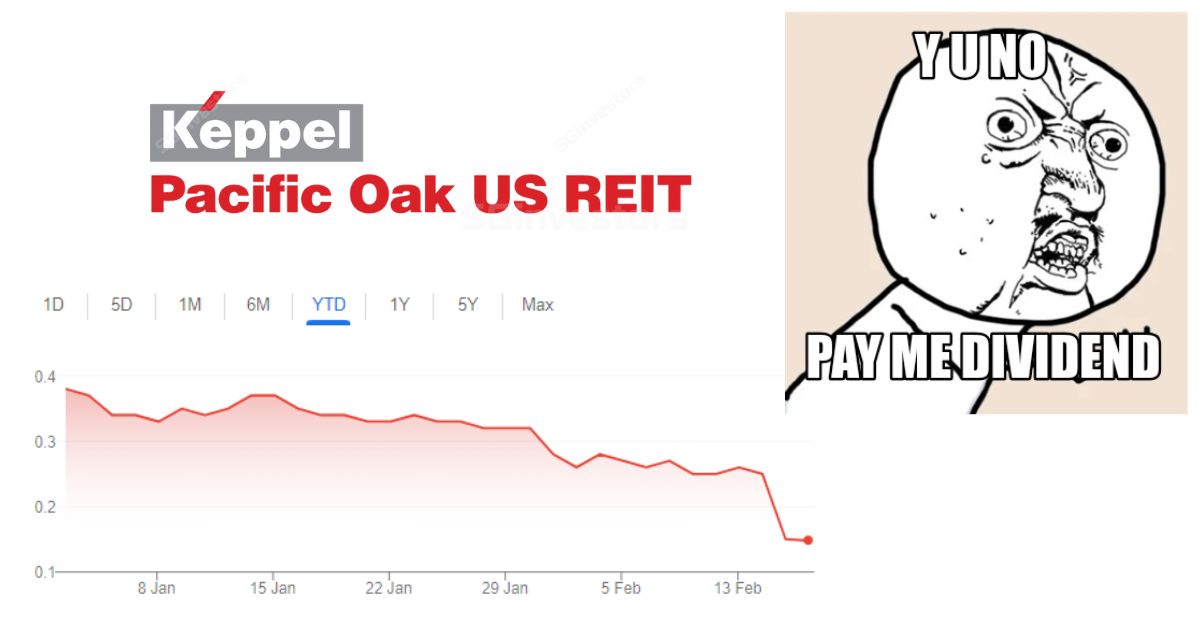

On 15 Feb 2024, Keppel Pacific Oak US REIT (KORE REIT) announced that they will be suspending dividends. This announcement comes just 2 weeks after the REIT decided to delay their financial results.

KORE REIT is down -40% since the announcement:

What should you do if you own KORE REIT and is this a good time for opportunistic investors to get in on depressed prices?

I share my thoughts and analysis in this article and this video:

What happened to KORE REIT?

The Covid pandemic has left its mark on the U.S. commercial real estate industry as companies have shifted to a hybrid work model, with more than 50% of the U.S. workforce still working from home.

Hence the demand for U.S. office property has declined, leading to poor valuations.

Case in point; KORE REIT’s property valuation had gone down by ~6.8% year-on-year.

Looking at the numbers in the table above, you would notice that compared to the other US office REITs listed in Singapore, Manulife US REIT (MUST) and Prime US REIT (PRIME), KORE REIT’s re-evaluation doesn’t look as bad.

On top of that, KORE REIT’s portfolio overlaps pretty nicely with the relocation of offices in the U.S. to states like Washington and Texas. Compared to MUST and PRIME, KORE REIT only has 3% of its portfolio in Gateway states that were experiencing an exodus of commercial tenants. This means that KORE is least impacted by the outflow of offices from Gateway cities.

However, just before Chinese New Year, KORE REIT announced that it will be delaying the release of its financial report, leaving investors worried.

You may be wondering…

How bad is KORE REIT’s situation?

As of 2H23, KORE REIT had managed to grow its revenue by 1.3% year-on-year (y-o-y) and its income by 2.3% y-o-y.

However, they had to deal with higher costs leading to a decline in income available for distribution by 10%. There was likely some valuation loss that affected their net profit as well, but overall KORE REIT’s business fundamentals looks stable.

On the debt front, KORE REIT’s gearing is at 43.2%, which is still below the 50% limit imposed on Singapore REITs. But more on this below.

On the occupancy front, KORE REIT has also been managing well. Their latest occupancy rate of 91.4% is above the U.S. average and is the highest among the three US office Singapore REITs too.

So…why is KORE REIT in a rut?

In short, the REIT needs spare cash on hand.

In their recapitalisation plan, the management mentioned that their gearing is currently 43.2% but there is a possibility of hitting “undesirable levels if capital needs continue to be funded with debt”.

Although there’s still a distance from the 50% requirement imposed on REITs and some debt room to go, the KORE REIT management may be anticipating that their valuation may drop further, causing their gearing ratio to exceed that 50% in the future.

In order to get a bit more breathing room, the management is taking more precautions on the debt front and proactively managing their cash levels. But…

Is dividend suspension the best way out?

A suspension in dividends is considered the worst outcome for dividend investors and it seems a tad too early to call for a suspension. The management of KORE REIT explained in their suspension announcement that this was the “least of all evils” as:

i) Divestment is difficult because of bad market

According to the management, the soft US commercial real estate market makes it difficult for them to sell their properties at reasonable prices, as there are too few buyers.

At the same time, banks are reluctant to lend money if gearing reaches above 45%.

ii) Rights issues at current prices are not feasible

Another common way to raise cash is to do a rights issue. This allows a company to raise money from their existing unitholders. The equity will go up and the gearing will go down, so there would be a balancing effect.

However in KORE REIT’s case, with the share price going down drastically, to a point where it is now way below its book value, there’s really no incentive for the manager to do a rights issue.

In the current situation, a rights issue will lead to a massive dilution for unitholders as they will need to issue way too many units in order to raise the same amount of money. Doing so could also depress prices further and lead to a longer term issue especially for current unitholders.

Impact of dividends suspension on KORE REIT’s balance sheet

Although by withholding dividends, KORE REIT will not immediately raise money up front as cash will only come in when their tenants pay the rent, but the cost saving is significant.

Using KORE REIT’s distribution amount of ~US$60M in FY22, they could save about US$150M by withholding dividends for 2.5 years. This would effectively lower their gearing ratio to about 32%, which is a more comfortable level.

It seems that the management’s strategy is to conserve cash now and use the cash from rentals to fund the operations of the business instead. This would give them the resources required to continue enhancing their properties and maintain their occupancy in the coming years, without having to borrow more money from banks.

Summary: KORE REIT has suspended dividends, what should you do?

tl;dr KORE REIT has announced that it will be suspending its dividends from 2H2023 to 2H2025, which is about 2.5 years.

Though this move is a precautionary action from the management, if you had invested in KORE REIT for the dividends, it will impact your income directly. You might have already made the painful decision to cut losses and move onto another REIT. Afterall, not being able to get any payouts from KORE REIT until FY2026 is a dealbreaker for dividend investors.

You should also keep in mind that the US commercial property market is still struggling and could take years to recover. So there’s no guarantee that they wouldn’t extend the suspension depending on how the economy evolves.

Of course, I’m not in a position to suggest what you should do because our investing objectives may be different.

If you’re in the other group that’s wondering if it’s a good time to pick up KORE REIT…

Should KORE REIT be on your watchlist?

KORE REIT is currently trading below its book value, making it an undervalued stock. The management has shown that they are proactive in trying to resolve problems, instead of letting it fester and leaving shareholders in the dark. Plus, KORE REIT is backed by Keppel, a reputable blue chip company. This could be an opportunity to scoop up an otherwise high quality REIT at a discounted price.

That said, you should keep in mind that the uncertainty of the US commercial property market would persist. Regardless of whether you think the correction has been overdone, or if you want to wait for the recovery to come, I hope this article has given you the information to make a more informed decision.

More headwinds in the horizon

MUST had already been heavily impacted by the slowdown in the U.S. commercial real estate markets, they had a breach of bank covenant and could not payout dividends. The next REIT in focus would be Prime US REIT which should be releasing their earnings results soon.

We’ll be keeping an eye on the situation, subscribe to our newsletter for the latest analysis and insights!