I don’t know about you, but when I first started working, the OCBC 360 Account was pretty hot in the market.

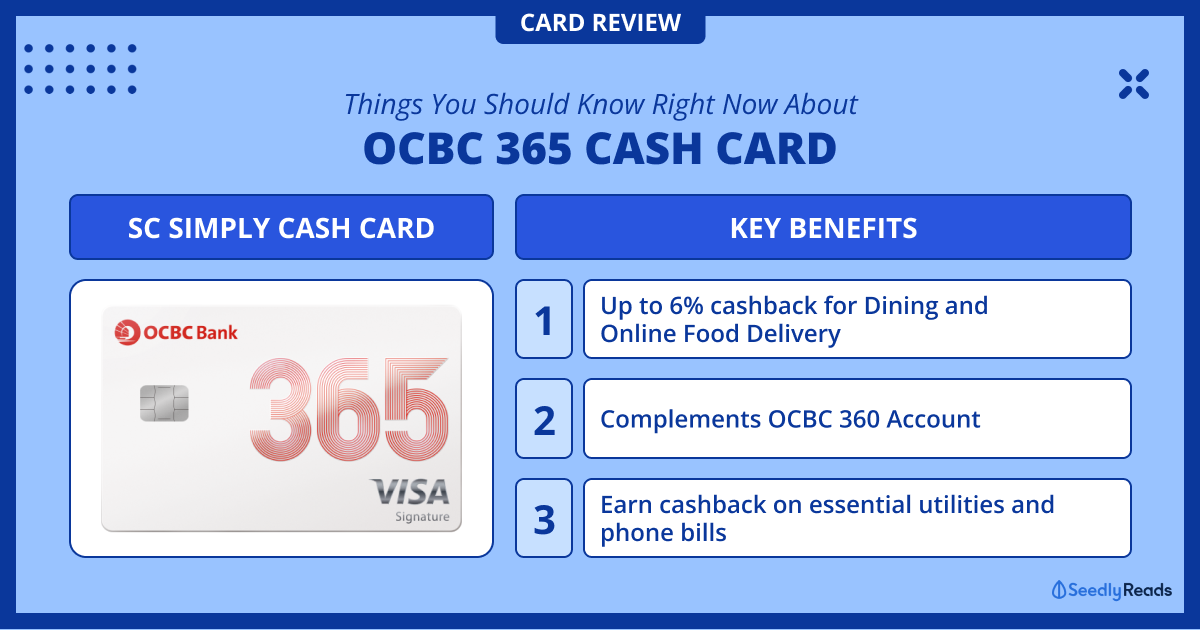

And with the opening of this account, you are usually introduced to the OCBC 365 credit card, which is said to be a versatile card that can be used across multiple categories.

The OCBC 365 Credit Card stands out in Singapore’s competitive credit card landscape by offering substantial cashback rewards on various everyday expenses.

This card promises to reward you generously, whether you’re dining out, fueling up your vehicle, or paying your utility bills.

But is that true? Let’s check it out!

TL;DR: OCBC 365 Credit Card Review 2024

The OCBC 365 Credit Card is designed to reward everyday spending across multiple categories:

- Dining and Online Food Delivery: Up to 6% cashback

- Fuel: Up to 5% cashback at all stations

- Groceries, Land Transport, Online Travel: Up to 3% cashback

- Recurring Electricity and Telco Bills: Up to 3% cashback

- All Other Spend: 0.3% cashback

Pros:

- High Cashback Rates: Earn up to 6% cashback on various categories and a base

- Versatile Categories: Covers a broad range of daily expenses without restricting specific merchants

- Annual Fee Waiver: When you meet the annual spend of S$10,000

- Accessibility: Accessible cashback categories make it ideal for diverse spending habits

- Rewards on Recurring Bills: Earn cashback on essential utilities and phone bills.

Cons:

- Minimum Spend Requirement: To qualify for higher cashback rates, you need to spend at least S$800 per month

- Cashback Caps: Cashback earnings are capped monthly across different categories, limiting potential rewards

- Transaction Exclusions: Certain transactions may not qualify for cashback, depending on merchant categorisation

- Complex Optimisation: Requires strategic planning to maximize rewards without exceeding cashback caps.

Cashback and Minimum Spends

While it boasts high cashback rates, especially on dining and fuel, it comes with cashback caps and specific exclusions.

The biggest caveat is that you must spend a minimum of S$800 per calendar month to unlock higher cashback rates. Otherwise, you will receive the base 0.25% cashback. Plus, the amount of cashback you can get is capped at S$80 per calendar month, with specific category caps:

- Dining, groceries, and transport: S$25 each

- Travel, recurring electricity and telco bills: S$15 each

- Fuel: S$20

- All other spend: S$5

That said, OCBC has increased its cashback cap to S$160 per calendar month for those who meet the minimum spend of S$1,600 per calendar month.

Complements OCBC 360 Account

The OCBC 365 Credit Card complements the OCBC 360 Account in several ways.

- Bonus interest: The OCBC 360 Account offers a ‘Spend’ bonus interest category that rewards customers for using their OCBC 365 Credit Card. By spending at least S$500 on the OCBC 365 Credit Card, account holders can earn up to 0.6% p.a. bonus interest on their OCBC 360 Account

- Promotional offers: OCBC occasionally runs promotions that incentivise customers to use both products. For example, new-to-OCBC customers could earn a S$150 sign-up bonus when they apply for an OCBC 360 Account and OCBC 365 Credit Card together, and credit their salary to their OCBC 360 Account

- Increased earning potential: By using the OCBC 365 Credit Card for everyday expenses and maintaining the OCBC 360 Account for savings, customers can potentially earn higher overall returns through a combination of cashback and increased interest rates

That said, you can check out our full review of savings account in Singapore for more information.

Fees and Charges

- Annual Fee: S$196.20, waived for the first year

- Foreign Currency Transaction Fee: 3% of the transaction amount

- Auto-annual fee waiver requirement: S$10,000 spent in one year.

Eligibility Requirements

- Age: 21 years and above

- Income: Minimum annual income of S$30,000.

Comparison with Other Cards

UOB One Card

If we’re looking purely from a S$500 spend per month standpoint, the UOB One card will be a potential competitor in the cashback card field as it offers up to 5% with no category caps, but it requires consistent monthly spending to qualify.

Fewer Hoops to Maximise Cashback

Unlike the UOB One Card where the cashback is tiered based on the minimum spending of S$500, S$1,000, or $2,000 per month, the OCBC 365 cashback is straightforward. The cashback earned on the transactions performed in the current month will be credited to your OCBC 365 card statement in the next month.

Caps on Cashback Earnings

The UOB One’s base 3.33% cashback is capped at $50, $100 or $200 per quarter, depending on your minimum spend of $500, $1,000 or $2,000, respectively. Any additional bonus cashback earned is credited to the top of this base amount.

Categorically, there is no cap.

In contrast, OCBC 365 offers broader category coverage but with capped cashback earnings. So, choose UOB One if you consistently meet the spend tiers for higher cashback rates; otherwise, OCBC 365 provides more flexibility across different spending categories.

Conclusion

The OCBC 365 Credit Card excels at covering everyday expenses, making it ideal for families and individuals with diverse spending patterns.

However, if you have specific spending priorities such as dining or groceries, other cards like Citi Cash Back or UOB One might offer higher cashback rates in those categories.