Excited to travel?

Before you get ahead of yourself while preparing for that trip to Japan or somewhere closer to home like Thailand, there’s still one important thing you’ll need before you pack your bags.

Travel Insurance!

Aside from safeguarding yourself from travel-related emergencies, it’s important to keep yourself covered for COVID-19 as well.

So buckle up as we take you through a detailed travel insurance comparison for Singaporeans!

TL;DR: Best Travel Insurance Singapore (2024)

Click here to choose your travel insurance:

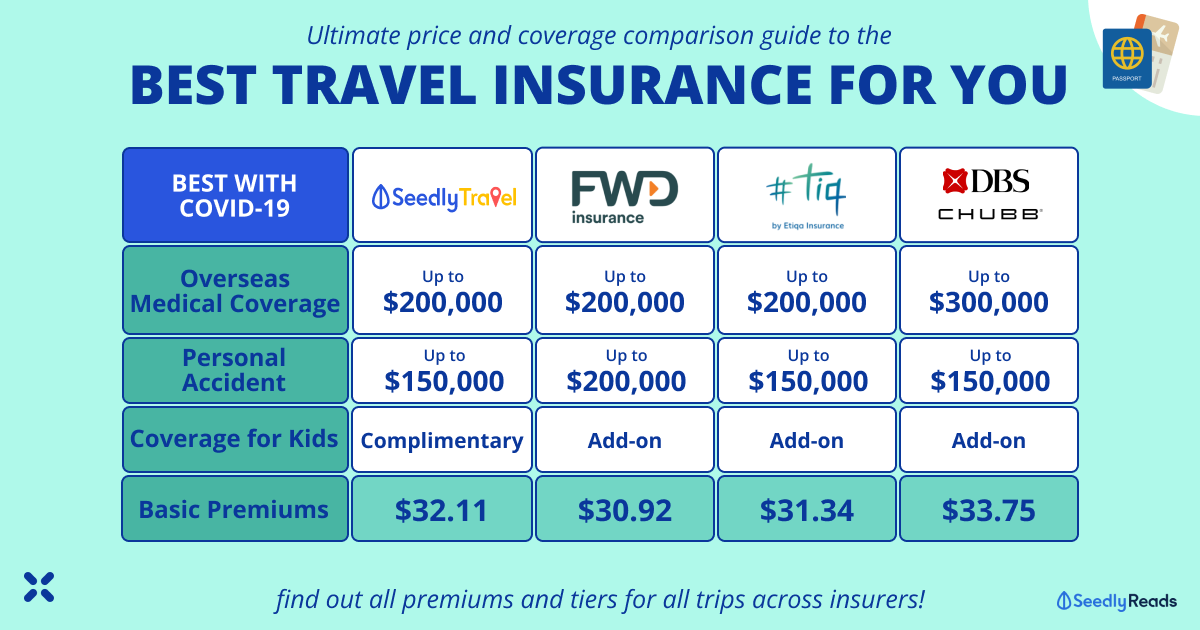

This is an overview of the current prices and promotions for a traveller below 70 years old:

And while you’re at it, remember to check out real user reviews:

Disclaimer: The Information provided by Seedly does not constitute an offer or solicitation to buy or sell any insurance product(s). It does not take into account the specific objectives or particular needs of any person. We strongly advise you to seek advice from a licensed insurance professional before purchasing any insurance products and/or services.

*Seedly and SingSaver are companies owned by MoneyHero Group. All estimated premiums listed are after discounts based on ongoing promotions. For more accurate premiums, please obtain a quote from the provider with the actual details of your trip.

Best Travel Insurance Singapore For Single Trips (ASEAN)

Note that the list below includes insurers who have automatically included COVID-19.

| Plan Name | Premiums after discounts | Overseas medical coverage for persons under 70 years old | Personal Accident (Accidental death and permanent total disability) | Trip Inconveniences |

|---|---|---|---|---|

| DBS Chubb TravellerShield Plus Classic | $33.75 (U.P. $75.00) |

Up to $300,000

+ COVID-19: Up to $50,000 |

Up to $150,000 | Trip Cancellation: Up to $5,000

Trip Delay: Up to $750 Loss/damage to baggage: Up to $3,000 |

| Income Classic Plan | $37.60 (U.P. $68.36) |

Up to $300,000 inclusive of COVID-19 | Up to $150,000 | Trip Cancellation: Up to $5,000

Trip Delay: Up to $1,000 Loss/damage to baggage: Up to $3,000 |

| Seedly Travel Safe | $32.11 (U.P. $67.59) | Up to $200,000 inclusive of COVID-19 | Up to $150,000 | Trip Cancellation: Up to $5,000

Trip Delay: Up to $1,000 Loss/damage to baggage: Up to $5,000 |

| Singlife Travel Lite Plan | $32.63 (U.P. $43.51) |

Up to $250,000

+COVID-19: Up to $50,000 |

Up to $50,000 | Trip Cancellation: Up to $5,000

Trip Delay: Up to $500 Loss/damage to baggage: Up to $3,000 |

| Sompo Essential Plan | $35.20 (U.P. $64.00) | Up to $200,000

+COVID-19: Up to $100,000 |

Up to $200,000 | Trip Cancellation: Up to $5,000

Trip Delay: Up to $800 Loss/damage to baggage: Up to $1,000 |

Best Travel Insurance Singapore For Single Trips (Asia Pacific)

We’ve considered that with longer distances, the chances of trip delay and loss or damage to baggage may increase too.

And after all, we’ve heard how someone lost his $20,000 Rolex and cash were burgled.

So, these are the insurance you can look at:

| Plan Name | Premiums | Overseas medical coverage for persons under 70 years old | Personal Accident (Accidental death and permanent total disability) | Trip Cancellation, Trip Delay, Loss/Damage to Baggage |

|---|---|---|---|---|

| FWD Travel Premium Plan | $33.39 (U.P. $34.02) | Up to $200,000 | Up to $200,000 | Trip Cancellation: Up to $7,500 Trip Delay: Loss/Damage to Baggage: $3,000 |

| Hong Leong Travel Protect Basic Plan | $32 (U.P. $64) | Up to $150,000 | Up to $200,000 | Trip Cancellation: Up to $5,000 Trip Delay: Loss/Damage to Baggage: Up to $3,000 |

| Income Classic Plan | $38.50 (U.P. $70.00) | Up to $300,000 | Up to $150,000 | Trip Cancellation: Up to $5,000 Trip Delay: Loss/Damage to Baggage: $3,000 |

| Seedly Travel Safe | $40.22 (U.P. $53.63) | Up to $200,000 | Up to $150,000 | Trip Cancellation: Up to $5,000 Trip Delay: Loss/Damage to Baggage: $5,000 |

| Tiq Travel Entry Plan | $36.30 (U.P. $66) | Up to $200,000 | Up to $150,000 | Trip Cancellation: Up to $5,000 Trip Delay: Loss/Damage to Baggage: $2,000 |

Best Travel Insurance Singapore For Single Trips (Worldwide)

When you’re on road trips, chances are you will rent a vehicle. We’ve shortlisted travel insurance that covers vehicle rental excess, as well as high personal accident coverage.

| Plan Name | Premiums | Overseas medical coverage for persons under 70 years old | Personal Accident (Accidental death and permanent total disability) | Trip Cancellation, Trip Delay, Loss/Damage to Baggage |

|---|---|---|---|---|

| Allianz Single Trip Silver | $86.40 (U.P. $144) | Up to $500,000 | Up to $100,000 | Trip Cancellation: Up to $5,000 Trip Delay: Loss/Damage to Baggage: Up to $3,000 |

| MSIG TravelEasy Elite Plan | $93.00 (U.P. $155.00) |

Up to $500,000 | Up to $200,000 | Trip Cancellation: Up to $4,000 Trip Delay: Loss/Damage to Baggage: $5,000 |

| Seedly Travel Secure | $79.74 (U.P. $106.32) | Up to $500,000 | Up to $300,000 | Trip Cancellation: Up to $5,000 Trip Delay: Loss/Damage to Baggage: Up to $5,000 |

| Tiq Travel Savvy Plan | $71.50 (U.P. $130) | Up to $500,000 | Up to $500,000 | Trip Cancellation: Up to $10,000 Trip Delay: Loss/Damage to Baggage: $1,000 |

| Singlife Travel Plus Plan | $87.71 (U.P. $116.94) | Up to $2,000,000 | Up to $100,000 | Trip Cancellation: Up to $15,000 Trip Delay: Loss/Damage to Baggage: $5,000 |

Singlife’s premium may be on the higher side, but the premium is relative to its $2,000,000 medical coverage as there is an extension of coverage for weddings & photoshoots, golfing, winter sports, and adventurous water sports.

Best Travel Insurance Singapore For Annual Trips (ASEAN)

| Plan Name | Premiums | Overseas medical coverage for persons under 70 years old | Personal Accident (Accidental death and permanent total disability) | Trip Cancellation, Trip Delay, Loss/Damage to Bagge |

|---|---|---|---|---|

| AIG Travel Guard Direct Superior Plan | $462.00 | Up to $1,000,000 | Up to $200,000 | Trip Cancellation: Up to $10,000 Trip Delay: Loss/Damage to Baggage: |

| DBS Chubb TravellerShield Plus Platinum | $428.44 (U.P. $571.25) | Up to $1,000,000 | Up to $500,000 | Trip Cancellation: Up to $15,000 Trip Delay: Loss/Damage to Baggage: Up to $8,000 |

| Income Preferred Plan | $440.80 (U.P. $551.00) | Up to $1,000,000 | Up to $500,000 | Trip Cancellation: Up to $15,000 Trip Delay: Loss/Damage to Baggage: $8,000 |

| MSIG TravelEasy Elite Plan | $319.20 | Up to $500,000 | Up to $200,000 | Trip Cancellation: Up to $4,000 Trip Delay: Loss/Damage to Baggage: Up to $5,000 |

| Singlife Travel Prestige Plan | $460.50 (U.P. $614.00) | Unlimited | Up to $500,000 | Trip Cancellation: Up to $20,000 Trip Delay: Loss/Damage to Baggage: $8,000 |

Best Travel Insurance Singapore For Annual Trips (Asia Pacific)

| Plan Name | Premiums | Overseas medical coverage for persons under 70 years old | Personal Accident (Accidental death and permanent total disability) | Trip Cancellation, Trip Delay, Loss/Damage to Bagge |

|---|---|---|---|---|

| AIG Travel Guard Direct Superior Plan | $462.00 | Up to $1,000,000 | Up to $200,000 | Trip Cancellation: Up to $10,000 Trip Delay: Loss/Damage to Baggage: |

| FWD Travel First Plan | $394.85 (U.P. $515.03) | Up to $1,000,000 | Up to $400,000 | Trip Cancellation: Up to $15,000 Trip Delay: Loss/Damage to Baggage: Up to $7,000 |

| Income Preferred Plan | $440.80 (U.P. $551.00) | Up to $1,000,000 | Up to $500,000 | Trip Cancellation: Up to $15,000 Trip Delay: Loss/Damage to Baggage: $8,000 |

| MSIG TravelEasy Elite Plan | $360.00 | Up to $500,000 | Up to $200,000 | Trip Cancellation: Up to $4,000 Trip Delay: Loss/Damage to Baggage: Up to $5,000 |

| Singlife Travel Plus Plan | $363.00 (U.P. $484.00) | Up to $2,000,000 | Up to $100,000 | Trip Cancellation: Up to $15,000 Trip Delay: Loss/Damage to Baggage: $5,000 |

Best Travel Insurance Singapore For Annual Trips (Worldwide)

| Details | Great Eastern TravelSmart Premier Elite Plan | Hong Leong Travel Protect Superior Plan | Tiq Travel Savvy Plan | Singlife Travel Plus Plan | DBS Chubb TravellerShield Plus (Economy) |

|---|---|---|---|---|---|

| Premiums | $576 | $422 | $440 | $448 | $423.50 |

| Overseas medical coverage for persons under 70 years old | Up to $500,000 | Up to $500,000 | Up to $500,000 | Up to $2,000,000 | Up to Unlimited |

| Personal Accident | Up to $500,000 | Up to $300,000 | Up to $500,000 | Up to $100,000 | Up to $250,000 |

| Trip Cancellation | Up to $15,000 | Up to $12,000 | Up to $5,000 | Up to $15,000 | Up to $3,000 |

| Trip Delay | $200 per 6 hrs (max $1,200) |

Up to $100 per 6 hrs (max $1,000) |

Up to $50 per 3 hrs (max $300) |

Up to $100 per 6 hrs (max $1,000) |

Up to $800 |

| Loss or Damage of Baggage | Up to $5,000 | Up to $7,000 | – | Up to $5,000 | Up to $3,500 |

| COVID-19 Medical Coverage | Up to $250,000 | Up to $150,000 | Up to $$500,000 (Only available as add-on to those without pre-existing medical condition) | Up to $100,000 | Up to $50,000 |

| Promotion & Validity | – | – | Single Trip: Enjoy a 40% discount; Annual Trip: Enjoy a 60% discount, get 1x draw chance in our weekly lucky draw.

Valid till 31 Jul 2023. T&Cs apply. |

– | – |

| Sign Up Now | Apply Now | – | Apply Now | – | – |

Best Travel Insurance Singapore For Pre-existing Medical Conditions

| Details | Income Classic, Deluxe, Preferred Plans |

|---|---|

| Premiums | Classic: $450.40 (U.P. $563.00)

Deluxe: $531.20 (U.P. $664.00) Preferred: $675.20 (U.P. $844.00) |

| Overseas medical coverage for persons under 70 years old | Classic: Up to $250,000

Deluxe: Up to $500,000 Preferred: Up to $1,000,000 |

| Personal Accident | Classic: Up to $150,000

Deluxe: Up to $200,000 Preferred: Up to $500,000 |

| Trip Cancellation | Classic: Up to $5,000

Deluxe: Up to $10,000 Preferred: Up to $15,000 |

| Trip Delay | Classic: Up to $1,000

Deluxe: Up to $1,500 Preferred: Up to $2,000 |

| Loss or Damage of Baggage | Classic: Up to $3,000

Deluxe: Up to $5,000 Preferred: Up to $8,000 |

| COVID-19 Medical Coverage | Included as part of medical coverage |

| Promotion & Validity | – |

| Sign Up Now | – |

Best Travel Insurance Singapore For Sports

Sports lovers, thrill seekers, and golfers, these are the travel insurance that has coverage on sports activities:

- AIG Travel Guard Direct Superior Plan

- AIG Travel Guard Direct Supreme Plan

- Allianz Travel Insurance Platinum Plan

- Bubblegum

- Seedly Travel Safe

- Seedly Travel Secure

Best Travel Insurance Singapore For Cruise Vacations

There are only a couple of insurers that offer additional add-ons for cruise vacations:

- Starr Insurance Travel Insurance Plans

- AIG Travel Guard Direct Superior Plan

- AIG Travel Guard Direct Supreme Plan

- Great Easter TravelSmart Premier Basic Plan

Best Travel Insurance With COVID-19 Coverage

Catching COVID-19 overseas is a bummer for sure. On top of possibly disrupting your trip, it might even be life-threatening for some.

Insurance premiums can be low because COVID-19 or baggage coverage are not automatically included!

Thankfully, most insurers have already factored in their COVID-19, and to save your time from looking through, these are the ones:

- AIG

- Allianz

- Bubblegum

- DBS Chubb

- Great Eastern

- HLAS

- Income

- MSIG

- Seedly

- Singlife

- Sompo

Cheapest Travel Insurance: For Those Who Look At Premiums Only

We know, we know…

While we don’t suggest readers only look at the premiums, we know that some might just want to find the cheapest ones. If this is you, here’s a table for you:

| Product / Plan Name | Single-Trip Per Adult (7 days, ASEAN) | Single-Trip Per Adult (7 days, Asia) | Single-Trip Per Adult (7 days, Worldwide including USA & Canada) | Single-Trip Per Adult (7 days, Worldwide excluding USA & Canada) |

|---|---|---|---|---|

| Seedly Travel Safe | $32.11 (U.P. $67.59) | $40.22 (U.P. $53.63) | $49.90 (U.P. $66.47) | |

| Tiq Travel Entry Plan | $31.34 (U.P. $57) | $36.30 (U.P. $66) | $53.90 (U.P. $98) | |

| HLAS CovidSafe Travel Protect360 Basic Plan | $29 (U.P. $58) | $32 (U.P. $64) | $41 (U.P. $119) | |

| FWD Travel Premium Plan | $30.92 (U.P. $31.50) | $33.39 (U.P. $34.02) | $54.41 (U.P. $55.44) | $53.11 (U.P. $54.12) |

| Income Classic Plan | $37.60 (U.P. $68.36) |

$38.50 (U.P. $70.00) | $75.35 (U.P. $137.00) | |

Back to top

Travel Insurance Providers in Singapore

Wow, that’s a lot of info!

When in doubt, we know that reading reviews might just be what some of you would do.

Here are the insurers mentioned above and all available travel insurance plans.

Do note that premiums-wise, we’re only looking at single trips.

AIG Travel Guard Direct Insurance

The AIG Travel Guard Direct Insurance is, no doubt, one of the plans that have the highest sums assured for overseas medical expenses (including COVID-19 coverage).

It also provides in-hospital cash allowance and COVID-19 overseas quarantine allowance.

| Product / Plan Name | Single-Trip Per Adult

(7 days, ASEAN) |

Single-Trip Per Adult

(7 days, Asia) |

Single-Trip Per Adult

(7 days, Worldwide) |

Overseas Medical Coverage | Personal Accident (Accidental death and permanent total disability) | Trip Cancellation | Trip Delay | Loss or Damage to Baggage | COVID-19 Medical Coverage | Other coverages without add-ons |

| AIG Travel Guard Direct Basic Plan | $48.00 | $68.00 | $68.00 | Up to $100,000 | – | Up to $5,000 | Up to $100 per 6 hrs (max $200) |

Up to $3,000 | Up to $50,000 | – Covers COVID-19 trip cancellation, alteration of trip, out of country COVID-19 diagnosis quarantine allowance, and early return home

– Covers overseas dental expenses (Standard, Superior & Supreme only) – Covers golfing, loss of sporting equipment, pet care (Superior & Supreme only) |

| AIG Travel Guard Direct Standard Plan | $60.00 | $87.00 | $114.00 | Up to $200,000 | Up to $100,000 | Up to $5,000 | Up to $100 per 6 hrs (max $1,000) |

Up to $3,000 | Up to $100,000 | |

| AIG Travel Guard Direct Superior Plan | $83.00 | $105.00 | $133.00 | Up to $1,000,000 | Up to $200,000 | Up to $10,000 | Up to $100 per 6 hrs (max $2,000) |

Up to $5,000 | Up to $200,000 | |

| AIG Travel Guard Direct Supreme Plan | $125.00 | $153.00 | $163.00 | Up to $2,500,000 | Up to $300,000 | Up to $15,000 | Up to $100 per 6 hrs (max $3,000) |

Up to $10,000 | Up to $250,000 | |

| Sign Up | Apply Now | |||||||||

Back to top

Allianz Travel Insurance

As with other insurance plans, the Allianz Travel Insurance coverage is very comparable to the AIG travel insurance.

Before purchasing, remember to check out which COVID-19 expense the insurance actually covers.

| Product / Plan Name | Single-Trip Per Adult

(7 days, ASEAN) |

Single-Trip Per Adult

(7 days, Asia) |

Single-Trip Per Adult

(7 days, Worldwide) |

Overseas Medical Coverage | Personal Accident (Accidental death and permanent total disability) | Trip Cancellation | Trip Delay | Loss or Damage to Baggage | COVID-19 Medical Coverage | Other coverages without add-ons |

| Allianz Single Trip Bronze | $38.40 (U.P. $64) | $40.80 (U.P. $68) | $66.60 (U.P. $111) | Up to $250,000 | Up to $50,000 | Up to $5,000 | Up to $400 per day (max $800) |

Up to $1,500 | Up to $200,000 | Covers COVID-19 trip cancellation, curtailment, incident, delay + Rental car excess coverage |

| Allianz Single Trip Silver | $39.60 (U.P. $66) | $64.20 (U.P. $107) | $86.40 (U.P. $144) | Up to $500,000 | Up to $100,000 | Up to $5,000 | Up to $400 per day (max $1,200) |

Up to $3,000 | Up to $500,000 | |

| Allianz Single Trip Platinum | $75.60 (U.P. $126) | $90.60 (U.P. $151) | $124.20 (U.P. $207) | Up to $1,000,000 | Up to $200,000 | Up to $10,000 | Up to $400 per day (max $1,600) |

Up to $5,000 | Up to $1,000,000 | COVID-19 coverage above + coverage for sporting equipment, equipment rental and sports search and rescue Rental car excess coverage Personal Money coverage |

| Promotion | Get 40% discount when you use the promo code TRAVEL40. Valid till 29 Feb 2024. T&Cs apply. | |||||||||

| Sign Up | Apply Now | |||||||||

Back to top

Bubblegum Travel Insurance

For the uninitiated, Bubblegum insurance is offered by MoneySmart and underwritten by India International Insurance Pte Ltd.

| Product / Plan Name | Single-Trip Per Adult

(7 days, ASEAN) |

Single-Trip Per Adult

(7 days, Asia) |

Single-Trip Per Adult

(7 days, Worldwide) |

Overseas Medical Coverage | Personal Accident (Accidental death and permanent total disability) | Trip Cancellation | Trip Delay | Loss or Damage to Baggage | COVID-19 Medical Coverage | Other coverages without add-ons |

| Bubblegum | $37.91 (U.P. $42.12) | $40.27 (U.P. $44.75) | $47.38 ($52.65) | Up to $150,000 | Up to $150,000 | Up to $5,000 (up to $600 for Covid-19) | $100 per 6 hours (max $400) |

Up to $3,000 | Up to $65,000 (as part of the $150,000) | Covers adventurous sports including hot air ballooning, scuba diving and skiing |

Back to top

DBS Chubb TravellerShield Plus

![]()

For the uninitiated, Chubb Insurance Singapore Limited underwrites DBS or POSB travel insurance.

Chubb Travel Insurance is protected under the Policy Owners’ Protection Scheme which is administered by the Singapore Deposit Insurance Corporation (“SDIC”) and comes in three tiers: Economy, Business, and First.

| Product / Plan Name | Single-Trip Per Adult

(7 days, ASEAN) |

Single-Trip Per Adult

(7 days, Asia) |

Single-Trip Per Adult

(7 days, Worldwide) |

Overseas Medical Coverage | Personal Accident (Accidental death and permanent total disability) | Trip Cancellation | Trip Delay | Loss or Damage to Baggage | COVID-19 Medical Coverage | Other coverages without add-ons |

| Economy | $33.75 (U.P. $75.00) |

$45.00 (U.P. $100.00) | $68.40 (U.P. $152.00) | Up to $300,000 | Up to $150,000 | Up to $5,000 | Up to $750 | Up to $3,500 | Up to $50,000 | Covers COVID-19 quarantine benefit, mortal remains, hospital confinement, trip cancellation, curtailment

Covers adventurous activities such as bungee jumping, sky diving, paragliding, helicopter rides, hot air ballooning, jet skiing, mountaineering, skiing/snowboarding, canoeing, underwater activities (Premier & Platinum only) |

| Business | $40.05 (U.P. $89.00) |

$53.10 (U.P. $118.00) | $81.00 (U.P. $180.00) | Up to $500,000 | Up to $200,000 | Up to $10,000 | Up to $1,500 | Up to $5,000 | Up to $100,000 | |

| First | $54.90 (U.P. 122.00) |

$68.40 (U.P. $152.00) | $96.75 (U.P. $215.00) | Up to $1,000,000 | Up to $500,000 | Up to $15,000 | Up to $2,000 | Up to $8,000 | Up to $200,000 |

Back to top

FWD Travel Insurance

Amongst all insurance plans, FWD Travel Insurance is good for those who want a low price with a relatively decent amount of coverage.

FWD has recently introduced a new ‘Cancel for Any Reason‘ optional add-on for single trips, allowing policyholders to be reimbursed up to 50% for all covered travel costs incurred, capped at the benefit amount indicated in the table of benefits!

This option allows you to file a claim for Trip Cancellation, Trip Postponement, or Trip Cut Short due to any reason, regardless of whether the reason falls within the initial definition of trip cancellation determined in the policy wording.

Do note that this add-on has to be purchased within seven days of your initial trip deposit for the trip.

| Product / Plan Name | Single-Trip Per Adult

(7 days, ASEAN) |

Single-Trip Per Adult

(7 days, Asia) |

Single-Trip Per Adult

(7 days, Worldwide) |

Single-Trip Per Adult (7 days, Worldwide excluding USA) | Overseas Medical Coverage | Personal Accident (Accidental death and permanent total disability) | Trip Cancellation | Trip Delay | Loss or Damage to Baggage | COVID-19 Medical Coverage (Optional add-on) | Other coverages without add-ons |

| FWD Travel Premium Plan | $30.92 (U.P. $31.50) | $33.39 (U.P. $34.02) | $54.41 (U.P. $55.44) | $53.11 (U.P. $54.12) | Up to $200,000 | Up to $200,000 | Up to $7,500 | Up to $150 per 6 hrs | Up to $3,000 | Up to $200,000 | Cancel for Any Reason: Up to $1,000 |

| FWD Travel Business Plan | $37.95 (U.P. $42.84) | $45.11 (U.P. $52.92) | $66.65 (U.P. $74.25) | $65.30 (U.P. $73.78) | Up to $500,000 | Up to $300,000 | Up to $10,000 | Up to $600 per 6 hrs | Up to $5,000 | Up to $200,000 | Cancel for Any Reason: Up to $3,000 |

| FWD Travel First Plan | $45.76 (U.P. $55.44) | $53.70 (U.P. $66.78) | $83.04 ($101.62) | $76.52 (U.P. $91.87) | Up to $1,000,000 | Up to $400,000 | Up to $15,000 | Up to $900 per 6 hrs | Up to $7,000 | Up to $200,000 | Cancel for Any Reason: Up to $6,000 |

| Sign Up | Apply Now | ||||||||||

Back to top

GrabInsure Travel Insurance

You would’ve heard of GrabInsure Travel Insurance if you’re on Grab.

This is another insurance product underwritten by Chubb, and it costs only $3.90 per day!

| Product / Plan Name | Single-Trip Per Adult

(7 days, ASEAN) |

Single-Trip Per Adult

(7 days, Asia) |

Single-Trip Per Adult

(7 days, Worldwide) |

Single-Trip Per Adult (7 days, Worldwide excluding USA) |

Overseas Medical Coverage | Personal Accident (Accidental death and permanent total disability) | Trip Cancellation | Trip Delay | Loss or Damage to Baggage | COVID-19 Medical Coverage |

| Economy | $3.90 per day | $5.10 per day | $10 per day | $8.60 per day | Up to $150,000 | Up to $200,000 | Up to $5,000 | – | Up to $3,000 | Up to $5,000 |

Back to top

Great Eastern TravelSmart Premier

Great Eastern’s TravelSmart Premier is Great Eastern’s travel insurance that provides comprehensive coverage.

You can indulge in an action-packed trip as the insurance covers adventurous activities such as mountaineering, snowboarding, and skydiving.

| Product / Plan Name | Single-Trip Per Adult

(7 days, ASEAN) |

Single-Trip Per Adult

(7 days, Asia) |

Single-Trip Per Adult

(7 days, Worldwide) |

Overseas Medical Coverage | Personal Accident (Accidental death and permanent total disability) | Trip Cancellation | Trip Delay | Loss or Damage to Baggage | COVID-19 Medical Coverage | Other coverages without add-ons |

| Classic | $70.00 | $70.00 | $107.00 | Up to $300,000 | Up to $250,000 | Up to $10,000 | $200 per 6 hrs (max $1,000) |

Up to $5,000 | Up to $50,000 | – |

| Elite | $81.00 | $81.00 | $127.00 | Up to $500,000 | Up to $500,000 | Up to $15,000 | $200 per 6 hrs (max $1,200) |

Up to $5,000 | Up to $150,000 | – |

Back to top

Hong Leong Assurance Travel Insurance

The premiums charged for the Hong Leong Assurance Travel Protect360 Insurance are relatively comparable to the other insurance plans, with four tiers.

Be warned that based on Seedly reviews, the claim process can be really long, but this might vary on a case-by-case basis.

| Product / Plan Name | Single-Trip Per Adult

(7 days, ASEAN) |

Single-Trip Per Adult

(7 days, Asia) |

Single-Trip Per Adult

(7 days, Worldwide) |

Overseas Medical Coverage | Personal Accident (Accidental death and permanent total disability) | Trip Cancellation | Trip Delay | Loss or Damage to Baggage | COVID-19 Medical Coverage | Other coverages without add-ons |

| Hong Leong Travel Protect Basic Plan | $29 (U.P. $58) | $32 (U.P. $64) | $41 (U.P. $119) | Up to $150,000 | Up to $200,000 | Up to $5,000 (Not Covered for Covid-19 cancellation) | Up to $100 per 6 hrs (max $1,000) |

Up to $3,000 | – | Covers golfing “Hole in One” |

| Hong Leong Travel Protect Enhanced Plan | $39.50 (U.P. $79) | $42.50 (U.P. $85) | $59.50 (U.P. $158) | Up to $200,000 | Up to $250,000 | Up to $7,000 | Up to $100 per 6 hrs (max $1,000) |

Up to $5,000 | Up to $50,000 | Covers golfing “Hole in One” |

| Hong Leong Travel Protect Superior Plan | $53 (U.P. $106) | $57.50 (U.P. $115) | $79 (U.P. $158) | Up to $500,000 | Up to $300,000 | Up to $12,000 | Up to $100 per 6 hrs (max $1,000) |

Up to $7,000 | Up to $150,000 | Covers golfing “Hole in One” |

| Hong Leong Travel Protect Premier Plan | $67.50 (U.P. $135) | $78.50 (U.P. $157) | $101 (U.P. $202) | Up to $750,000 | Up to $350,000 | Up to $15,000 | Up to $100 per 6 hrs (max $1,000) |

Up to $8,000 | Up to $200,000 | Covers golfing “Hole in One” |

Back to top

Income Travel Insurance

The NTUC Income Travel Plan has three categories – Classic, Deluxe, and Preferred, with premiums.

| Product / Plan Name | Single-Trip Per Adult

(7 days, ASEAN) |

Single-Trip Per Adult

(7 days, Asia) |

Single-Trip Per Adult

(7 days, Worldwide) |

Overseas Medical Coverage | Personal Accident (Accidental death and permanent total disability) | Trip Cancellation | Trip Delay | Loss or Damage to Baggage | COVID-19 Medical Coverage | Other coverages without add-ons |

| Income Classic Plan | $37.60 (U.P. $68.36) |

$38.50 (U.P. $70.00) | $75.35 (U.P. $137.00) | Up to $300,000 | Up to $150,000 | Up to $5,000 | Up to $1,000 | Up to $3,000 | Included as part of medical coverage | Covers pre-existing medical conditions |

| Income Deluxe Plan | $46.00 (U.P. $83.64) |

$48.40 (U.P. $88.00) | $85.80 (U.P. $156.00) | Up to $500,000 | Up to $200,000 | Up to $10,000 | Up to $1,500 | Up to $5,000 | Included as part of medical coverage | Covers pre-existing medical conditions |

| Income Preferred Plan | $59.80 (U.P. $108.73) |

$67.10 (U.P. $122.00) | $107.25 (U.P. $195.00) | Up to $1,000,000 | Up to $500,000 | Up to $15,000 | Up to $2,000 | Up to $8,000 | Included as part of medical coverage | Covers pre-existing medical conditions |

Back to top

MSIG TravelEasy Insurance

The MSIG TravelEasy Travel Insurance has one of the best coverages on this list, but its Single Trips are also pricier as compared to others.

| Product / Plan Name | Single-Trip Per Adult

(7 days, ASEAN) |

Single-Trip Per Adult

(7 days, Asia) |

Single-Trip Per Adult

(7 days, Worldwide) |

Overseas Medical Coverage | Personal Accident (Accidental death and permanent total disability) | Trip Cancellation | Trip Delay | Loss or Damage to Baggage | COVID-19 Medical Coverage | Other coverages without add-ons |

| MSIG TravelEasy Standard | $37.20 (U.P. $62.00) | $45.60 (U.P. $76.00) | $72.90 (U.P. $121.50) |

Up to $250,000 | Up to $150,000 | Up to $3,000 | Up to $100 per 6 hr (Max S$500) |

Up to $3,000 | Up to $75,000 | Covers COVID-19 travel cancellation, postponement, replacement of traveller, emergency repatriation etc.

Covers wedding clothing and accessories Covers Golfer’s golf equipment, green fee due to illness/injury, Hole-in-One, Unused entertainment ticket Covers vehicle rental excess |

| MSIG TravelEasy Elite Plan | $49.50 (U.P. $82.50) | $63.60 (U.P. $106.00) | $93.00 (U.P. $155.00) |

Up to $500,000 | Up to $200,000 | Up to $4,000 | Up to $100 per 6 hr (Max S$1,000) |

Up to $5,000 | Up to $150,000 | |

| MSIG TravelEasy Premier Plan | $69.60 (U.P. $116.00) | $87.90 (U.P. $146.50) | $125.10 (U.P. $208.50) |

Up to $1,000,000 | Up to $500,000 | Up to $5,000 | Up to S$100 per 6 hr (Max S$1,500) |

Up to $7,500 | Up to $250,000 | |

| Sign Up | Apply Now | |||||||||

Back to top

Seedly Travel Insurance

![]()

If you’re a Seedly fan or avid reader, you must know that we have launched our own Seedly Travel Insurance! Our travel insurance is available in two tiers: Seedly Travel Safe and Seedly Travel Secure.

And here’s the lowdown: It’s underwritten by HL Assurance Pte. Ltd, covering everything from wild adventures to COVID-19, and even child support, all without any extra fees.

But here’s the really awesome part – if you’re traveling with the kiddos, they’re covered for free!

Do note that Single Trips are available right now, and Annual Trips will be rolled out in due time.

| Product / Plan Name | Single-Trip Per Adult

(7 days, ASEAN) |

Single-Trip Per Adult

(7 days, Asia) |

Single-Trip Per Adult

(7 days, Worldwide) |

Overseas Medical Coverage | Personal Accident (Accidental death and permanent total disability) | Trip Cancellation | Trip Delay | Loss or Damage to Baggage | COVID-19 Medical Coverage | Other coverages without add-ons |

| Seedly Travel Safe | $32.11 (U.P. $67.59) | $40.22 (U.P. $53.63) | $49.90 (U.P. $66.47) | Up to $200,000 | Up to $150,000 | Up to $5,000 | Up to $1,000 | Up to $5,000 | Included as part of medical coverage | Covers COVID-19 trip cancellation, postponement, curtailment, disruption, quarantine allowance, hospital income

Covers scuba diving and mountaineering/hiking up to a certain limit Covers children for free Covers Double Public Transport |

| Seedly Travel Secure | $51.03 (U.P. $107.44) | $53.72 (U.P. $71.63) | $79.74 (U.P. $106.32) | Up to $500,000 | Up to $300,000 | Up to $10,000 | Up to $2,000 | Up to $10,000 | Included as part of medical coverage | |

| Sign Up | Apply Now | |||||||||

If you’re considering travel insurance, make sure you check out Seedly Travel Insurance!

This travel insurance is ideal for everyone, particularly families, as it automatically includes insurance protection for children without needing additional add-ons!

Built from the ground up based on what users want in a travel insurance plan, Seedly Travel insurance includes COVID-19 coverage, personal accident benefits per child, and all your travel essentials covered!

Sign up now to enjoy 50% off and an additional 5% off with promo code: ‘SeedlyCommunity‘. You’ll also receive a 3GB Airalo travel eSIM (worth US$10) and up to S$50 worth of Grab Vouchers. This promo is valid till 31 January 2024. T&Cs apply.

Plus, each plan purchase will entitle you to the following:

- 1x chance to win a 64GB Apple iPad 10.2″ 9th Gen (worth S$508.30). This promo is valid till 31 January 2024. T&Cs apply

- Every 88th buyer will score a Samsonite Volant Spinner 68/25 EXP worth S$480. The promotion runs from 22 Jan – 31 March 2024. T&Cs apply.

- Huat Huat Hour Giveaway: Be the first to purchase any insurance product via SingSaver at every hour from 1pm – 8pm each day, to receive an S$88 eCapitaVoucher! The promotion runs from 8 Jan – 11 Feb 2024.

Apply Now

Singlife Travel Insurance

Singlife Travel Insurance is another contender for affordable travel insurance with good coverage.

At $86.05, you get unlimited coverage on overseas media expenses!

| Product / Plan Name | Single-Trip Per Adult

(7 days, ASEAN) |

Single-Trip Per Adult

(7 days, Asia) |

Single-Trip Per Adult

(7 days, Worldwide) |

Overseas Medical Coverage | Personal Accident (Accidental death and permanent total disability) | Trip Cancellation | Trip Delay | Loss or Damage to Baggage | COVID-19 Medical Coverage | Other coverages without add-ons |

| Singlife Travel Lite Plan | $32.63 (U.P. $43.51) |

$40.46 (U.P. $53.95) | $60.19 (U.P. $80.25) | Up to $250,000 | Up to $50,000 | Up to $5,000 | Up to $100 per 6 hrs (max $500) |

Up to $3,000 | Up to $50,000 | Covers COVID-19 emergency medical evacuation, repatriation, overseas quarantine, trip cancellation and interruption

Covers Rental Vehicle Excess and Return Covers Domestic Pet Care Covers loss of frequent flyer points Covers pregnancy, childbirth related conditions, motorcycling |

| Singlife Travel Plus Plan | $46.25 (U.P. $61.67) |

$58.45 (U.P. $77.93) | $87.71 (U.P. $116.94) | Up to $2,000,000 | Up to $100,000 | Up to $15,000 | Up to $100 per 6 hrs (max $1,000) |

Up to $5,000 | Up to $100,000 | |

| Singlife Travel Prestige Plan | $64.54 (U.P. $86.05) |

$81.46 (U.P. 108.61) | $128.32 (U.P. $171.09) | Unlimited | Up to $500,000 | Up to $20,000 | Up to $100 per 6 hrs (max $2,000) |

Up to $8,000 | Up to $200,000 |

Singlife Travel Insurance Add-ons:

- Wedding & photoshoots

- Golfing

- Winter sports

- Adventurous water sports

Back to top

Sompo TravelJoy Travel Insurance

Sompo TravelJoy Travel Insurance is a popular choice amongst those with a lower budget.

At $48 or $62.25 (after a 25% discount), you will get relatively good coverage for personal accidents compared to other insurance!

| Product / Plan Name | Single-Trip Per Adult

(7 days, ASEAN) |

Single-Trip Per Adult

(7 days, Asia) |

Single-Trip Per Adult

(7 days, Worldwide) |

Overseas Medical Coverage | Personal Accident (Accidental death and permanent total disability) | Trip Cancellation | Trip Delay | Loss or Damage to Baggage | COVID-19 Medical Coverage | Other coverages without add-ons |

| Sompo Essential Plan | $35.20 (U.P. $64.00) | $49.50 (U.P. $90.00) | $70.95 (U.P. $129.00) | Up to $200,000 | Up to $200,000 | Up to $5,000 | Up to $100 per 6 hrs (max $800) |

Up to $1,000 | Up to $100,000 | Covers COVID-19 trip cancellation, postponement, curtailment, disruption, quarantine allowance, hospital income |

| Sompo Superior Plan | $45.65 (U.P. $83.00) | $62.70 (U.P. $114.00) | $90.75 (U.P. $165.00) | Up to $400,000 | Up to $500,000 | Up to $10,000 | Up to $100 per 6 hrs (max $1,200) |

Up to $1,000 | Up to $200,000 |

Back to top

Starr Insurance TraveLead Travel Insurance

One thing I like about Starr Insurance TraveLead Travel Insurance is that it is highly customisable.

One thing I like about Starr Insurance TraveLead Travel Insurance is that it is highly customisable.

You can include add-ons such as golf protection, cruise vacation, scuba diving, and snow sports, starting at $2.

BUT, COVID-19 and baggage coverage are NOT automatically included, hence you have to top-up for them.

That said, its premiums are very competitive. But even so, we are also cautious as it doesn’t seem to be a fan favourite (see SeedlyReview below).

| Product / Plan Name | Single-Trip Per Adult

(7 days, ASEAN) |

Single-Trip Per Adult

(7 days, Asia) |

Single-Trip Per Adult

(7 days, Worldwide) |

Overseas Medical Coverage | Personal Accident (Accidental death and permanent total disability) | Trip Cancellation | Trip Delay | Loss or Damage to Baggage | COVID-19 Medical Coverage | Other coverages without add-ons |

| Starr Insurance TraveLead Bronze Plan | $26.52 (U.P. $40.80) | $26.52 (U.P. $40.80) | $32.76 (U.P. $50.40) | Up to $200,000 | Up to $150,000 | Available as add-on | Up to $100 per 6 hrs (max $500) |

Available as add-on | Up to $15,000 | Covers vehical rental excess Covers COVID-19 trip cancellation, curtailment (Silver & Gold only) |

| Starr Insurance TraveLead Silver Plan | $31.98 (U.P. $49.20) | $34.32 (U.P. $52.80) | $46.02. (U.P. $70.80) | Up to $500,000 | Up to $300,000 | Available as add-on | Up to $100 per 6 hrs (max $600) |

Available as add-on | Up to $30,000 | |

| Starr Insurance TraveLead Gold Plan | $41.34 (U.P. $63.60) | $44.46 (U.P. $68.40) | $59.28 (U.P. $91.20) | Up to $1,000,000 | Up to $500,000 | Available as add-on | Up to $100 per 6 hrs (max $800) |

Available as add-on | Up to $65,000 | |

| Sign Up | Apply Now | |||||||||

Starr Travel Insurance Add-ons:

- Golf protection

- Cruise vacation

- Scuba diving

- Snow sports

Back to top

Tiq Travel Insurance

Tiq is the insurance arm of Etiqa, a prominent insurance company in Singapore.

The Tiq Travel Insurance covers travellers who have pre-existing medical conditions!

For those without pre-existing conditions, these are the coverages:

| Product / Plan Name | Single-Trip Per Adult

(7 days, ASEAN) |

Single-Trip Per Adult

(7 days, Asia) |

Single-Trip Per Adult

(7 days, Worldwide) |

Overseas Medical Coverage | Personal Accident (Accidental death and permanent total disability) | Trip Cancellation | Trip Delay | Loss or Damage to Baggage | COVID-19 Medical Coverage | Other coverages without add-ons |

| Tiq Travel Entry Plan | $31.34 (U.P. $57) | $36.30 (U.P. $66) | $53.90 (U.P. $98) | Up to $200,000 | Up to $150,000 | Up to $5,000 | Up to $50 per 3 hrs (max $300) |

– | Up to $500,000 (Only available as add-on to those without pre-existing medical condition) | – |

| Tiq Travel Savvy Plan | $44.55 (U.P. $81) | $56.65 (U.P. $103) | $71.50 (U.P. $130) | Up to $500,000 | Up to $500,000 | Up to $5,000 | Up to $50 per 3 hrs (max $300) |

– | Up to $$500,000 (Only available as add-on to those without pre-existing medical condition) | – |

| Tiq Travel Luxury Plan | $61.60 (U.P. $112.00) | $75.90 (U.P. $138) | $92.95 (U.P. $169) | Up to $1,000,000 | Up to $500,000 | Up to $10,000 | Up to $50 per 3 hrs (max $500) |

– | Up to $500,000 (Only available as add-on to those without pre-existing medical condition) | – |

| Sign Up | Apply Now | |||||||||

Tiq Insurance Add-ons:

- COVID-19 Coverage at around $13 – $20

Back to top

Frequently Asked Questions (FAQs) Regarding Travel Insurance With COVID-19 Benefits

Need Help With Choosing The Best Travel Insurance in Singapore?

“OMG, there are so many options to choose from! How do I know which one is good?”

Simply head on over to Seedly Reviews for real user reviews of the best travel insurance in Singapore!

With real, unbiased reviews from our community, you no longer have to worry about picking the wrong policy as you get an inside look at issues such as the ease of making claims or customer service.

Why wait? Head on over and find out the best travel insurance for you now!