A few weeks ago DBS Research published their bullish stance on S-REITs after the Feds looked to pause hiking the rates.

Thus the title “High (not higher) for longer” with reference to how interest rates will pen out in the upcoming 1-2 years.

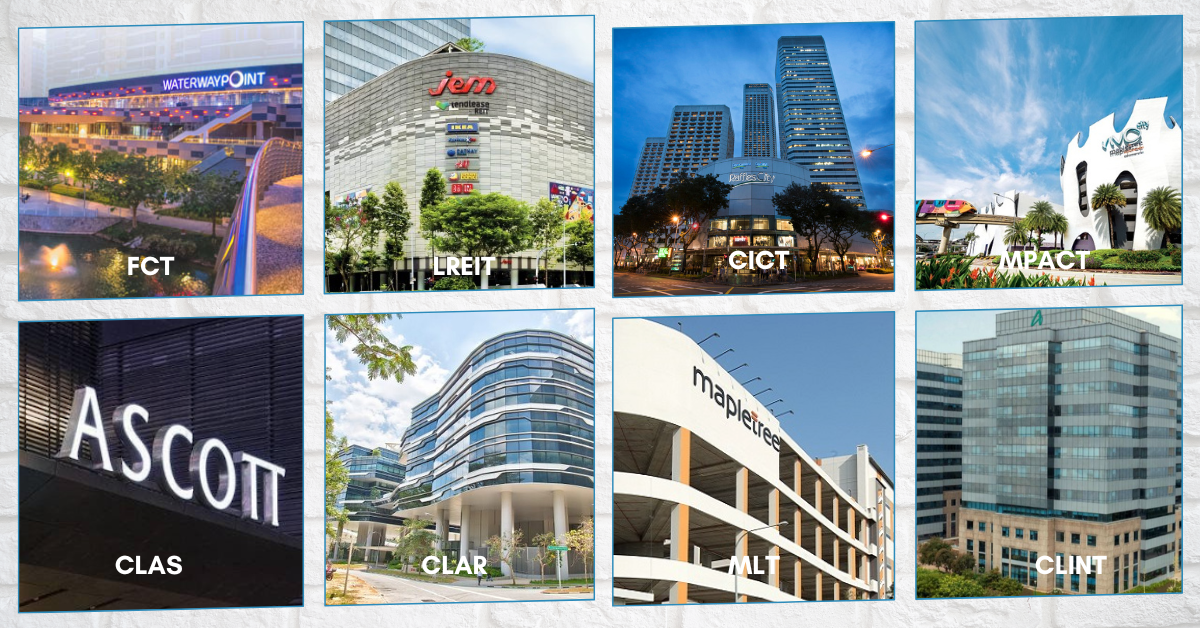

For those who might be too lazy to go through the research, here is a gist of what’s mentioned, and the 8 REITs that DBS deemed undervalued.

I will go through the 8 REITs mentioned with a little bit of my comments, but from the looks of it, all 8 REITs are definitely above average.

DBS Research TL;DR

DBS Research theorizes that S-REITs should gain momentum as global yields retreat. US 10-year year yield declined by c.0.4% to 4.5%; SG 10-year declined by 0.3% to 2.95%.

We all know that high-interest rates have been a bane to REITs. But it does look like we have hit the peak before going back down to normal levels.

Thus, REITs with superior operational metrics, translating to great fundamentals should be stable and firm even if interest rates continue to persist at such levels.

With that, DBS cited retail and hospitality REITs have demonstrated metrics higher than pre-COVID levels.

Value buy 1: Fraser Centrepoint Trust (FCT)

Frasers Centrepoint Trust (SGX: J69U) is a leading developer-sponsored real estate investment trust (REIT) and the largest suburban retail mall owner in Singapore. The company’s property portfolio comprises nine retail malls and an office building located in the suburban regions of Singapore. FCT is among the top ten largest Singapore REITs (S-REITs) by market capitalization.

Gross rental income has been increasing steadily over the last 5 years. Operating income trends along with the higher gross rental income, while net income to unitholders seems flattish due to the higher interest expenses.

Per unit wise, due to an enlarged outstanding of units from capital raising exercises, earnings per unit and distributions per unit might seem a bit on the flat side. During both rounds of capital raising exercises, the offer price for 1 unit of FCT was in the region of SGD 2.30.

As of the time of writing, with a unit price of SGD 2.20, non-invested but interested investors can actually become unitholders at a lower price than previous predecessors who bought at higher prices or have subscribed to the preferential offerings at higher prices.

Value buy 2: Lendlease Global Commercial REIT (LREIT)

Lendlease Global Commercial REIT (SGX: JYEU) is a Singapore-listed REIT, which has properties used primarily for retail and/or office purposes. The REIT’s portfolio comprises leasehold interest in two properties in Singapore namely Jem (office and retail property) and 313@somerset (retail property) as well as freehold interest in three Grade A office buildings, Sky Complex, in Milan.

Out of the 8 REITs, LREIT seems to be a curveball. In terms of age, LREIT went public around the pandemic era and does not have much historical past track record.

Although all seems to be growing, a huge chunk of its growth spurt comes from its acquisition of JEM.

LREIT has REIT portfolio metrics that most REITs would be envious of. A high portfolio committed occupancy, great tenant sales, a long WALE, and a retail rental reversion of close to 20%.

But when it comes to capital management, I become a bit wary.

With just 3 properties, LREIT is already hitting a 40.6% gearing ratio (without considering perpetual securities as debt). Plus with the REIT trading at a discount in terms of book value, LREIT might risk its gearing ratio breached, something similar to Manulife US REIT.

The lease with Sky Italia for Sky Complex in Milan poses a risk, which albeit a relatively low one, would be disastrous to LREIT if the unwanted circumstances were to happen.

Value buy REIT 3: CapitaLand Integrated Commercial Trust (CICT)

A name that is ubiquitous to investors and non-investors.

CapitaLand Integrated Commercial Trust (SGX: C38U) is the merger between CapitaLand Mall Trust and CapitaLand Commercial Trust.

With a portfolio of 26 properties, CICT is the largest REIT in Singapore. It also kickstarted its foray into Australia and Germany a few years back, but the bulk of its portfolio still remains predominantly in Singapore.

2023 pg 9

There isn’t much to nitpick about CICT, apart from the higher interest expense and rate, but which REIT is spared by the rates? Gross revenue YTD is up 9.8% YoY, while net property income is also up 6.8% YoY.

2023 pg 14

In fact, given the size of CICT, its tenant concentration is low – the top 10 tenants contribute to less than 20% of its total gross rent. Even with the news of WeWork filing for bankruptcy, the 2.4% exposure did not see much over-reaction when news broke out.

Value buy 4: Mapletree Pan Asia Commercial Trust (MPACT)

Mapletree Pan Asia Commercial Trust (SGX: N2IU) is the rebranding of the old pure play Mapletree Commercial Trust when it merged with its sister REIT Mapletree North Asia Commercial Trust.

Unlike CICT, MPACT’s merger 1 year on has been hampered by a new challenge – “geographical diworsification”. Even though the Singapore properties have rebounded past their pre-COVID level highs, the Hong Kong, Japan, and China properties are still going through some challenges in terms of rental reversion.

Don’t get me wrong. I supported the move for the merger. It just so happened the timing was off and we saw the late COVID-19 reopening of Hong Kong and China that is still showing the scars from the prolonged lockdown.

Higher interest rates also shrunk the DPU YoY – it dropped 8.2% due to a 37.5% increase in net finance cost.

But if interest rates have peaked, we might just be seeing the bottom of MPACT.

Value buy 5: CapitaLand Ascott Trust (CLAS)

There are so many properties by CapitaLand that they used to have plenty of REITs for each category. Even after the consolidation of CMT and CCT, there is still CapitaLand Ascott Trust (SGX: HMN), which invests in lodging or hospitality assets.

CLAS is one of the most geographically diversified REITs under the CapitaLand umbrella. It has 103 properties in 44 cities around 15 countries.

While the hospitality sector does have its cyclicity – holiday periods and quarters can generate the bulk of the revenue, CLAS’s RePAU seems to be on a steep upward trend.

CLAS demonstrated prudence when it comes to capital management. The gearing ratio is 35.2%, with an interest coverage of 4.2x, which is considerably high as REITs all around the world face a higher interest expense and hence a lower ICR.

Their prudence is also exhibited in the foreign exchange hedges, with only a loss of 0.7%.

Value buy 6: CapitaLand Ascendas REIT (CLAR)

Formerly known as Ascendas Real Estate Investment Trust, CapitaLand Ascendas REIT (SGX: A17U) is Singapore’s first and largest listed Business Space and Industrial Real Estate Investment Trust (REIT).

From a pure-play Singapore industrial and logistics REIT, CLAR pivoted and joined the data center bandwagon in 2021. Its first foray outside of Singapore was in 2015 with its entry into Australia.

Today, it has over 230 properties, with 62% of it in Singapore, with the rest in the US, Australia and the UK and Europe.

Capital management and balance sheet-wise, CLAR sports an ICR of 4.0x and an aggregate leverage of just below 40%, at 37.2%. Due to its size, stability, and track record, it has one of the higher Moody’s ratings at A3.

Value buy 7: Mapletree Logistics Trust (MLT)

This is the other half of MPACT that seems to be doing well in terms of geographical diversification. Mapletree Logistics Trust (SGX: M44U) focuses on investment properties in the logistics sector, while another Mapletree Industrial Trust (SGX: ME8U) deals with properties for industrial and data center purposes.

MLT’s tenants hail from the e-commerce and logistics segment mainly. It was one of the beneficiaries during the e-commerce boom and still plays an integral part today judging by how the buying and spending habits have evolved.

With interest rates peaking and expected to be tamed down to normal levels, MLT’s debt maturity profile looks to capitalize on the lower interest rates by FY 25/26.

Value buy 8: CapitaLand India Trust (CLINT)

Yet another curveball. CapitaLand India Trust (SGX: CY6U) is either a love-it-or-hate-it. After the previous forex risks and aftermath by Lippo Malls Indonesia Retail Trust (SGX: D5IU) and First REIT (SGX: AW9U), the appetite towards REITs with full foreign exposure is being waned significantly.

But before writing off CLINT, even with the INR depreciation against the SGD, CLINT managed to grow its DPU in SGD by 33%.

With superior growth, prudent hedging, and debt management, CLINT’s interest expenses when its debt matures in FY 2024 would be minimal and manageable.

It’s important to note that the revolving credit facilities RCFs are lines that CLINT can tap into and undrawn.

CLINT counts US companies as its major tenants in its IT parks, with names like Amazon, BoA, and even French banking firm Soc Gen.

That said, skeptics might worry when the music ends, will there be any chairs left?

My verdict and view

Most of us are not economists, nor can we switch the interest rates to our favor in line with our stock holdings.

Even the curveballs presented by DBS have their merits – they trade at a discount and offer better yields. If the REIT management is able to maneuver the REIT out of the high-interest rates and continue the growth when interest rates normalize, these curveballs might turn out to be the best buys of the decade.

Conversely, those who are risk-aversive have plenty of good choices still. Blue chip REITs from CapitaLand and Mapletree yielding 5-6% yield per annum is not something that happens every day.

That said, will any of them face a blowup like their US REIT counterparts? Well time to dig deeper into the track records and reports of the respective REITs to convince yourself the best REIT to buy!

If you like REITs, you may find my framework on picking the best REITs useful.

P.S. if you’re interested in REITs and want to build a dividend portfolio, join Chris at his next live webinar to learn from someone who has retired doing just that.