As part of this year’s Singapore Fintech Festival, Singaporean bank UOB took to the stage to present the main findings for its annual FinTech in ASEAN report on Thursday (November 6) afternoon.

Janet Young, the managing director and group head of channels and digitalisation at UOB, presented the report’s key takeaways, which outlined pivotal events that shaped the fintech industry in the past decade and explored potential catalysts that could accelerate the sector’s growth in the future.

A panel discussion was also held after the presentation, and here’s what was said.

Highlights of the report

In her presentation, Young first acknowledged the definitive events that have greatly impacted the world, namely the COVID-19 pandemic, Brexit and the introduction of OpenAI and ChatGPT.

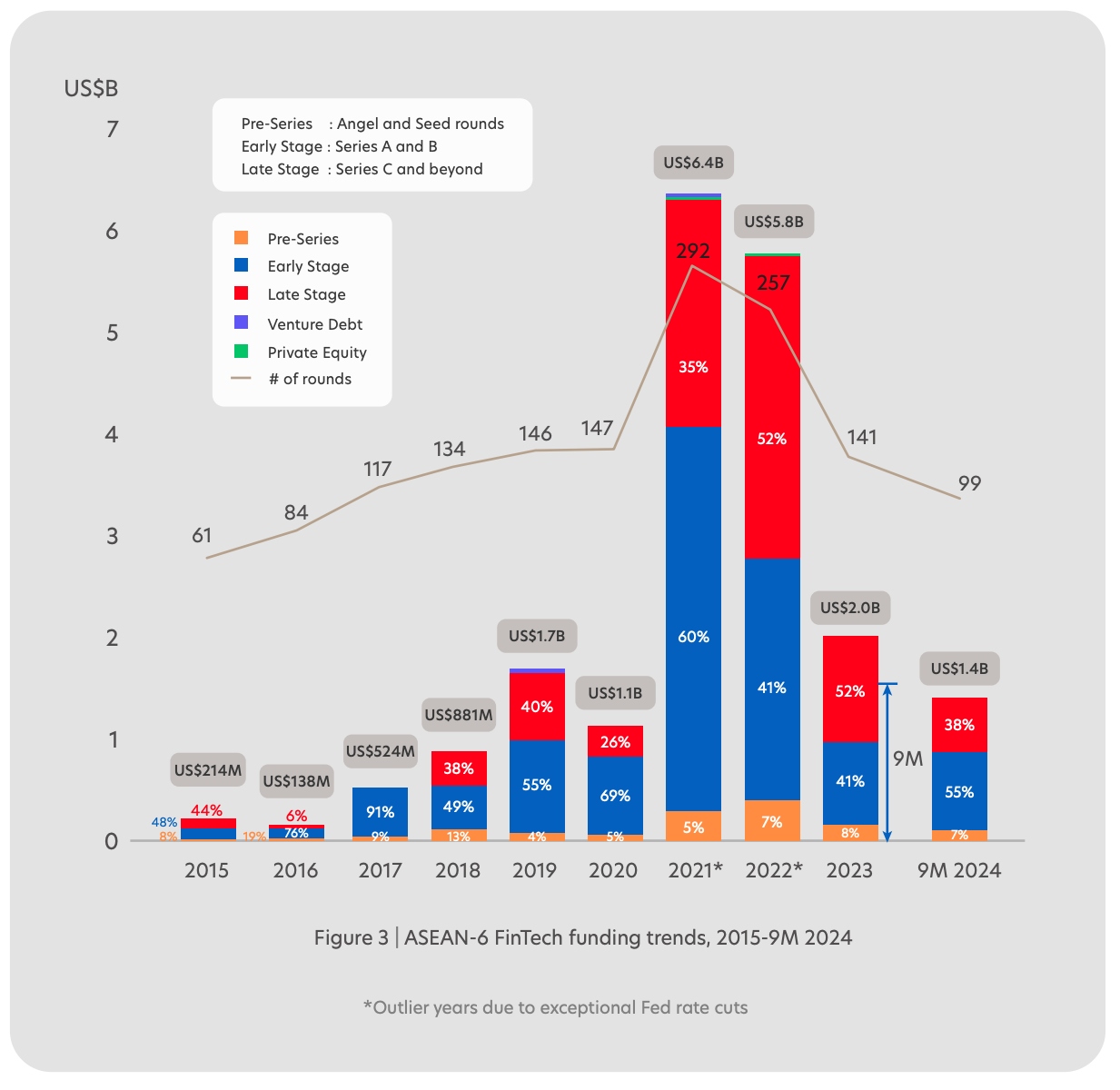

However, despite these events’ disruptions, the report found that ASEAN’s fintech funding has surged more than 10 times since 2015 and reached a peak of almost US$6.4 billion in 2021.

In total, fintech businesses in the region have raised over US$20 billion in funding from 1500 fundraising deals over the past decade. Young added that global fintech funding has also grown by 10%, with the projected funding for the year at US$39 billion.

She also pointed out that early-stage funding has continued to grow despite the challenging environment and encouraged young startups to move forward with their innovations.

Addressing the sharp spike in 2021, Young explains that due to the Fed cuts in 2020, interest rates were at a “historical low,” making the funding environment more conducive.

Looking forward, she shared that generative artificial intelligence (Gen AI), blockchain and quantum computing will spur “the next era” of fintech funding and growth.

Singapore as a global fintech hub

Following the presentation, a panel discussion amongst leaders in the fintech industry focused on the future of Singapore’s fintech industry.

Wanyi Wong, fintech leader at PwC Singapore, kicked off the discussion by highlighting that Singapore accounts for more than half of funding in the ASEAN region, which signifies the city-state’s attractiveness to the industry.

So the main question is: Why Singapore?

Wong Joo Seng, co-founder and CEO of Spark Systems, stated that the country “ticks all the boxes” for fintech businesses. “It has been a place where money looks for good ideas, and good ideas seek funding,” he added.

He went on to explain that while Singapore has a small population compared to its foreign counterparts, it is still a good test bed and springboard for successful businesses that have gained traction and are looking to expand outwards.

On the regulatory front, Wong added that intellectual property (IP), vital to tech startups, is safeguarded by Singaporean law. Walter De Oude, founder of Singlife and Chocolate Finance, jumped in, stating that the city-state is “probably the gold standard” as a regulated environment.

He elaborated that the country’s legislation recognises the required standards for operating governance and structure in the financial services sector.

“People might argue that Singapore’s system is very stringent and difficult, but if you can demonstrate credibility and capability and success in the Singapore context, you can do it pretty much anywhere,” De Oude added.

Shadab Taiyabi, president of the Singapore Fintech Association (SFA), shared his thoughts from a regulator’s perspective. Collaborative regulators and clear guidelines are needed to engage with policymakers, who actively listen and implement suggestions from the community, allowing trust to be built.

Beyond policies, several government initiatives and education institutions have played positive roles in the industry. Notably, co-working spaces set by Enterprise SG provide platforms for founders, and local universities have evolved their curriculums to cover emerging technologies.

Where is Singapore’s fintech industry at now?

A decade has passed, and Singapore’s fintech industry has evolved. Wong shared that, at the beginning, the community was “filled with new ideas.”

But the industry has grown beyond simply having new ideas. Having been in the sector for 20 years, some companies who have identified their audience’s pain points and developed their solutions are on the path towards success.

In addition, artificial intelligence (AI) will “behave” like tech and permeate our everyday lives and operations. “AI will become something that it will be second nature to all of us, and that will drive probably the second sort of wave of fintech development,” Wong added.

De Oude, however, has an opposing opinion. He stated that there has been an “overexuberance” of fintech startups in the past decades, especially between 2020 and early 2022, and many fintech startups will die in the next three to five years.

He explained that many payment companies operate on similar business models and questioned how they could effectively compete with one another. “Yes, payment flow has gone up to trillions. But the consolidation, or the death of fintechs, is going to come soon.”

If I’m a new guy and I want to start my own business, what should I do? Don’t do something that everybody else is doing, because the competition is high, not only for customers, but competition is high for capital, for resources, and actually just for diversified being different from everybody else.

Walter de oude, founder of Singlife and Chocolate Finance

Adding to the topic of AI in the industry, De Oude predicted that the world of agency in AI would become “a phenomenal section of growth”—beyond replacing talent with agents, the orchestration of how to make agents efficient could potentially be an entirely new industry.

While he added that the “new industry” will be where a large amount of funding will go, procuring funds will not be “easy to come by” from early stages to scaling, leading to “tough times ahead.”

Taiyabi chimed in, adding that more than half of companies holding SFA membership have evolved from startups to scale-ups. However, despite the potential decrease in the number of companies, maturity will increase.

Due to the cooling of funding from the sharp spike in 2021 and 2022, he also stated that many founders shared that the industry is “normalising”.

Advice to founders and people looking for fintech jobs

At this point, we have seen the tech industry go through its highs and lows, and it seems that it’s at a point of stagnation and, in Wong’s words, exhaustion.

However, he not only believes that positive change is happening in the fintech industry—it’s accelerating.

It’s difficult for the human mind to think of acceleration by our natural instinct. We kind of want to know where is the leopard jumps and where the leopard in three seconds time, and that’s linear, exponential growth is difficult to conceptualise, but I think that we will see that.

I think we will see changes in the industry in the next 10 years that will rival the last 50 years, right? So that’s the definition of accelerated change.

If you can find a pain point that you think needs to be solved, and you think you know how to do it. Do it.

Wong Joo Seng, co-founder and CEO of Spark Systems

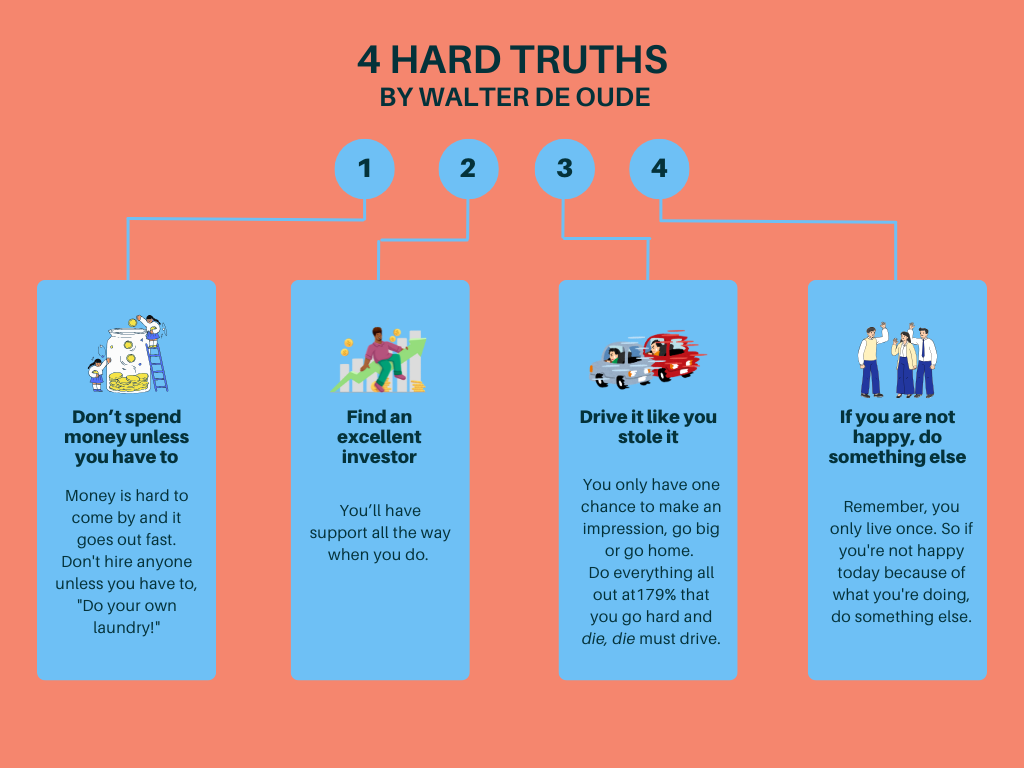

De Oude offered four pieces of advice, which Taiyabi deemed to be “hard truths” for those in the fintech space. Taiyabi addressed his advice to people who are looking to get hired into the industry,

According to him, 60% of fintech companies are B2B, and one of the key challenges they face is that they cannot clearly articulate the challenges of the potential client or prospect they are selling to, which leads to a significant mismatch between both parties.

Try and put yourself in the shoes of the person you’re selling to clearly identify the challenges that person has, because your product can be the best product in the world, and you can have the most flashy marketing slides. But if you’re not able to capture the other person’s pain points in your first five minutes, you’re out of the door in his mind.

Shadab Taiyabi, president of the Singapore Fintech Association (SFA)

De Oude chimed in, proclaiming that he values the hunger to solve problems over credentials. “I don’t care what university you went to. I don’t care at all. I don’t care if you went to university.”

Wong took a milder yet more encouraging approach as he concluded the panel, stating that passion is irreplaceable. “What you want is someone who can come up on top at the very edge of where things are in as short a time as possible.”

- Read the full report by UOB here.

- Read our other stories on Singapore’s fintech industry here.

Featured image credit: Vulcan Post

![[SFF 2024] What’s next for Singapore’s fintech industry? [SFF 2024] What’s next for Singapore’s fintech industry?](https://sianzzz.com/wp-content/uploads/2024/11/photo_2024-11-06-16.21.27.jpeg)