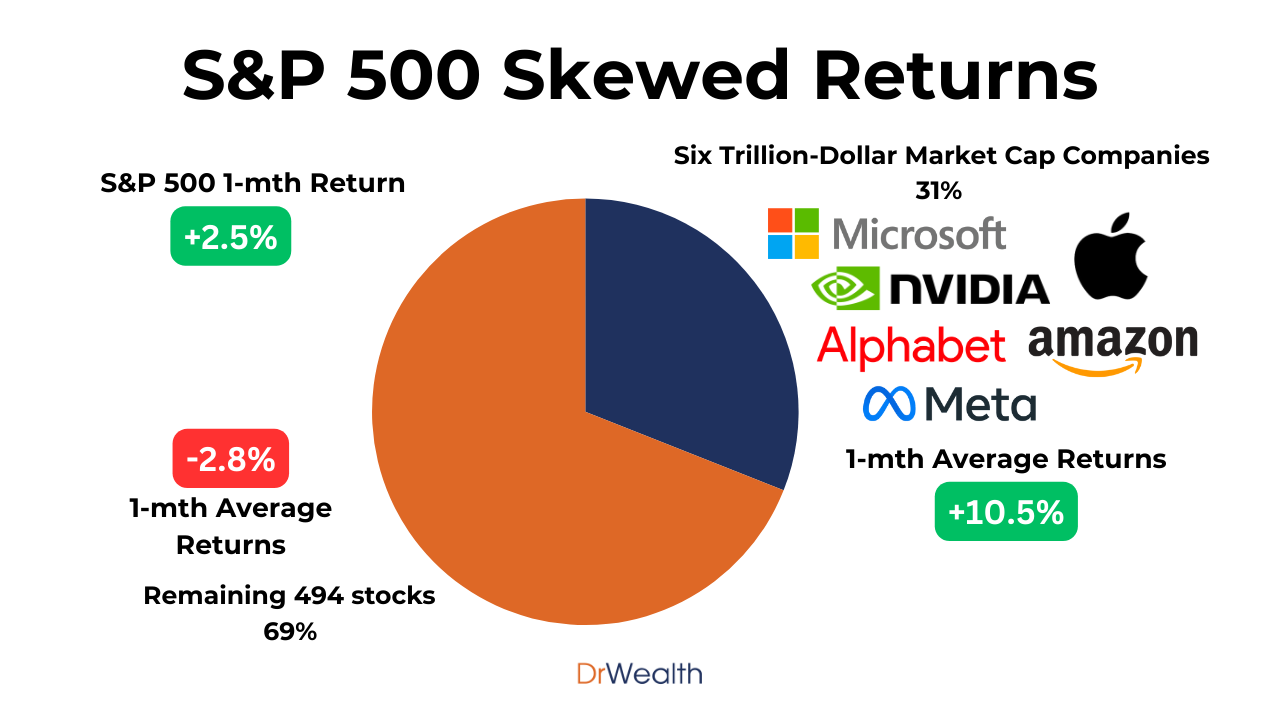

“Sell in May and go away” didn’t happen this time, as the S&P 500 was up 2.5% from a month ago. Or did it?

While the S&P 500 has been reaching record highs lately, a closer look beyond the trillion-dollar market cap companies reveals that the rest of the index stocks have struggled to make money over the past month.

This is because the index has become more concentrated in a few stocks than ever before. Microsoft (MSFT), NVIDIA (NVDA), and Apple (AAPL) – the three trillion-dollar market cap companies – collectively take up 20.1% of the S&P 500 index.

If we consider the six trillion-dollar market cap companies (MSFT, NVDA, AAPL, Google (GOOG/L), Amazon (AMZN), and Meta (META)), their total weight in the S&P 500 rises to 31.24%.

Thus, the movements of the S&P 500 index are largely determined by these trillion-dollar-cap companies.

These stocks have performed well this year, driven by the AI narrative they’ve successfully sold to investors.

Apart from Amazon, which saw a -1.2% decline in its stock from a month ago, the rest have delivered higher returns than the S&P 500, helping to pull up the index:

- Nvidia: +42.6%

- Apple: +13.1%

- Meta: +6.1%

- Microsoft: +5.9%

- Alphabet: +3.6%

While the market-cap weighted S&P 500 was up 2.5% in the past month, the median return was actually negative at -3.3%. The top six stocks delivered average returns of 10.5%, while the remaining 494 stocks were down an average of 2.8%. This highlights how the performance of mega-cap stocks masked the broader poor performance of the U.S. stock market.

There were 150 S&P 500 components that made gains in the past month, but they were outnumbered by 353 losers (totaling more than 500 stocks due to multiple share classes). In other words, 70% of S&P 500 components declined in the past month!

The average percentage gain for the gainers was 5.6%, while the average percentage loss was 6.1%.

Of course, not only the trillion-dollar companies saw gains. Among the top ten gainers in the past month, Nvidia is the only trillion-dollar stock. Half of the top gainers are related to AI – Nvidia, Broadcom, Hewlett Packard Enterprise, NetApp, and Oracle are riding the AI boom.

The remaining five are non-AI related:

- First Solar (FSLR): Solar energy

- Best Buy (BBY): Retail

- Deckers Outdoor (DECK): Retail

- Insulet (PODD): Diabetes solutions

- Eli Lilly (LLY): Diabetes solutions

While these stocks benefited from favorable industry trends and good results, not all stocks in these non-AI industries are performing well.

Taking this adjusted view of the U.S. stock market, it is actually much weaker than the index suggests.

The ultimate question is: is this okay? Can the top six stocks continue to power the S&P 500 index higher while the rest lag further behind?

My sense is that this isn’t sustainable. Either the top six stocks will lead the rest of the market higher, or they will eventually be dragged down by the lagging stocks. Of course, my hope is for the former.