Navigating the world of credit cards can be overwhelming, with various options offering different perks and benefits.

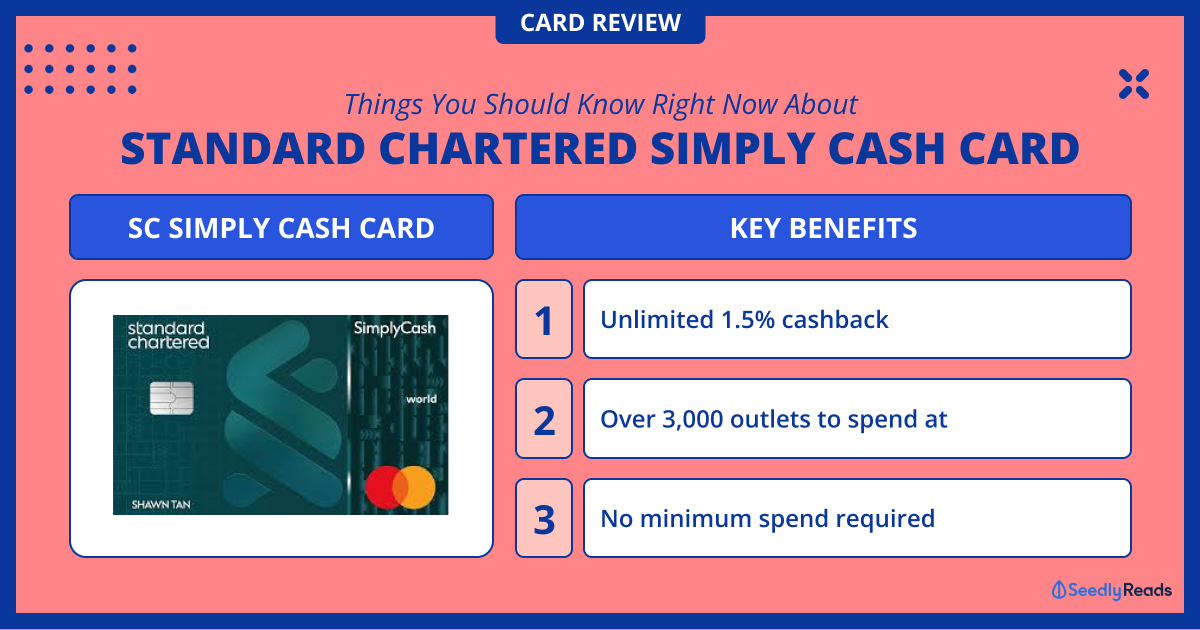

Enters the Standard Chartered Simply Cash Credit Card – a straightforward cashback card designed for simplicity and ease of use.

Its 1.5% flat cashback rate and no complex requirements make it an attractive option for those who prefer a hassle-free way to earn rewards on their everyday spending.

This review looks at the card’s key features, benefits, and potential drawbacks.

TL;DR: Standard Chartered Simply Cash Credit Card Review 2024

The Standard Chartered Simply Cash Credit Card is perfect for those seeking a simple and effective cashback card. It offers a flat 1.5% cashback on all eligible spending with no minimum spend and no cap on cashback earnings.

Additional perks include a waived annual fee for the first year, various sign-up bonuses, and access to exclusive offers and privileges at over 3,000 Asian outlets. It’s an ideal card for everyday use, providing flexibility and ease of cashback accumulation.

Standard Chartered Simply Cash Credit Card Pros

- No Minimum Spend: Earn cashback on every dollar spent without the need to hit a minimum spend threshold

- No Cashback Cap: Unlimited cashback earnings with no maximum limit

- Wide Acceptance: The 1.5% cashback applies to all eligible spending categories, offering versatility for all types of purchases

- Automatic Cashback Crediting: Cashback earned in each statement cycle is automatically credited to your card account in the following statement month

- Additional Cashback Opportunities: Earn extra cashback on specific transactions through SC EasyBill and approved Funds Transfer amounts.

Standard Chartered Simply Cash Credit Card Cons

- Annual Fee: The annual fee of S$196.20 applies after the first year, which might be a consideration for some users

- Basic Cashback Rate: While 1.5% is competitive for a flat-rate card, some specialized cards offer higher cashback rates in specific categories.

Standard Chartered Simply Cash Credit Card Key Features

The Standard Chartered Simply Cash Credit Card comes packed with features that cater to the needs of a wide range of consumers. Here’s a closer look at what the card offers:

Flat Cashback Rate

- 1.5% Unlimited Cashback: Earn a flat 1.5% cashback on all eligible spending. There are no minimum spend requirements and no cap on the cashback you can earn, making it an easy choice for all types of expenditures.

Annual Fee Waiver

- Fee Waiver: The annual fee of S$196.20 (including GST) is waived for the first year. This makes it cost-effective for new users to enjoy the benefits without an initial financial commitment

Additional Benefits

- Offers and Privileges: Access exclusive offers and privileges at over 3,000 outlets in Asia, including dining, shopping, travel, and lifestyle perks

- 0% Interest Instalment Plans: Enjoy flexible payment options with 0% interest instalment plans for retail transactions

- Mobile Payment Compatibility: Compatible with Apple Pay, Google Pay, and Samsung Pay for convenient mobile payments

Fees

- Annual Fee: S$196.20 (waived for the first two years)

- Late Payment Fee: Applicable if the minimum payment is not made by the due date

- Foreign Transaction Fee: Additional fees may apply for transactions made in foreign currencies.

Other Points to Note

- Eligibility: The card is available to new Standard Chartered credit card members, subject to meeting the bank’s criteria

- Cashback Crediting: Cashback earned in each statement cycle is credited to the card account in the following statement month

- Instant Digital Card: Receive instant digital credit card approval and issuance when applying via MyInfo.

Comparison With UOB One, OCBC 365 Card & Citi Cashback Card

When comparing the Standard Chartered Simply Cash Credit Card to other cashback cards, consider the following:

- UOB One Card: Offers up to 15% cashback but comes with tiered spending requirements and caps

- OCBC 365 Card: This card provides higher cashback rates in specific categories, like dining and groceries, but it has category restrictions and monthly caps

- Citi Cash Back Card: Similar to OCBC 365, it offers higher rates in selected categories with spending caps.

Conclusion

The Standard Chartered Simply Cash Credit Card is an excellent choice for those seeking a simple, no-frills cashback card. Its flat 1.5% cashback rate on all eligible spending, without minimum spend requirements or caps, makes it a versatile and straightforward option for everyday use.

This card provides solid value with added benefits like a waived annual fee for the first two years, attractive sign-up bonuses, and extensive offers and privileges.

However, a specialised card with higher cashback rates might be more suitable for those who spend heavily in specific categories. Overall, the Standard Chartered Simply Cash Credit Card offers convenience, flexibility, and steady rewards for a wide range of users.