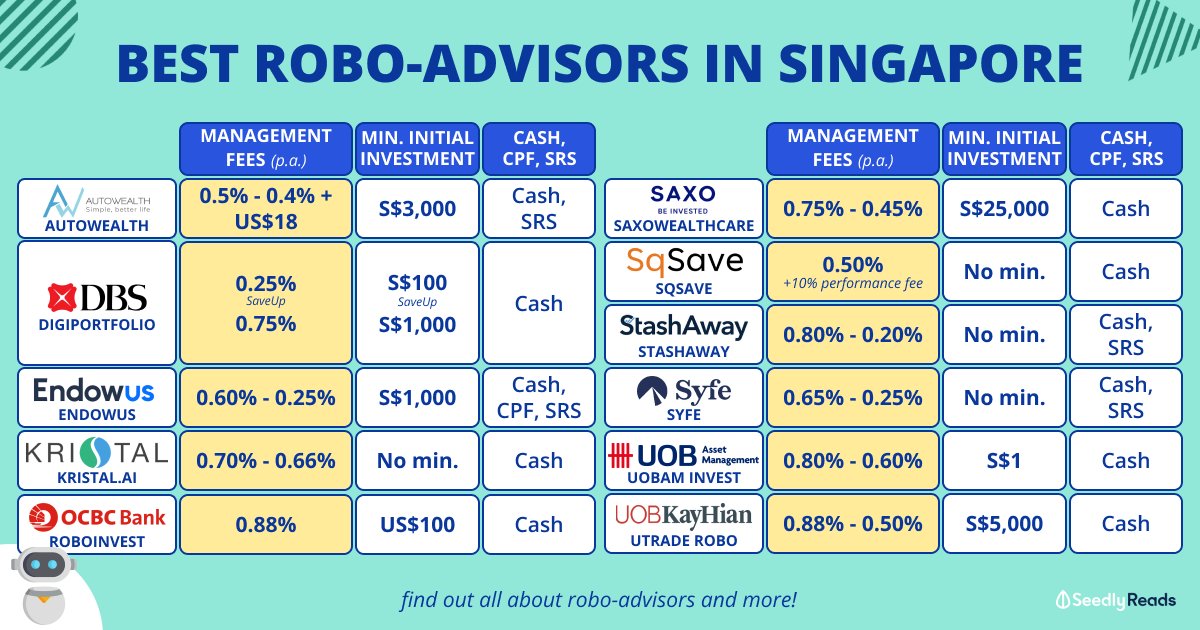

If you’re an investor currently looking at the robo-advisor scene, here’s a detailed comparison of some of the major robo-advisor players in the market to find the best robo-advisor to suit your investment style.

Note: we’ve omitted FSM Maps and PhillipCapital SMART Portfolio from this comparison as they both behave more like a risk-based unit trust portfolio recommendation than as a true robo-advisor.

Disclaimer: This non-sponsored article is updated as of 25 Oct 2024. Do note that the information provided by Seedly serves as an educational piece and does not constitute an offer or solicitation to buy or sell any investment product(s). It does not take into account the specific investment objectives, financial situation, or particular needs of any person. Readers should always do their own due diligence and consider their financial goals before investing in any investment product(s). The article will focus on investment portfolios and not cash management accounts.

TL;DR: Which Robo Advisor Should You Use?

Robo-advisors are a low-cost investment solution, but there’s more to choosing a robo-advisor than just the lowest fees.

Here’s what else you should be looking out for when choosing a robo-advisor (click to jump):

| Robo Advisor | Fees (p.a.) | Minimum Investment Amount | Cash, SRS, CPF Support |

|---|---|---|---|

| AutoWealth | AutoWealth SRS: 0.40%

AutoWealth Starter: 0.50% + USD$18 (platform fee) AutoWealth Plus+: 8% only on profits |

S$3k (AutoWealth Starter, SRS) S$10k (AutoWealth Plus+) |

Cash and SRS |

| DBS digiPortfolio | SaveUp: 0.25% Income/Asia/Retirement/Global: 0.75% |

S$100 (SaveUp) S$1k (Income/Asia/Retirement/Global) |

Cash |

| Endowus | Cash: 0.6% (up to S$200k) to 0.25% (more than S$5 Mil) CPF & SRS: |

S$1k | Cash, SRS, CPF |

| Kristal.AI | Singapore Residents

Investment Advisory & Management Services Fees: 0.54% Non-Singapore Residents Investment Advisory & Management Services Fees: 0.50% |

None | Cash |

| OCBC RoboInvest | 0.88% | US$100 | Cash |

| SaxoWealthCare | 0.75% (first S$50k) to 0.45% (above S$1m) |

S$25k | Cash |

| SqSave (formerly SquirrelSave) | 0.5% + 10% of positive returns |

None | Cash |

| StashAway | 0.8% (first S$25k) to 0.2% (more than S$1 Mil) |

None | Cash and SRS |

| Syfe | 0.65% (first S$20k) to 0.25% (more than S$5m) |

None | Cash |

| UOBAM Invest | 0.8% (first S$25,000) to 0.6% (more than S$25,000) |

S$1 | Cash |

| UTrade Robo | 0.88% (first S$50,000) to 0.5% (more than S$100,000) |

S$5k (per portfolio) | Cash |

What Is A Robo-Advisor?

When it comes to wealth management, the only way you could do it in the past is through a mutual fund.

That’s where fund managers curate a list of funds with the ultimate goal of doing better than what the market returns.

Naturally, they would usually charge a hefty 2-3% per annum (p.a.) management fee to try to ‘beat the market’.

These exorbitant fees eat into your returns in the long run, and the ones who benefit ultimately are the fund managers.

With the advancements in technology and developments in machine learning, the advent of robo-advisors — digital platforms that make automated and algorithm-driven investment decisions — aims to change all of this by providing an option for low-cost, diversified passive investing.

The Promise: Low-Cost, Diversified, Passive Investing

- Low Cost: Usually, 0.3% to 1% fees are charged for the total amount managed. The costs are low because they are run by models and algorithms instead of an actual human fund manager – hence the name ‘Robo’.

- Diversified: Usually put into a basket of Global Exchange Traded Funds (ETFs) which exposes the fund to the global economy in different sectors and usually diversified through a mix of equities and bonds in the portfolio. Note: some of these ETFs are not available to retail investors.

- Passive Investing: Suitable for a longer-term approach (longer than 10 years) to growing wealth rather than high-frequency trading and taking short-term positions.

Are Robo-Advisors Regulated?

All Robo-Advisors in Singapore are regulated by the Monetary Authority of Singapore, typically with the license “Capital Markets Services Licensee“.

So Who Would Benefit From Robo Advisors?

Robo advisors are perfect for time-starved working adults who are looking to grow their money passively.

(Think: the majority of Singaporeans today, who are between 21 to 45 years old).

Instead of physically going to a bank to look for a relationship or fund manager—who may or may not even have your interests at heart—why not opt for a more transparent method that only seeks to grow your wealth?

Roboadvisor Fees

Although most robo advisors charge a ‘so-called’ all-inclusive fee, there might be additional fees that you need to be aware of.

For example, if the underlying assets that the robo advisors pick are ETFs, there will be a fund management fee of about ~0.20% that is not included.

A Brief Introduction to the Robo-Advisors in Singapore

AutoWealth

- History: Started in 2015 by Ow Tai Zhi, an ex Investment Banker at Singapore’s sovereign wealth fund, hedge fund, and family fund, and management consultant Noel Lee

- Funding: Undisclosed but backed by high-net-worth angel investors.

- Operation License: AUTOWEALTH PRIVATE LIMITED – MAS Licensed Financial Advisor (Collective Investment Schemes + Securities).

- Management Fees / Platform Fees/ Advisor Fees (p.a.):

- AutoWealth SRS: 0.40% + USD$18 (platform fee)

- AutoWealth Starter: 0.50% + USD$18 (platform fee)

- AutoWealth Plus+: 8% only on profits

- Minimum Amount to Start: S$3,000 (AutoWealth Starter, SRS), S$10,000 (AutoWealth Plus+)

- Methodology: A rule-based investment approach and strategy which places a strong emphasis on diversification across major asset classes, geographical regions, and industries.

- Investment Portfolios: Autowealth portfolios can span over 10,000 securities across 44 countries, providing maximum diversification.

- Safety and Protection: AutoWealth is licensed by the Monetary Authority of Singapore and regulated under the Financial Advisers Act. AutoWealth clients’ portfolio assets and monies are held in personal, segregated custody accounts at Saxo Capital Markets & iFAST, MAS-licensed financiaal institutions that are regulated to perform custodial services.

Client enjoys full protection against the insolvencies of both AutoWealth, Saxo Capital Markets and iFAST. - Miscellaneous: You can contact a dedicated wealth manager over WhatsApp for advice.

DBS digiPortfolio

- History: The DBS digiPorfolio is created by DBS Bank and its DBS portfolio management team. Chief Investment Officer Hou Wey Fook who oversees of the macro-overview strategy of the portfolio.

- Operation License: DBS Bank Ltd.

- Management Fees / Platform Fees/ Advisor Fees (p.a.):

- SaveUp: 0.25%

- Income/Asia/Retirement/Global: 0.75%

- Minimum Investment Amount: S$100 (SaveUp), S$1,000 (Income/Asia/Retirement/Global)

- Cash. CPF or SRS Investment Support: Cash only.

- Methodology: Hassle-free, ready-made investment portfolio that offers a combination of human expertise and robo-technology. With it, you have an instant, cost-effective way to grow and protect your wealth through regional or global diversification.

- Investment Portfolios:

- Retirement Portfolio: A multi-asset and diversified portfolio of unit trusts with asset allocation adjusted automatically as you move towards your retirement age.

- SaveUp Portfolio: Conservative fixed income-only portfolio. 3 – 6 unit trusts, investing primarily in fixed-income instruments.

- Income Portfolio: Equity and bond unit trusts.

- Asia Portfolio: Portfolio of SG-listed ETFs investing across Asia with a Singapore focus

- Global Portfolio (ETF): Portfolio of UK-listed ETFs investing globally

- Global Portfolio PLus (UTs): Portfolio of unit trusts tactically adjusted to capitalise on market opportunities

- Safety and Protection: digiPortfolio is created and delivered by the Safest Bank in Asia and Best Digital Bank Globally. DBS Bank also enjoys the highest credit ratings from the three top credit rating agencies in the world. digiPortfolio’s investment process is completely integrated into the bank’s secure systems so you have peace of mind knowing you are not being redirected to a third-party platform to transact.

Endowus

- History: Endowus was started in 2017 and is led by Samuel Rhee, former CEO and CIO of Morgan Stanley Investment Management Asia.

- Funding: Undisclosed but seems to be independently owned and operated.

- Operation License: ENDOW.US PTE. LTD – MAS Licensed Financial Advisor for advising on investment products (Collective Investment Schemes) and issuing or promulgating on investment products (Collective Investment Schemes).

- Management Fees / Platform Fees/ Advisor Fees: All-in fund level access fee of 0.25% to 0.60% p.a.

- Minimum Investment Amount to Start: S$1,000

- Cash. CPF or SRS Investment Support: Cash, CPF, SRS.

- Methodology: Building of Global portfolio via Dimensional Fund Advisors (DFA) & PIMCO funds

- Investment Portfolios:

- Endowus Flagship Portfolios that can be customised based on your investment objectives and risk tolerance. Broken down into percentage of equities and bonds.

- Endowus ESG Portfolios designed to track market benchmarks while supporting sustainable business practices.

- Endowus Factor Portfolios that are globally diversified, systematic, multi-factor portfolios suitable for your risk-return objectives.

- Endowus Income Portfolios to receive monthly payouts while growing or preserving your capital, through portfolios focused on income, dividends and stability.

- Endowus Satellite Portfolios to take advantage of optimised, best-in-class portfolios designed by Endowus to target specific regions, themes, asset classes, and megatrends.

- Endowus Fund Smart where you can access a curated list of institutional funds to construct your portfolio and customise your fund allocations.

- Safety and Protection: All your assets are custodised in a trust account in your own name with UOB Kay Hian, one of Asia’s largest brokerage firms. UOB Kay Hian is regulated by the Monetary Authority of Singapore and has a Capital Markets Services License to provide custodial services for securities.

Kristal.AI

- History: Founded by Asheesh Chanda and Vineeth Narasimhan in 2016; what started as an ambitious idea sketched out on a blackboard, is now present and thriving in Singapore, Hong Kong, India, and Dubai.

- Funding: US$6M Series A funding led by Chiratae Ventures (formerly IDG Ventures India) – total funding amount stands at $9.1M.

- Operation License: KRISTAL ADVISORS (SG) PTE. LTD. – MAS Capital Markets Services licensee (fund management) and Exempt Financial Advisor advising on investment products like Collective Investment Schemes, Securities, etc.

- Management Fees / Platform Fees/ Advisor Fees:

- Investment Advisory & Management Services Fees: 0.54%

- Safe Keeping Fee: 0.162%

- Funds deposit Fees – For remitting the funds to Kristal’s account

- US $ 7.50 for US Deposit

- Other currencies – charged by intermediary sender Banks for funds deposited to Kristal.

- Funds Withdrawal Fees– Fees charged when you withdraw funds from Kristal

- US withdrawal – Up to US $ 50

- SGD – NIL

- HKD – NIL

- For other currencies at actuals charges by intermediaries

- Minimum Investment Amount to Start: No minimum.

- Cash. CPF or SRS Investment Support: Cash only

- Methodology: You can choose from more than 200 investment strategies (Kristals) to suit your investment requirements and risk profile. Every Kristal is carefully created and managed by combining the power of Artificial Intelligence and the experience of professional money managers.

- Investment Portfolios: Low-cost, customised portfolios comprising of curated ETFs called Kristals or individual ETFs.

- Safety and Protection: All client monies/assets managed by Kristal.AI are held in separate accounts in the respective client’s name and are not mixed up with the companies’ assets. All clients’ monies/assets are custodised in a trust account in your own name with Interactive Brokers and Saxo Capital Markets.

OCBC RoboInvest

- History: OCBC RoboInvest is a collaboration between OCBC and a Fintech firm Planar Investments Pte Ltd (WeInvest).

- Operation License: OVERSEA-CHINESE BANKING CORPORATION LIMITED

- Management Fees / Platform Fees/ Advisor Fees: Portfolio management fee of 0.88% p.a. for AUM.

- Minimum Investment Amount: US$100

- Cash. CPF or SRS Investment Support: Cash only.

- Investment Methodology: Specially curated for you by OCBC’s leading wealth experts. Includes portfolio rebalancing opportunities as market changes.

- Investment Portfolios: 38 portfolios across 7 markets for various risk appetites. Also, it is the only platform that allows investors to investors to invest in individual stocks within the curated themes.

- Safety and Protection: OCBC RoboInvest is created and delivered by OCBC, a trusted financial institution recognised for its stability and wealth management expertise.

SaxoWealthCare

- History: SaxoWealthCare is the latest digital wealth management service by Saxo Markets, a global leader in smart trading and investing online with decades of experience.

- Operation License: SAXO CAPITAL MARKETS PTE. LTD. – MAS Capital Markets Services licensee and Exempt Financial Advisor advising on investment products and issuing or promulgating on investment products like Collective Investment Schemes, Securities, etc.

- Management Fees / Platform Fees/ Advisor Fees: 0.45% p.a. ($1m AUM and above) to 0.75% p.a. (first $50k AUM)

- Minimum Investment Amount: $25,000

- Cash. CPF or SRS Investment Support: Cash only.

- Investment Methodology and Investment Portfolios: SaxoWealthCare portfolios are monitored, reviewed and rebalanced, daily if necessary, and at least monthly or quarterly, based on trade signals from some of the world’s largest portfolio managers. Saxo is also the only robo-advisor to offer you Portfolio Protector, a feature that offers active protection by reallocating from riskier to more stable assets when markets are volatile. This is done automatically on your behalf and Portfolio Protector has no additional cost and can be switched on and off at any time – no lock-in.

- Safety and Protection: Saxo Capital Markets is regulated by the Monetary Authority of Singapore. As such all client funds are protected and kept in a segregated client funds account, separate from the company’s own money and assets.

SqSave (formerly SquirrelSave)

- History: Led by Victor Lye, a Corporate entrepreneur with over 25 years’ cross-industry experience in investments, insurance and healthcare.

- Operation License: PIVOT FINTECH PTE. LTD. – MAS Capital Markets Services licensee (fund management) and Exempt Financial Advisor advising on investment products and issuing or promulgating on investment products like Collective Investment Schemes, Securities, etc.

- Management Fees / Platform Fees/ Advisor Fees: 0.50% p.a. / Special fee rate will apply on request for AUM above SGD 500,000 (Management Fee) + 10% of any positive return (Performance Fee)

- Minimum Investment Amount: No minimum

- Cash. CPF or SRS Investment Support: Cash only.

- Investment Methodology and Investment Portfolios: SqSave AI seeks the portfolio with the highest predicted return for the risk you want to take. Unlike others who typically rebalance you backwards to a historical model portfolio, SqSave will rebalance you to a forward-looking portfolio. Moreover, it manages risk before chasing returns.

- Safety and Protection: Tiger Brokers (Singapore) Pte. Ltd. (“Tiger”) is SqSave’s appointed broker-dealer and custodian for the ETFs. Hence, the Global ETFs are technically held and owned by Tiger. PIVOT Fintech Pte. Ltd. (SqSave’s legal entity) is a beneficiary of Tiger. As a client and Global ETF investor of SqSave, you are beneficiary on our Portfolio Accounting ledger. Therefore, you are the owner of the ETFs in your Global ETF Portfolio(s).

StashAway

- History: Started in 2016 by ex ZALORA Group CEO, Michele Ferrario, ex Nomura MD, Freddy Lim and CTO Nino Ulsamer.

- Funding: US$36 million in five funding rounds, with the latest Series C round being led by Australian Venture Capitalist firm Square Peg Capital. In January 2021, it was reported that StashAway has over US$1 billion (SG$1.36 billion) in assets under management (AUM).

- Operation License: ASIA WEALTH PLATFORM PTE. LTD. – MAS Capital Markets Services licensee (fund management + dealing in capital markets products) and Exempt Financial Advisor advising on investment products and issuing or promulgating on investment products like Collective Investment Schemes, Securities, etc.

- Management Fees / Platform Fees/ Advisor Fees: 0.8% (first S$25,000) – 0.2% (>$1,000,000) based on your total AUM with StashAway. You will pay less the more you invest with StashAway.

- Minimum Investment Amount: No minimum.

- Cash. CPF or SRS Investment Support: Cash and SRS.

- Investment Methodology: A proprietary investment strategy called the Economic Regime-based Asset Allocation (ERAA) which continually monitors economic and market cycles to rebalance accordingly.

- Investment Portfolio: Stashaway constructs portfolios based on varying levels of risk exposure. The underlying investment products are equities (ETFs from all over the world), fixed income assets as well as gold.

General Investing powered by StashAway

General Investing powered by BlackRock®

Responsible Investing (ESG)

Thematic Portfolios

Flexible Portfolios where you can customise your own portfolios by picking your assets and adjusting their allocations. - Safety and Protection: Even in an unlikely bankruptcy event, any money held in a trust or custodian account can’t be touched, as it belongs to you – not to StashAway.

For General Investing and Goal-based portfolios, your deposits first go to a DBS trust account. Then, your purchased securities go to a custodian account through Saxo Capital Markets. For StashAway Simple™, HSBC Hong Kong holds your funds.

However, your funds are held in a co-mingled account i.e. your funds are mixed with the funds of other users of the platform.

On balance, StashAway keeps a detailed ledger with the names of their investors and the amount of securities under their name. Also, as one of the earliest and most popular (as evidenced by its US$1 billion AUM) robo-advisors, StashAway is likely to have been audited and regulated more by MAS.

Syfe

- History: Syfe is a digital wealth manager licensed by the Monetary Authority of Singapore for retail fund management. The company was founded back in 2017 by current chief executive officer (CEO) Dhruv Arora. Arora was a former director at UBS and also founded Grofers: an Indian online grocery delivery service backed by Softbank and Sequoia.

- Funding: Backed by Unbound, MPGI, Valar Ventures, David Rogers, and Paul Redbourn

- Operation License: SYFE PTE. LTD. – MAS Capital Markets Services licensee (fund management) and Exempt Financial Advisor advising on investment products and issuing or promulgating for Collective Investment Schemes.

- Management Fees / Platform Fees/ Advisor Fees: 0.65% (first S$50,000) – 0.25% (S$5,000,000based on your total AUM with Syfe. You will pay less the more you invest with Syfe.

- Minimum Investment Amount: No minimum

- Cash, CPF or SRS Investment Support: Cash / SRS

- Investment Methodology: Syfe takes a dynamic, risk-based approach to your portfolio’s asset allocation to deliver better returns.

- Investment Portfolio:

- Syfe Core Portfolios: Allows you to invest in a blend of equity, bonds and gold Exchange Traded Funds (ETFs). Asset Class Risk Budgeting approach maximises expected return for each risk level while keeping asset allocation stable.

- REIT+ Portfolio: Access to the largest and most tradeable REITs in Singapore. Syfe’s new REIT+ portfolio is the first investment offering to closely replicate the performance of the SGX iEdge S-REIT Leaders Index.

- INCOME+ Portfolio: Earn regular, diversified income with a tax-efficient, actively-managed bond portfolio powered by PIMCO®.

- Thematic Portfolios such as ESG and Clean Energy, Disruptive Technology, etc.

- Syfe Select Portfolios where you can customise your portfolio

- Safety and Protection:

Funds in managed portfolios and brokerage are held in trust accounts at established banks like DBS and HSBC, respectively. They are kept separate from Syfe’s own accounts, and invested only in your portfolio assets.

UOBAM Invest

- History: UOBAM Invest was launched by UOB Asset Management Ltd (UOBAM) as a digital platform offering investors guided and personalised investment service.

- Operation License: UOB ASSET MANAGEMENT LTD – MAS Capital Markets Services licensee (fund management) and Exempt Financial Advisor advising on investment products and issuing or promulgating on investment products like Collective Investment Schemes, Securities, etc.

- Management Fees / Platform Fees/ Advisor Fees: 0.8% p.a. (first S$25,000) and 0.6% p.a. (above S$25,000).

- Minimum Investment Amount: S$1

- Cash. CPF or SRS Investment Support: Cash only.

- Investment Methodology: UOBAM Invest employs risk profiling and goal-setting algorithms to design an investment solution that is most suited to your investment objectives, investment horizon and risk tolerance. The Digital Adviser is designed to help you attain your goals in time, which is done by allocating funds towards more conservative assets as you edge closer to the target completion date.

- Investment Portfolios: Customised portfolios with underlying assets like ETFs, REITS and fixed income assets.

Core Portfolios: Explore a guided approach to investing

Satellite Portfolios: Diversify your portfolio with a Do-It-Yourself (DIY) approach - Safety and Protection: UOBAM Invest is created and delivered by UOBAM, a trusted financial institution recognised for its stability and wealth management expertise. UOBAM is also backed by the UOB Group.

UTRADE Robo by UOB Kay Hian

- History: UTRADE Robo is a digital fund manager providing customised portfolios to suit the investment objectives of their clients. This robo-advisor was launched by UOB Kay Hian: one of Asia’s largest brokerage firms, and backed by the UOB group.

- Operation License: UOB ASSET MANAGEMENT LTD – MAS Capital Markets Services licensee (fund management) and Exempt Financial Advisor advising on investment products and issuing or promulgating on investment products like Collective Investment Schemes, Securities, etc.

- Management Fees / Platform Fees/ Advisor Fees: 0.88% p.a. (first S$50,000) – 0.5% p.a. (AUM >S$100,000) depending on your investment amount.

- Minimum Investment Amount: S$5,000 per portfolio

- Cash. CPF or SRS Investment Support: Cash only.

- Investment Methodology: Automated fund management service that maximises investment return for each client’s risk profile, which is determined by their financial objective and risk profile. UTRade Robo also uses Modern Portfolio Theory to allocate among the chosen asset classes to determine the maximum expected return for a given level of risk

- Investment Portfolios available: Globally diversified multi-asset portfolios built using low-cost ETFs that grant access to 11,000 stocks and bonds.

So… Which Robo Advisor Should You Use?

Need help deciding which robo-advisor to go with?

Comparing Costs Based on Your Investment Amount

Besides the amount which you want to invest in a robo-advisor.

You’ll also have to consider incurring any potential management, platform, or performance fees.

In most cases, the fees are relatively affordable.

With most robo-advisor management fees ranging between 0.30% to 1% per annum.

Remember to keep these costs as low as you can so that you get to keep more of what your investments reap.

Here’s What Real Users Have to Say About the Various Robo Advisors

Would you prefer to hear from actual people and users who have used robo-advisors, before making your decision?

Our Seedly community members have left honest reviews covering stuff like the pros and cons of each robo-advisor as well as the returns they have made.

You can use this one-stop portal to compare ALL the robo-advisors on the market and see which is the one for you!

The Importance of Doing Your Own Diligence Before Investing

As with any other investments out there, there are bound to be risks aplenty.

Even if robo-advisors are arguably an easy way to get started on passive investing.

It is ultimately up to you as a retail investor to do your own due diligence when selecting which robo-advisor to go with as well as what kind of funds to invest in before executing!

If the ever-surging popularity of US-based robo-advisors like Wealthfront (led by an experienced management team) and Betterment (heavily funded and growing assets under management) is any indicator.

The era of low-cost investment options is here to stay and that’s great news for us as retail investors!