(This piece on the Magnificent 7 might be lengthy for some readers, but you can also catch the key points in my 20-minute talk at the FSM Invest Expo 2024. Sign up for the event here and you’ll receive this Investor’s Guide as a PDF.)

The Magnificent 7, comprising Apple, Microsoft, Alphabet, Amazon, Nvidia, Meta, and Tesla, have established themselves as indispensable global entities. Not only are they among the world’s most important companies, but they also dominate in terms of market capitalization, with seven of them ranking in the top 10 in the US.

Remarkably, all five companies with a market cap exceeding one trillion dollars belong to this elite group. Specifically, Microsoft has surpassed the $2 trillion mark while Apple has achieved a $3 trillion market cap.

The massive market capitalizations of the Magnificent 7 have also led to a notable concentration within the S&P 500 index. These seven stocks alone account for nearly 30% of the index’s weight, while the remaining 493 stocks collectively hold the other 70%.

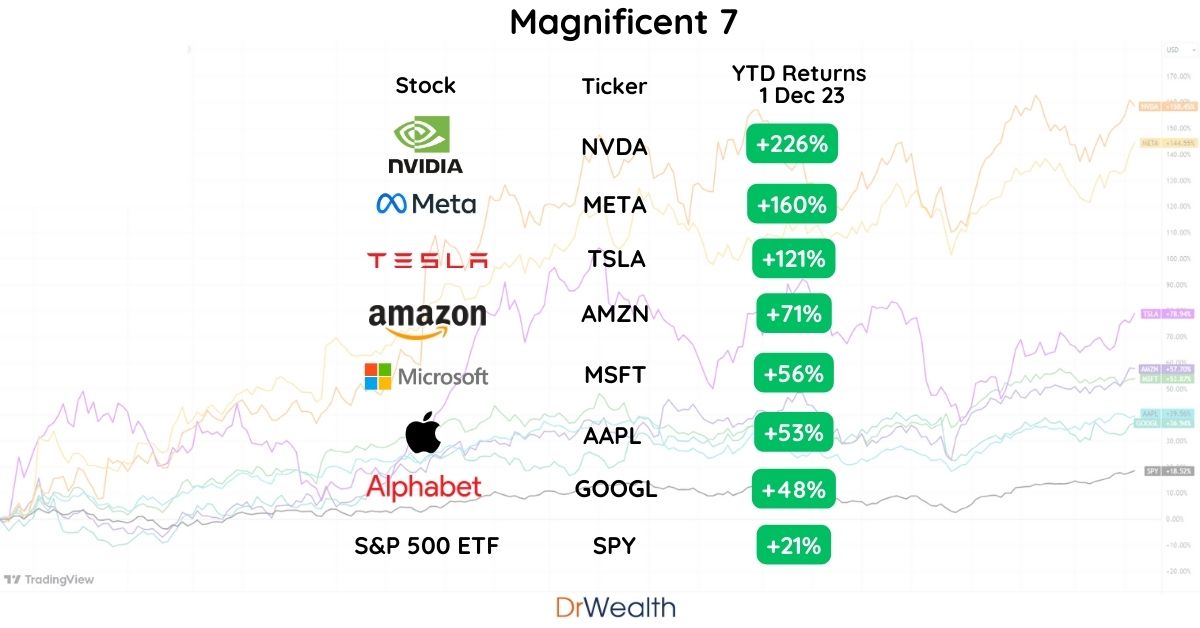

In 2023, the bull run in the US stock market was significantly driven by these companies. Each member of the Magnificent 7 outperformed the S&P 500 in terms of year-to-date returns. Due to their substantial presence in the index, their impressive returns have markedly elevated the average.

Looking ahead, I am confident that the Magnificent 7 will continue to be pivotal in both the stock market and the broader economy in 2024 and beyond. Their sheer size and influence make them indispensable to investors; they have become a barometer for the stock market.

In the subsequent sections, we will delve into the key focus areas for each of the Magnificent 7 stocks, exploring their growth prospects and potential concerns.

#1 Apple (AAPL)

The iPhone has consistently been Apple’s primary revenue source, accounting for about half of its total revenue even today.

However, Apple hasn’t been immune to the global slowdown in demand for smartphones and laptops. In FY23, all Apple products, except for Services, which saw a 9% revenue increase, experienced a decline in sales.

This slowdown, often cyclical, is not the only concern. An issue for Apple is its long-standing reliance on China for most of its production. In recent years, Apple has begun diversifying its supply chain to mitigate risks associated with its Chinese operations.

Nevertheless, even as production shifts to countries like India and the United States, it’s facilitated by companies like Foxconn and TSMC, both Taiwanese. This indicates that while the production locations have changed, the manufacturing expertise and reliance on these suppliers remain constant.

The new production facilities in countries other than China and Taiwan are not yet on par in terms of production and technological capabilities. For instance, TSMC’s U.S. facilities can produce chips up to 4nm, whereas the more advanced 3nm chips are still manufactured in Taiwan.

China’s response to this relocation has been frosty, with policies seemingly targeting Apple and Foxconn. There have been instances of government staff being discouraged from using iPhones, and Foxconn facing tax investigations. These actions are perceived externally as China expressing its discontent over the economic impacts of production relocation.

This situation is critical for Apple, as China accounted for about 19% of its revenue in FY23. Any stringent measures by the Chinese government could significantly impact Apple’s financial performance. Moreover, competitors like Huawei have overcome challenges to outperform Apple in the Chinese market, as evidenced by Huawei’s Mate 60 Pro seizing the market share lead.

Apple CEO Tim Cook’s diplomatic skills are essential in balancing the interests of the U.S. and Chinese governments. His surprise visit to China in October and meeting with the information technology minister are steps in this direction, and more such efforts may be necessary in 2024 to maintain a harmonious relationship and avoid misunderstandings.

On a positive note, Apple’s array of services, like Apple Pay, Apple Card, and Apple One, shows its expansion into diverse sectors, even competing with traditional financial and entertainment services. The company’s command over the app store, taking a significant cut from in-app purchases and subscriptions, further cements its position as a market leader.

Apple’s service offerings can be likened to various industry giants, yet its service revenue surpasses the combined revenues of these comparable companies. This underlines the depth of Apple’s customer loyalty and the strength of its ecosystem.

Looking ahead to 2024, Apple is expected to introduce the Apple Vision Pro, its foray into AR/VR technology. The market’s response to such products remains to be seen.

Apple’s reputation for high-quality design and products, coupled with its powerful brand, allows it to maintain its market dominance. Incremental improvements, rather than new product launches, continue to drive its sales, supported by a strong and loyal customer base. This trend is unlikely to change in the near future.

#2 Microsoft (MSFT)

Under the leadership of Satya Nadella, Microsoft has experienced a significant rejuvenation. Nadella’s tenure has been marked by impressive achievements, with the most recent being the timely partnership with OpenAI. This collaboration has posed a formidable challenge to Alphabet, previously considered a leader in AI, especially after the emergence of OpenAI’s widely popular ChatGPT.

Despite this, the integration of Bing and ChatGPT has not made significant inroads, as the initial excitement faded and Google Search maintained its dominance. Nevertheless, Microsoft’s ownership of a 49% stake in OpenAI, currently one of the world’s most prominent AI companies, is a significant advantage. OpenAI has already achieved widespread adoption, a hurdle that is often more challenging than the development of technology itself. Therefore, Microsoft already possesses a successful product while others continue to strive for market acceptance.

Beyond AI, Microsoft has made strides in other areas. Its gaming division was recently strengthened by the successful acquisition of Activision Blizzard, a move unimpeded by antitrust laws. Additionally, its cloud business, Azure, continues to grow and capture market share.

Like Apple, Microsoft Windows has also been impacted by the decreased demand for PCs, but this is seen as a temporary, cyclical downturn with expectations of recovery in the future.

Among the Magnificent 7, Microsoft boasts the most diversified revenue streams, with three major segments contributing almost equally. This diversification lends robustness to its business model.

Given the steady growth across its various products and services, Microsoft is expected to remain one of the most stable performers among the Magnificent 7. Its diverse revenue streams and lack of major challenges position it well for continued success in the future.

#3 Alphabet (GOOG/GOOGL)

Alphabet has reasons for optimism as Bing’s integration with ChatGPT hasn’t dented Google Search’s dominant market share, which remains above 90%, while Bing lingers around 3%.

Despite the introduction of its AI chatbot Bard, Google hasn’t seen a shift in user base from the original ChatGPT. With the advent of ChatGPT 4, offering real-time internet search capabilities, the actual competition for Google Search seems to be ChatGPT rather than Bing.

This competition is pivotal for Alphabet, given that 57% of its revenue is driven by Google Search. Fortunately, the company has managed to sustain its leadership, evidenced by an 11% year-over-year growth in Google Search revenue in 3Q23. This suggests continuity in Google’s business operations despite emerging AI technologies.

On a personal note, despite being a regular ChatGPT user, I haven’t noticed a decrease in my Google Search usage. This indicates that changing search habits might be challenging for many users.

Another area of concern is the competition from TikTok, which directly impacts YouTube, accounting for about 10% of Alphabet’s revenue. YouTube’s introduction of short videos seems more like an attempt to retain users inclined towards brief content, while its strength remains in longer videos.

Statistics highlight TikTok’s rising popularity, with users now spending more time on it than on YouTube.

However, YouTube still boasts a larger user base, 2.491 billion compared to TikTok’s 1.218 billion. While TikTok’s growth is rapid, it’s likely to decelerate as it reaches the user base size of platforms like YouTube and Facebook, following the principle of diminishing returns.

I believe there’s room for both video formats in the market, with YouTube continuing to thrive due to its generous revenue-sharing model with creators, who receive 55% of ad revenue. This factor, coupled with YouTube’s 12% revenue growth in 3Q23, suggests it’s premature to discount YouTube’s relevance.

Finally, Google Cloud is emerging as a significant growth engine for Alphabet, having experienced the fastest growth rate over the years, including a 22% year-over-year increase in 3Q23. Now the third-largest cloud provider globally, Google Cloud has started generating a positive operating profit, marking a turnaround from its previous growth-driven, loss-making, investment phase.

Looking ahead, the focus for Google Cloud will be on integrating AI services, a domain where Google has long invested. Although Microsoft has made substantial progress with OpenAI’s assistance, the burgeoning demand for AI capabilities is likely to benefit all top cloud providers, including Google, indicating a promising future in this rapidly evolving sector.

#4 Amazon (AMZN)

Amazon, while renowned as an e-commerce giant, has also made a significant mark as a pioneer in cloud services, holding the largest market share today. It might seem surprising that Amazon leads in cloud computing, especially when considering Alphabet’s capabilities with search functions, videos, and global server networks, or Microsoft’s longstanding role as a key enterprise software provider. Yet, it was Amazon that successfully capitalized on this opportunity.

Amazon Web Services (AWS), in particular, stands out as the company’s most profitable division, effectively subsidizing its other segments. For the first nine months of FY23, AWS boasted an impressive operating profit margin of 26%, compared to a modest 3% for North American e-commerce and an operating loss for international e-commerce. Consequently, AWS has become Amazon’s main profit driver.

Another emerging growth area for Amazon is its advertising business. With the rise of numerous indie e-commerce players on major marketplaces, including Amazon, the competition for visibility has intensified. Sellers are increasingly investing in ads to enhance product ranking. This strategy has borne fruit, as evidenced by a 23% increase in ad revenue in 3Q23. Notably, since 2021, Amazon’s advertising revenue has even surpassed that of YouTube.

In the e-commerce domain, Amazon continues to dominate both the U.S. and European markets, the world’s two largest consumer markets. Its market share in the U.S. is a commanding 37.6%, nearly six times higher than its closest competitor, Walmart.

While recent years have seen Chinese companies like SHEIN and Temu making inroads into the U.S. market, their impact remains relatively minor. SHEIN’s estimated revenue of $24 billion in 2022 and the combined revenue of Temu and Pinduoduo at $19 billion are dwarfed by Amazon’s e-commerce revenue of $434 billion. Thus, these newcomers are not yet posing an existential threat to Amazon’s dominance.

Amazon’s previously overextended capacity during the COVID-19 boom is now stabilizing as e-commerce demand fills up the warehouses again. Given Amazon’s substantial lead in the ecommerce market, it appears unlikely that any competitors will catch up in the near future.

#5 Nvidia (NVDA)

In 2023, Nvidia emerged as a standout performer, primarily fueled by the meteoric rise in AI adoption and the consequent surge in interest around AI-related technologies. As the producer of the world’s leading GPUs, essential for powering AI applications, Nvidia suddenly found itself in the enviable position of experiencing soaring demand for its products.

Historically, Nvidia’s primary revenue source was the gaming sector, where high-end graphics cards are essential for seamless gameplay. There was also a phase when Nvidia GPUs were popular for cryptocurrency mining. However, these revenue streams now seem modest compared to the demand from the AI sector. Remarkably, in just two years, revenue from Nvidia’s Data Center segment has skyrocketed by 345%, underscoring the tangible financial impact of the AI boom.

While AMD remains a close competitor, Nvidia’s GPUs are still the preferred choice in the market. This dominance is expected to continue for the next few years, with all other members of the Magnificent 7 being Nvidia’s customers, highlighting its current industry clout.

Despite this success, Nvidia faces potential challenges. Major cloud providers like Amazon, Microsoft, and Alphabet are developing their own AI chips to reduce dependence on Nvidia and to offer more tailored or cost-effective solutions to their cloud customers. Amazon’s Trainium2 and Gravitron4, Microsoft’s Maia 100, and Google’s TPU v5e are notable examples of this trend.

Nvidia is acutely aware of the dual role these Big Tech companies play – as customers and potential competitors. In response, Nvidia has launched its DGX Platform, a cloud service focusing on AI. This platform offers enterprises access to GPU servers for AI development, directly competing with major cloud providers.

This competitive landscape highlights Nvidia’s niche position within the Magnificent 7, heavily reliant on its GPU products. The company is actively seeking to diversify into AI and gaming cloud services, although the success of these ventures compared to its GPU business remains to be seen.

#6 Meta Platforms (META)

Meta Platforms, once grappling with the impact of Apple’s iOS privacy updates on Facebook and Instagram’s ad targeting capabilities, the rising popularity of TikTok causing concerns about its social media platforms’ user engagement, and skepticism over its heavy investment in the metaverse. These factors had previously led to a decline in Meta’s stock.

However, Meta’s fortunes shifted in 2023, with its share price soaring by 157% as of December 4, 2023. Despite the unresolved ad targeting issues stemming from iOS privacy changes, advertisers continued to spend in Meta’s platforms, resulting in a 23% revenue growth year-over-year in 3Q23. This performance marked the highest quarterly revenue for Meta, indicating that the iOS privacy policy has not significantly deterred ad spending.

Additionally, the growth in Meta’s revenue has alleviated concerns regarding TikTok’s competitive threat. Meta’s active user numbers have continued to rise, and while ByteDance (TikTok’s parent company) reported $54 billion in revenue for the first half of 2023, nearing Meta’s $60.6 billion, the simultaneous growth of both companies indicates that the overall market is large enough to support Meta, ByteDance, and even YouTube.

Interestingly, Mark Zuckerberg has shifted his public focus from the metaverse to AI, aligning with current technological trends. Meta has released its Large Language Model (LLM), Llama 2, as open source, positioning Meta as an AI player.

Despite these positive developments, Meta still faces the challenge of identifying a new growth driver. While other members of the Magnificent 7 have found fresh avenues for expansion, Meta primarily relies on its metaverse project, which has yet to gain significant market acceptance. This situation leaves the company at a crossroads, seeking a viable path to sustain its recent momentum.

#7 Tesla (TSLA)

In the first half of 2023, Tesla, along with BYD, emerged as the top-selling EV brands globally. Tesla’s EV sales notably surpassed the combined sales of the next four leading EV brands, underscoring its market dominance.

In terms of revenue, Tesla maintained a lead over BYD with automotive revenue of $41 billion in the first half of 2023, compared to BYD’s $39 billion. This disparity highlights that although BYD sold more vehicles, Tesla’s offerings were priced higher on average.

While electric vehicles are undoubtedly the future of transportation, the market is also intensely competitive. This has implications for Tesla’s growth trajectory, which has shown signs of slowing since the beginning of 2022.

Furthermore, Tesla’s initiation of a price war in the industry has impacted its operating margins in recent quarters. Despite this, Tesla’s margins remain higher than those of many competitors, and the strategy is seen as a long-term play to increase efficiency and make its vehicles more affordable to a broader market. Ultimately, Tesla’s goal is to outcompete less efficient automakers.

A significant potential growth driver for Tesla is the Cybertruck.

After overcoming production challenges, Tesla finally began delivering the Cybertruck in November 2023. Elon Musk has cautioned investors to ‘temper expectations’ regarding the Cybertruck, as production costs nearly double the initial estimates from 2019. Despite this, Musk anticipates the company building 250,000 Cybertrucks by 2025, potentially generating about $15 billion in revenue, equivalent to roughly 20% of Tesla’s FY22 automotive revenue.

If these projections hold true, the Cybertruck could become a substantial growth driver for Tesla.

Magnificent 7 likely to pound through 2024 with their market dominance

I believe that the Magnificent 7 will grow from strength to strength, though some stronger than the others. Each of them have some promising developments and growth drivers, while having some watch areas at the same time.

If I could summarize for each of them in a table:

| Magnificent 7 | Growth Driver/s | Watch Areas |

|---|---|---|

| Apple | – Services – Apple Vision Pro |

– Geopolitical issues in supply chain – Sales in China |

| Microsoft | – Azure Cloud – AI products |

None |

| Alphabet | Google Cloud | Competition from OpenAI’s ChatGPT |

| Amazon | Advertising revenue | Emerging competition from SHEIN and Temu |

| Nvidia | – GPU demand for AI – DGX Cloud Service |

Cloud providers developing their own AI chips |

| Meta | None | – Metaverse development costs – Rise of TikTok |

| Tesla | Cybertruck | Intense competition, price wars and margin compression |

Do join me at the FSM Invest Expo 2024 for a talk on the Magnificent 7. When you sign up, you’ll also receive a PDF version of this guide.